Australia’s exports of logs grew a remarkable 38.9% over the year-ended April 2016, reaching over 3.515 million m3 and adding almost 1.000 million m3 to total exports. While exports of softwood logs continue to dwarf those of hardwood logs, growth in hardwood log exports was a massive 277.5%, albeit from a low base. The big lift in exports highlights important policy questions, especially about the adequacy of the nation’s plantation estate.

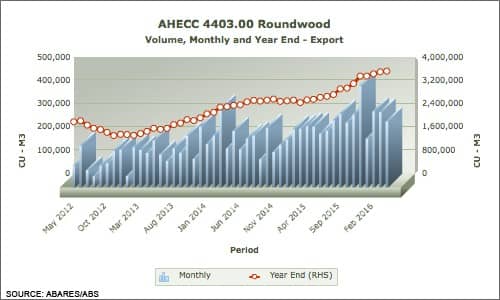

Total roundwood or log exports are detailed in the following chart, which displays better than any other available tool, the continuous increase in Australia’s log exports since the beginning of 2013.

To go straight to the dashboard and take a closer look at the data, click here.

Leaving aside the occasional monthly blips (December 2015 and January 2016 are examples), the last eighteen months has seen almost continuous increases in monthly export levels, with an apparent plateau having been reached in the early part of 2016. Total log exports settling it at between 250,000 m3 and 300,000 m3 per month seems entirely likely on the data and industry intelligence.

As outlined above, the significant proportion of exports is softwood logs, and other than hardwood logs, the other log exports (including treated logs and tropical species logs) total less than 10,000 m3 per annum.

The table below sets out exports of softwood logs and hardwood logs over the last two years.

| Year Ended Apr ‘15 | Year Ended Apr ‘16 | % Change | |

| Softwood Logs | 2,431,485 | 3,159,500 | 29.9 |

| Hardwood Logs | 92,535 | 349,327 | 277.5 |

It is plain to see that what has come to be known as the ‘wall of wood’ is being exported in log form, as much as it is being exported as woodchips.

Although the conditions and circumstances are different by species and also by region, there is no escaping that some processors are concerned about the volume of log exports, wondering at what point their own supplies may be curtailed by the export trade. That is part of both the global fibre market’s dynamics, as much as it is of the local market situation.

Ultimately, what it underscores is the Australian industry’s concern that Australia has insufficient plantations to meet the demand for forestry and wood products now, let alone in the future.