As Australia’s total retail sales growth appeared to stall in July, the housing related indices both declined. The Hardware, Building and Garden Supplies industry eased 1.4% compared to the prior month and the Furniture and Floor Coverings industry slipped a more modest 0.4%. Total retail sales declined 0.1% in July, possibly suggesting a contraction in housing related expenditure.

Coupled with some commentator’s views that the housing market maybe coming off its peak, this data may provide confirmation. That would be unsurprising, at least when considered from the perspective of the last year.

While the recent monthly data shows declines, for the year ended July 2015, the Hardware, Building and Garden Supplies industry has still grown at 7.8%, on a seasonally adjusted basis and when compared with the year to the end of July 2014. Similarly and over the same period, the Furniture and Floor Coverings industry experienced growth of 9.1%.

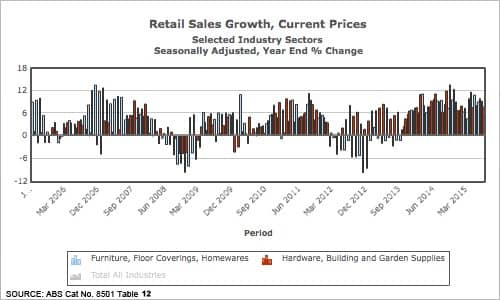

The chart below shows the experience of the two industries since July 2005.

To go straight to the dashboard and take a closer look at the data, click here.

This decadal chart serves to demonstrate the varied, cyclical and regularly changing patterns of retail sales in these two industries. It is plain to see that regularly, growth in one sector coincides with little or no activity in the other. It appears this is because, in the context at least of periods of housing expansion, their expenditure occurs at marginally different points in the cycle of investment.

That is, as a house is built, different products are required at different times. It might generally be expected that Hardware, Building and Garden Supplies investments will be more continuous than the ‘one-offs’ associated with floor coverings and perhaps even furniture.

Those points are debatable, but what is not contestable, on the data at least, is that since the final quarter of 2013, growth in retail sales for both of these product ranges has been strong, sustained and generally linked. It is instructive that the combined lift in sales commenced close to, but less than a year after the current housing boom commenced. These are after all, expenditures that occur when there is a dwelling either being lived in or close to it.

The relationship between increases in housing and these retail sales seems clear and there is a level of dependency.

That makes it difficult to use retail sales data to predict the end of the housing boom. Although the data may not be exactly correlated, the end of the retail sales expansion is unlikely to occur until the housing boom has been over for a few months.