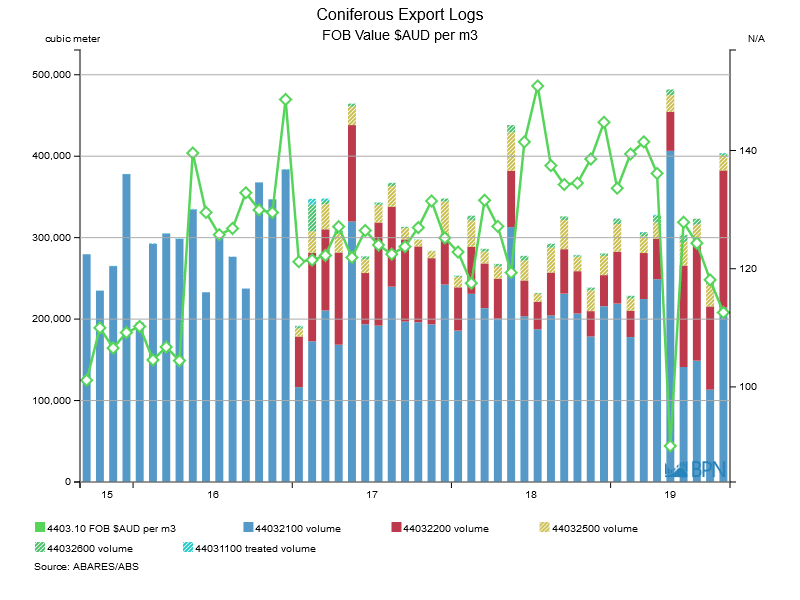

Exports of Australia’s softwood logs lifted significantly in September, as the smaller dimension (<15cm diameter SED) pine logs hit a monthly record and a nineteen-month annualised high. Total softwood log exports reached 403,894 m3 in September, with the total still dominated by the larger dimension (>15cm diameter SED) logs.

The data can be seen in the chart below, noting that the separation between sizes (and for species other than pine) only commenced in January 2017.

To go straight to the dashboard and take a closer look at the data, click here.

| Description | 19M03 | 19M04 | 19M05 | 19M06 | 19M07 | 19M08 | 19M09 |

| Monthly | 306,957 | 328,168 | 482,178 | 303,689 | 323,203 | 246,678 | 403,894 |

| AUD $ per m3 | 141.47 | 136.12 | 90.00 | 127.87 | 124.31 | 118.12 | 112.60 |

A noticeable feature of the aggregate export data is the volatility experienced in price. We may anticipate that the lower prices occur when the smaller dimension log exports are more prominent, but that is not the case.

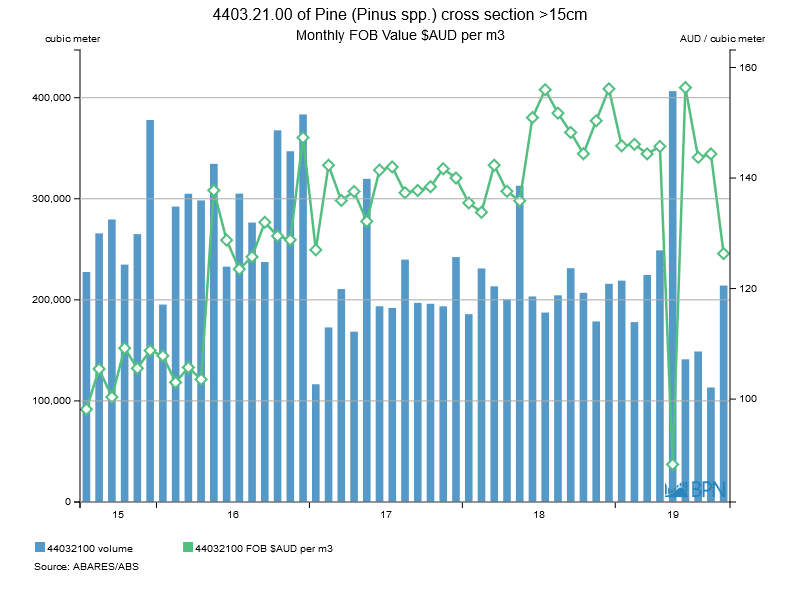

We can observe in the chart below that when larger dimension logs hit their all-time record of 406,549 m3 in May 2019, the average price for those logs plunged to a reported AUDFob88.19/m3. That is a remarkable fall for logs that a month early were worth 65% more.

It is clear log markets are quite febrile and the large volumes appear to represent at least some material that was very cheap, presumably because it was damaged in some way. That however does not explain the solid 214,195 m3 exports in September and the lower than average AUDFob126.33/m3 price recorded for the month.

To go straight to the dashboard and take a closer look at the data, click here.

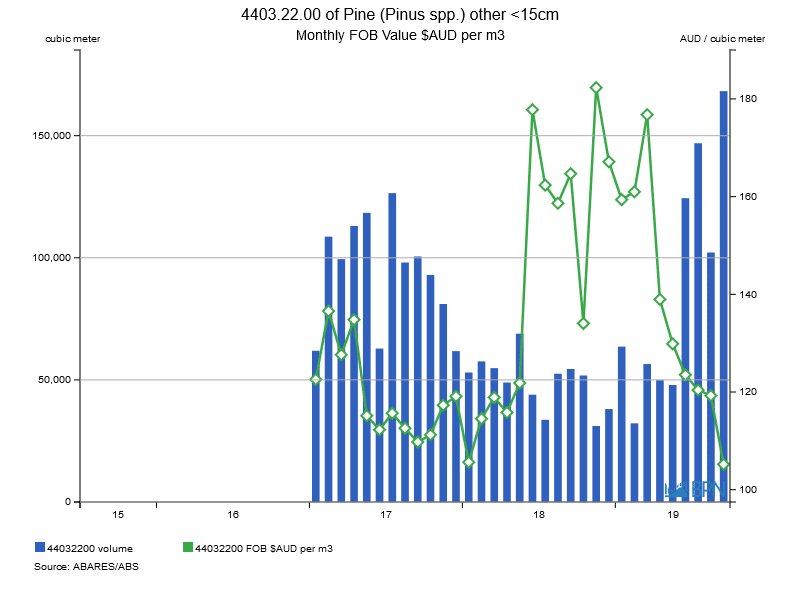

For their part, smaller dimension softwood logs (<15cm SED) totalled a record 168,261 m3 in September 2019, more than triple exports from a year earlier. As a result, annualised epxorts lifted to 912,946 m3, their highest level since April 2018 and a solid 29.7% higher than a year earlier.

To go straight to the dashboard and take a closer look at the data, click here.

The chart shows some interesting trends, culminating in the most recent period – really the last four months, in which monthly exports have more than doubled the previous monthly average and recorded that most recent record.

So, why are smaller dimension log exports on the rise?

Clearly, the average price has something to do with the situation. We can see the period where the average price was higher, and the table below includes the last month when that was the case. In March 2019, the average smaller dimension softwood log export price was AUDFob176.78/m3, on a volume of a little more than 56,000 m3. Fast forward to September and we can see export volumes were almost exactly triple and the average price had been crunched down to AUDFob105.20/m3.

| Description | 19M03 | 19M04 | 19M05 | 19M06 | 19M07 | 19M08 | 19M09 |

| Monthly | 56,502 | 49,893 | 47,918 | 124,426 | 146,915 | 102,187 | 168,261 |

| AUD $ per m3 | 176.78 | 138.96 | 129.86 | 123.52 | 120.40 | 119.26 | 105.20 |

We know that exporters will not have entered the market because the price had fallen (that makes no sense). So, we can surmise that exporters being in the market at these volumes has something to do with the average price.

We do not know if sheer volume (and demand side weakness in China for instance) played the main role in driving prices down. Equally, we are uncertain what role the quality of these <15cm SED logs might have played. What we think it is reasonable to say is that for one reason or another, this wood is being liquidated.

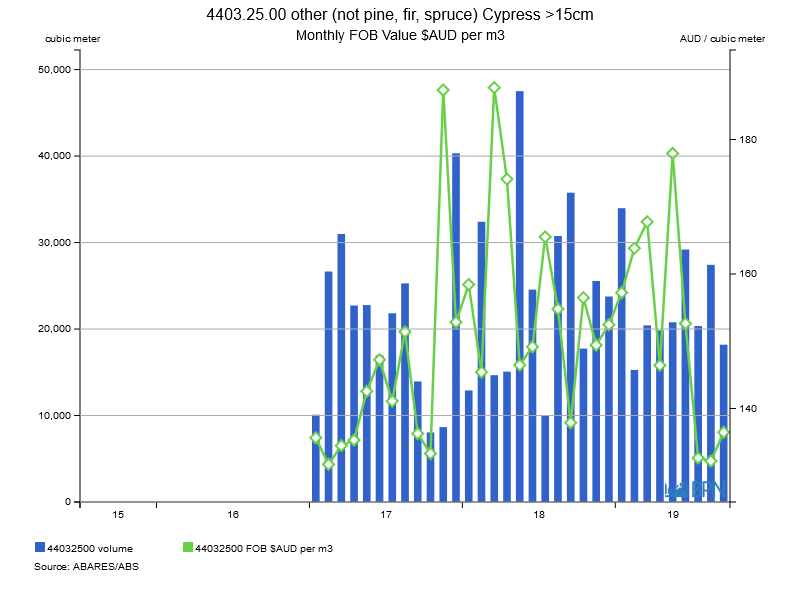

Finally, the other volume of relevance is exports of softwood logs >15cm other than pine. This is generally the export designation for cypress. As the chart below shows, this trade is more stable and appears to be reasonably range bound over the last year, including as to price (the chart parameters distort the average price movements to some extent).

To go straight to the dashboard and take a closer look at the data, click here.