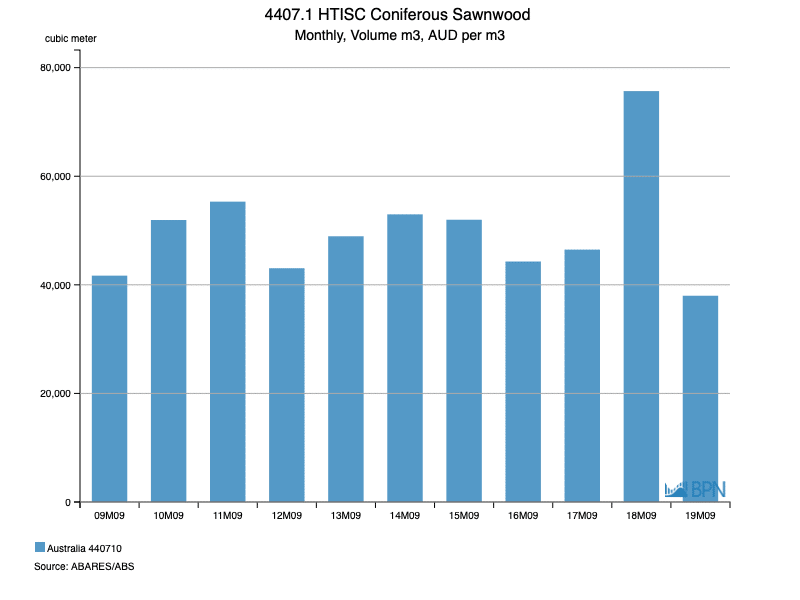

Sawn softwood sales fell to a reported 37,993 m3 in September 2019, their lowest September total in more than a decade. Remarkably, total reported sales were just half the total recorded in September 2018, falling a massive 49.8% year-on-year.

To be fair, imports were at their highest ever monthly level in September 2018, but the contrast, shown in the chart below, is none-the-less, very sharp.

To go straight to the dashboard and take a closer look at the data, click here.

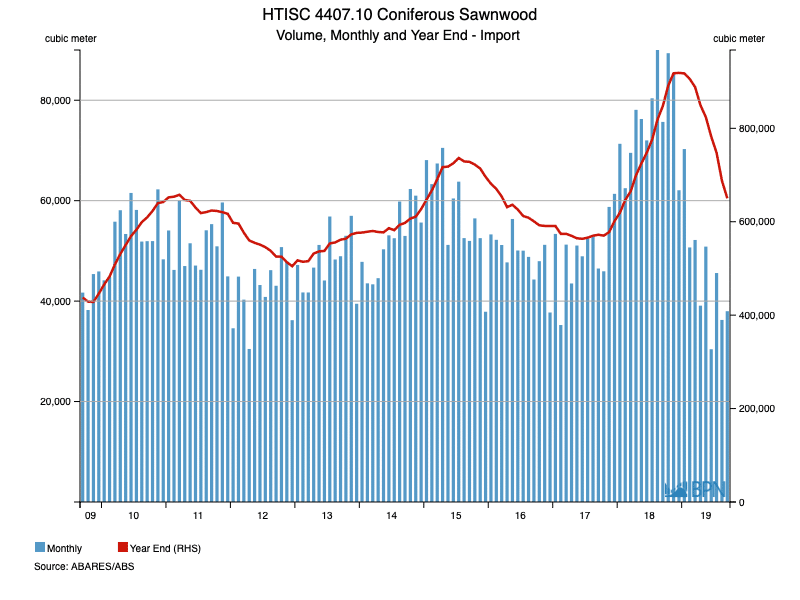

There is little doubt that the drop in imports from September to September was dramatic, and it certainly underscores the easing experienced in the total market over 2019. However, looking beyond the immediate, the chart below shows that total sawn softwood imports plunged to their absolute monthly low for the decade in June 2019. That month, imports were just 30,413 m3.

There are some suggestions that the peak in imports was related to some overly ambitious market projections that have subsequently been washed through the market.

To go straight to the dashboard and take a closer look at the data, click here.

The chart also shows that year-end imports have continued to fall and are more or less assured to continue falling through the next three to four months at least. Imports for the year-ended September 2019 totalled 650,134 m3, down 23.3% on the year before. It is worth noting that annual imports have averaged 626,265 m3 over the last decade. The current slump is set to fall well below that level and may even flatten out at below 600,000 m3 for the full calendar 2019.

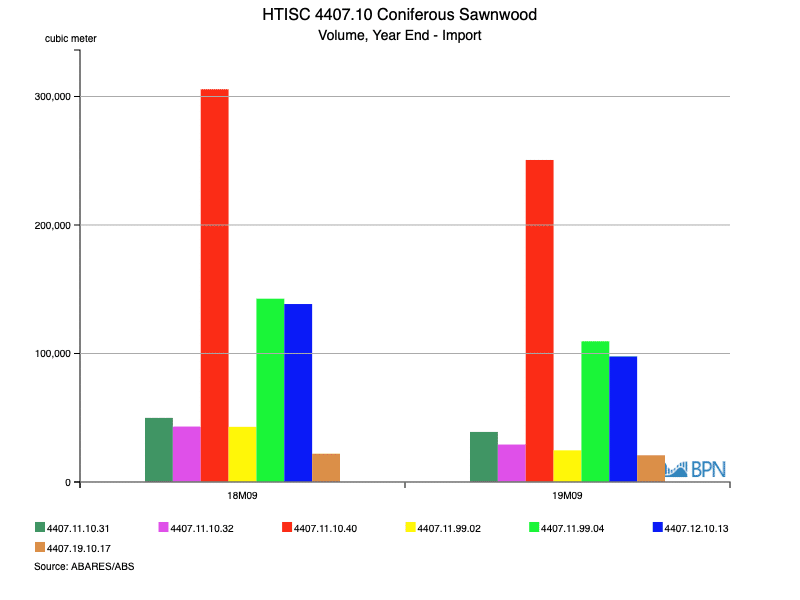

It is equally relevant to consider the grades of sawn softwood that have experienced import declines over the last year. That, coupled with housing data, provides some clues as to the drivers of softening imports.

Here we can see that the major import grade, shown in red and described as Dressed, Untreated (4407.11.10.40) experienced an 18.0% import decline over the year-ended September 2019, falling to 250,605 m3. Note that grades with imports totalling less than 20,000 m3 in either year have been excluded for simplicities’ sake.

To go straight to the dashboard and take a closer look at the data, click here.

The table shows the relative imports of each of the grades with more than 20,000 m3 of imports in each year. The majority are definitively structural grades, supporting the conclusion that imports have been heavily impacted by the downturn in dwelling approvals described earlier in this edition of Statistics Count.

| Import Code | Description | YE Sep ’18 | YE ‘Sep ’19 | % Change |

| 4407.11.10.31 | Dressed, Treated, Radiata pine | 49,878 | 38,960 | -21.9 |

| 4407.11.10.32 | Dressed, Untreated, Radiata pine | 43,121 | 29,172 | -32.3 |

| 4407.11.10.40 | Dressed, Untreated, excl. Radiata pine | 305,617 | 250,605 | -18.0 |

| 4407.11.99.02 | Roughsawn, Treated, Radiata pine | 42,920 | 24,645 | -42.6 |

| 4407.11.99.04 | Roughsawn, Untreated, excl. Radiata Pine | 142,695 | 109,486 | -23.3 |

| 4407.12.10.13 | Dressed, Fir or Spruce | 138,485 | 97,694 | -29.5 |

| 4407.19.10.17 | Dressed, Other | 22,017 | 20,788 | -5.6 |