Exports of softwood logs and hardwood chips both remained near record levels over the year-ended January 2019. Total woodchip exports were down 0.8% to 7.444 million bone dried metric tonnes (bdmt), but that includes renewed confidentiality restrictions for softwood chip exports, meaning total exports are likely to have been higher. Softwood log exports eased 7.8% to 3.644 million m3 over the year.

The chart below shows the continuous strength of woodchip exports over the last three years, with the particular emphasis on hardwood chips (shown in green).

To go straight to the dashboard and take a closer look at the data, click here.

The table below details the export volumes displayed above.

| YE Jan ’14 | YE Jan ’15 | YE Jan ’16 | YE Jan ’17 | YE Jan ’18 | YE Jan ’19 | |

| 4401.21.20 – Softwood Chips | 596,369 | 631,597 | 633,327 | 829,044 | 583,467 | 563,018 |

| 4401.22.99 – Hardwood Chips | 3,605,233 | 4,603,164 | 5,225,470 | 6,336,199 | 6,580,033 | 6,790,401 |

It is clear that hardwood chip exports are at or near peak levels, and have been for three years. Industry participants can barely produce more and the supply-chain is stretched to its limits.

Hardwood chips on the one hand and softwood logs on the other. That seems to be the continuing trend of Australia’s raw wood exports.

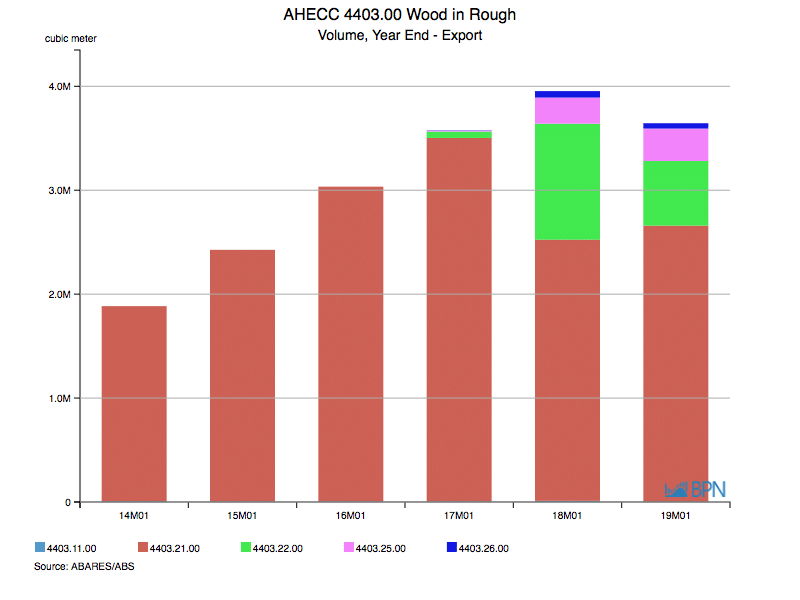

Softwood log exports softened over the year-ended January 2019, easing 7.8% to 3.644 million m3. It should be noted this includes all softwood logs, including preserved logs (a somewhat value-added product). Additionally, softwood log exports have been split between those <15 cm SED and >15 cm SED since the start of 2017.

To go straight to the dashboard and take a closer look at the data, click here.

While total softwood log exports have declined, it is quite clear that the main decline has been in those shown in green (4403.22.00), which are logs <15 cm diameter at the small-end. These log exports fell 44.2% over the year-ended January 2019, to 622,460 m3.

By contrast, larger dimension logs, those over 15 cm diameter at the small-end and shown in red (4403.21.00), increased 5.7% over the year to 2.657 million m3. These logs are purported to be sawlogs or veneer logs. Their export has caused some tension over the last few years, but the market dynamic associated with some of those logs is one thing, and the realignment of the national estate to meet future supply needs is another.

The ‘right-sizing’ of the softwood plantation estate that has contributed to high levels of log exports, may be approaching an end. If that is so, softwood log exports may ease over the next year. At the other end of the large volume export markets, hardwood chip exports will continue at around their current levels, for at least the next two to three years.