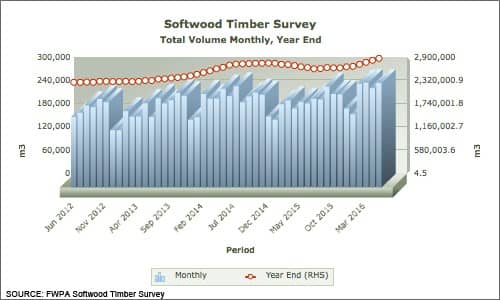

Reported sales of sawn softwood hit a new record of 2.866 million m3 for the year-ended May 2016, a rise of 8.0% on the prior year. Major contributing factors were a modest increase in total sales of structural sawn softwood products and very strong growth in a range of softwood products from Outdoor Domestic to Packaging.

The first chart shows total sales on a monthly basis and on a year-end basis, charted on the right hand side.

To go straight to the dashboard and take a closer look at the data, click here.

In May 2016, sales of sawn softwood reached 269,000 m3, less than 1000 m3 below the monthly record set in March 2016.

Sales of sawn softwood follow obvious seasonal trends, and are of course, driven by the housing sector’s performance. However, in addition to new participants in the FWPA survey since the start of 2016, the first four months is showing what might be called ‘seasonal resilience’. It is too soon to assess whether this is a trend or a blip, but keep an eye on this data for early signals of a market that may be shifting and stabilising in unfamiliar ways.

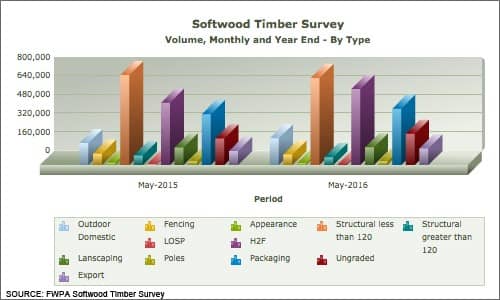

However, in the short to medium term, the real interest is on the attributions to sales growth. That is, how did each of the major product groupings fare? The chart below shows these, but after that, the table reassembles some of the data to show ‘structural’ grades versus other grades.

To go straight to the dashboard and take a closer look at the data, click here.

At a specific grade level, the really big mover has been H2F, the treated, seasoned structural pine product. Year-ending May 2016, sales totalled 648,521 m3, up a very strong 22.07% or more than 117,300 m3 on the prior corresponding period. There is an extent to which these sales are cannibalising the untreated cousins of course. To address the growth in sales of structural versus other major grades, the table below has been prepared.

| Grade/Grouping | YE May 2015 | YE May 2016 | % Change |

| Major Structural Grades (Structural <120, Structural >120, H2F) | 1,378,931 | 1,456,824 | 5.6 |

| Outdoor Domestic | 187,333 | 227,553 | 21.5 |

| Landscaping | 149,968 | 150,981 | 0.7 |

| Packaging | 433,574 | 480,651 | 10.9 |

| Ungraded | 226,704 | 266,111 | 17.4 |

| Export | 119,719 | 141,544 | 18.2 |

Of the grades presented here (accounting for more than 80% of total sawn softwood sales), the combined structural grades accounted for 55.2% for the year-ended May 2015 and for 53.5% for the year-ended May 2016.

The declining proportion of structural timber being sold may be related to the recent additions to the list of companies participating in the softwood survey. But it might also be signalling that despite its continued strength, the beginning of an easing cycle for the incredibly long-running housing boom in Australia.