Since the beginning of 2024, global shipping and freight costs have returned to growth, under a batch of pressures headlined by Red Sea vessel attacks and new capacity constraints in the Panama Canal.

One consequence of the two constraints has been the much longer and more expensive journeys being taken by many vessels. Those previously using the Red Sea are – in some instances – adding a fortnight or more to go around the Cape of Good Hope (South Africa), with the Panama Canal limits seeing some vessels take a reported eighteen-to-twenty day additional journey around Tierra del Fuego (Argentina).

Impacts are observable in January import data and are reportedly seeing increased costs for the subsequent months and for current freight arrangements.

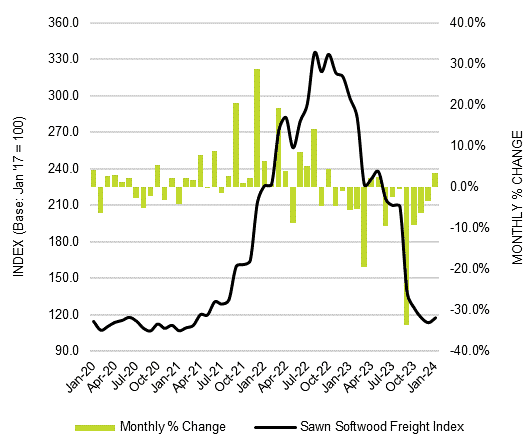

The Australian Sawn Softwood Freight Cost Index (Softwood FCI) arrested seven months of declining freight costs in January, with the index rising 3.5% to 117.8 points. The index isolates sea freight and insurance costs for sawn softwood imports to Australia and charts movement in those costs.

While the chart demonstrates that the cost of freight to Australia has almost returned to pre-pandemic levels, it also provides evidence of the pressures that can exist on global sea freight costs. At its peak in August 2022, the index hit 335 points, equivalent to shipping costs of AUD229/m3 of sawn softwood.

Australian Sawn Softwood Freight Cost Index: Jan ’20 – Jan ‘24 (INDEX & %)

Source: ABS and IndustryEdge

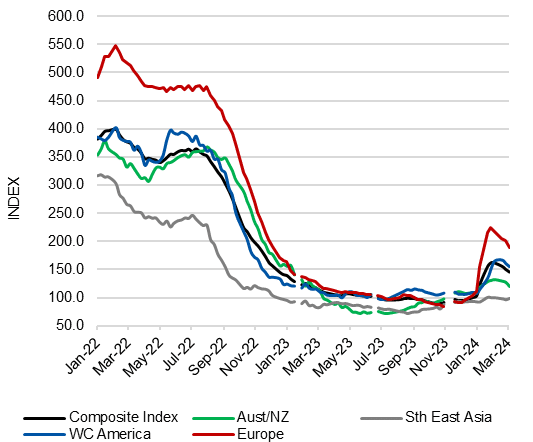

This data seems consistent with the latest from the China Containerised Freight Index (CCFI) which shows a large spike in freight costs on European routes, but a more muted response for other routes, less dependent upon the Red Sea for efficiency of trade.

Since the start of 2024, the Composite Index is up 40.1%, while the less-constrained routes from Shanghai to Australia (Melbourne is the benchmark port in the CCFI) lifted just 4.9%. We can anticipate freight costs from Asian destinations will be moderately higher, but from further afield, will be significantly higher over coming months.