Australia’s retail sales slipped 3.9% in December, falling sharply and for the first time in more than a year. Latest data on the costs of living show mortgage repayments are up significantly, now accounting for 26.6% of total household income. As mortgage interest rates rise, the money available for other things automatically reduces.

While the employment data may have caused limited concern in December, a 3.9% fall in retail sales for the month has sirens warming up and amber lights flashing in the nerve centres of the national economy. In large part, that’s because retail sales account for one-fifth (more or less) of national economic activity.

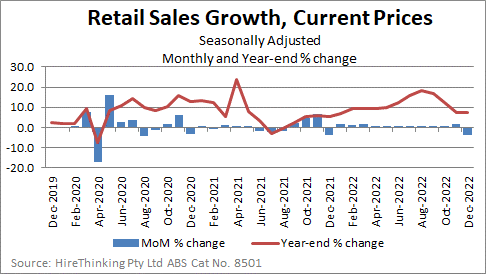

The chart below shows falls are less common than rises, but just as important, a long series of small increases has been offset by a sharp fall in a single month. In other words: retail sales remain pretty fragile.

Fragility in retail sales is important because it underscores the nation’s sensitivity to changes in disposable income and the ability for households to spend as they did previously.

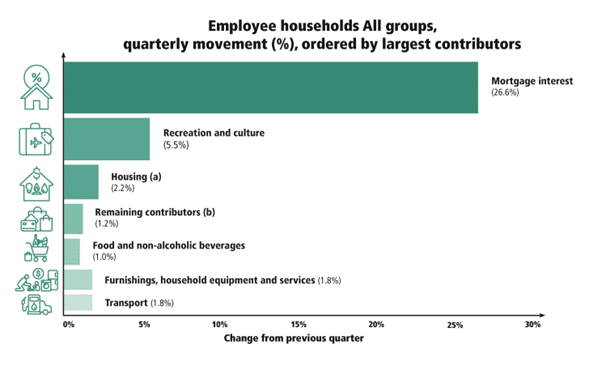

Providing more detail of changes in household spending is the Selected Living Cost Indexes for the December quarter. These releases from the ABS show, not surprisingly, that Mortgage Interest payments comprised the biggest change in the quarter, rising by 26.6%

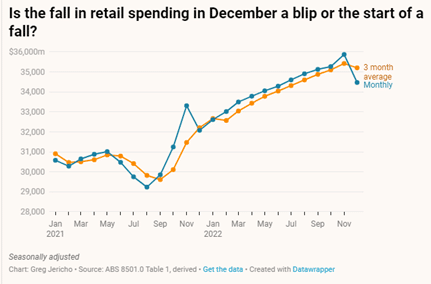

Writing in The Guardian, Greg Jericho pointed out the magnitude of a 3.9% fall in retail sales in a month. This is the largest ever monthly fall other than the introduction of the GST or through the pandemic!

Jericho also articulates why the data must be viewed cautiously. Because, as he says, over the last three years, the economy has been ‘nuts’. As his best example, he points to the trends for retail sales and shows it is running 14% above where it would be if we had not experienced the pandemic.

Because the world has gone a little loopy, Jericho makes the excellent point that monthly analysis of retail sales is not all that helpful. The three month moving average shows the decline in December, but its more muted than the 3.9% for December on its own.

Are retail sales sending us a signal the economy is rapidly slowing? We’ll know pretty soon if it was a one off, or if the economy has taken a sharp turn down.