Finance for new housing construction has begun to assert itself, growing 10.0% for April 2015, compared with April 2014. Meanwhile those refinancing or seeking to buy an existing home have started to take a breather in the market and investor loans have commenced the RBA’s preferred slowdown amidst the ongoing frenzy of commentary about the price of housing in the largest Australian cities.

When those refinancing a loan are removed, the national housing loan book expanded by AUD24.8 billion in May 2015. Investors still accounted for 52.5% of the total loan book for the month, and the chart below shows how they have built a dominant position over time.

For further details, go to the FWPA Data Dashboard.

Although it is a little difficult to discern, there is change underpinning the headline data. In the last month, both investors and owner-occupiers have backed off their borrowings. Investor borrowing was down 3.2% in May compared with April and owner-occupiers borrowed 6.3% less than a month earlier.

Either or both of the borrowers and lenders have just eased from the market. Doubtless, the RBA’s commentary has had some effect in that regard. First home-buyers are in a different situation however. In May, they borrowed 3.7% more than in April, possibly winning a greater proportion of auctions and sales as those who already have a place to call home stood out.

Although it is early days and the numbers remain relatively small, the Reserve Bank of Australia will presumably be pleased that its ‘jawboning’ on housing credit and the prospects of a ‘bubble’ is at least showing signs of bearing fruit.

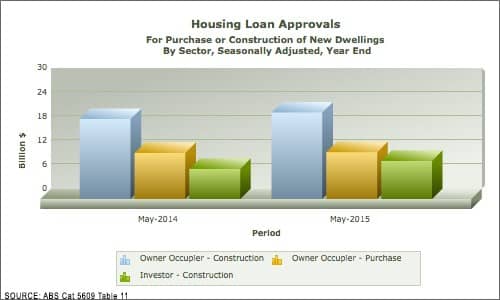

However, the story doesn’t end there. The value of loans for construction of new dwellings, continues to rise, as the chart below shows.

For further details, go to the FWPA Data Dashboard.

The largest sub-sector for housing credit remains owner-occupier construction. For the year ended May 2015, it grew to AUD21.5 billion, a rise of 8.1% compared with the prior corresponding period. Underscoring their love of apartments, investors grew their new construction loans by a sizeable 26.7% over the same period, hitting AUD9.5 billion. Purchases of existing properties by owner-occupiers remained stable, growing just 1.7% to record a total of AUD11.7 billion.

So housing credit data appears to be running in two directions simultaneously. There is a slow down in those already in the market pursuing new loans and at the same time, where there is growth, it is most pronounced for newly constructed dwellings. There is no certainty, but that seems to point to the bubble argument being at least partly right. That is, the data may be suggesting that it is simply more efficient to build new dwellings than it is to purchase those that already exist. This is further supported by the 3.7% decline in credit for alterations and additions to existing dwellings, from April to May.

We say partly right because there are other interpretations of the same data, including the impressive argument that pent up demand for new housing is finally finding the investment it has been waiting for.