It is an uncomfortable reality that Australia’s market has failed to supply the required volume of housing, over a relatively long period. At its simplest, the market appears to have failed, which is why intervention from the combined Australian and State Governments is being welcomed and encouraged. To understand the failure of the housing system, we need to look at some of the key evidence of that failure.

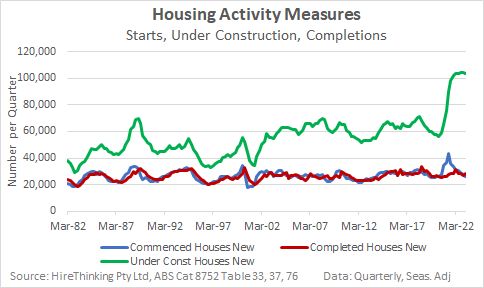

Over history, Australia has failed to build more than around 35,000 houses per quarter. Even at the most pressing times, the system of work called the ‘housing market’ or the ‘housing economy’ has routinely failed to pump out enough dwellings to meet demand.

The grand experiment of the pandemic saw the largest spike in housing approvals in the nation’s history. Those approvals – because of the way the stimulus was front-loaded, very quickly became record levels of building commencements. These are shown on the blue line in the chart below.

However, those commencements were piled onto an existing pipeline of work that had been trending higher for four decades, as the green line shows. That is, over a very long period of time, the amount of building work in the pipeline was increasing at a faster rate than completions were being achieved (the red line).

It was only in the March quarter of 2023 that a modest fall in the total pipeline of houses under construction was achieved, and even then, not because completion rates increased. Rather, it was because commencements reduced as a flow on from the last year of soft approvals.

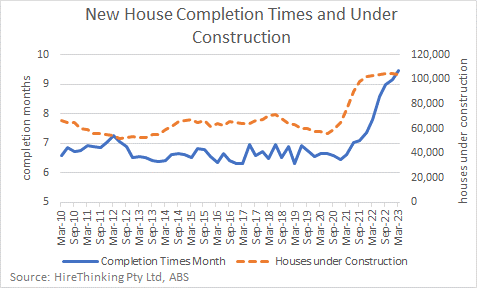

At its simplest, this expanding – and now very large – pipeline of work under construction just means we are taking longer to build the same number of houses, than ever before, as the next chart shows.

One version of events is ‘oh well, it just takes longer’, but there are a few things wrong with that scenario.

The longer it takes to build the more likely costs are to increase and margins for builders are likely to be hollowed out. Builder insolvencies are written into this outcome, as are households having their finance withdrawn as interest rates increase and the household’s ability to provide cover decreases.

As Michael Bleby wrote in the Australian Financial Review, this might be easier said than done because:

“The Industry’s capacity remains challenged after a slew of builders went broke amid soaring costs.”

There are already less builders in the market – especially the volume home builders – than are required to build the national future.

These issues are playing out before our eyes right now and what it means is the pipeline is large but a little fanciful, because the likelihood is a growing proportion of it will not be built.

It has been argued that the fiscal stimulus that drove the pipeline higher was pretty poorly targeted but that water is under the bridge now. What is still an issue and is going to remain an issue for some time, is that the nation cannot build the dwellings it needs in a timely manner, and that is a systemic problem.

The medium density, urban infill revolution may be on our doorsteps, but even there, the challenges include a capacity to build that is underwhelming right now. Bleby again:

“Cracking the medium-density nut in a country that has grown up with high-rise CBDs and flat, wide suburbs is crucial.”

Bleby continues on to address variety of required measures – faster approvals of land release, infill incentives where there is existing infrastructure, reduced capacity for ‘nimby’ neighbours to complain and so on. These are all relevant points, but what is also important as Bleby points out, is that Australia does not have enough construction workers.

We’ll double that down, because it also doesn’t have enough trucks to move goods, sufficient warehouses, enough facilities and plants in which to do the required work.

If the country is to build something like 1.2 million dwellings in the next five years, it must develop the capacity to build more and faster, and that is likely to mean new systems of work, fuelled by a new national commitment and very significant finance.