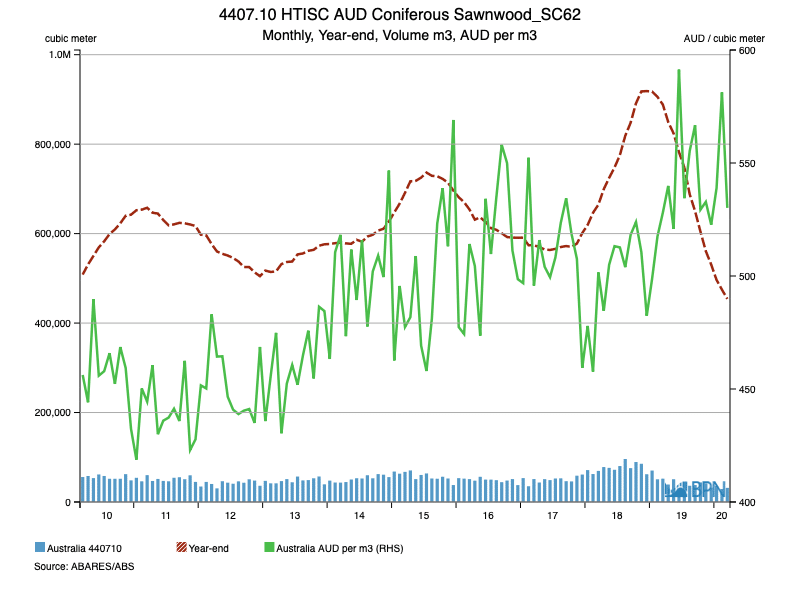

Imports of sawn softwood fell 47.5% over the year-ended March, tumbling to 475,109 m3. Over the same period, the average price of sawn softwood products tracked 6.9% higher to AUDFob543/m3 year-ended March 2020. However, most of the price growth was recorded in late 2019, with the 2020 trend pointing down. In March, the average import price was AUDFob530/m3, down 8.8% on the prior month.

As the opening chart shows, year-end volumes have declined for fifteen consecutive months, with imports falling steeply to levels not seen in more than a decade. While aggregate consumption may be lower than two years ago, local demand has not fallen anything like as quickly as imports.

At the same time however, it can be observed that average prices increased, even as import volumes began to decline. In part this is a function of a gradually depreciating Australian dollar through 2019, but also has something to do with the global demand and supply dynamic that delivers increasingly clear market signals as to prices in international markets.

Fig. 17

To go straight to the dashboard and take a closer look at the data, click here.

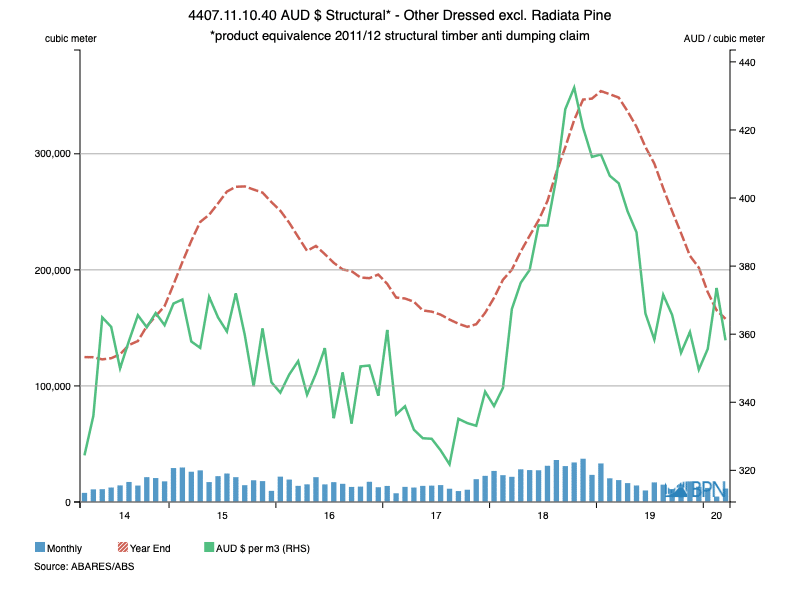

This is the aggregate data, but of course, there are differences between the main import grades. It is typically of greatest interest to examine the structural grades – those used for house framing and other activities requiring structural integrity.

The two largest volume import grades are Dressed Other (excl Radiata Pine), recorded under the import codes as 4407.11.10.40 and Roughsawn Other (excl Radiata Pine) recorded as 4407.11.99.04. These two grades effectively describe the majority of imports from Europe.

Over the year-ended March, as the table below shows, imports of both grades have fallen by a very similar proportion – greater than 50%. The same is true of the annual weighted average prices, each of which has declined, but less than 10% over the course of the year.

|

Dressed |

Roughsawn |

|||

|

Volume |

AUDFob/m3 |

Volume |

AUDFob/m3 |

|

|

YE March 19 |

348,461 |

$405.93 |

146,857 |

$414 |

|

YE March 20 |

157,802 |

$366.74 |

68,236 |

$382 |

|

% Change |

-54.7% |

-9.7% |

-53.5% |

-7.7% |

It is instructive to examine the import charts to observe the trajectories of imports and prices. The charts below – for these two major grades – show similar growth rates to the top of their cycle around the end of 2018, after which they fell in a similar fashion.

However, the data points to a steeper fall for the dressed product (4407.11.10.40), that has yet to flatten out. The industry will reasonably be wondering at what point imports will find the plateau of normalised minimum supply. Since mid-2019, average import prices have hovered at or around the AUDFob/m3 mark, suggesting that prices have little capacity to move lower, regardless of what may happen with import volumes.

Fig. 18

To go straight to the dashboard and take a closer look at the data, click here.

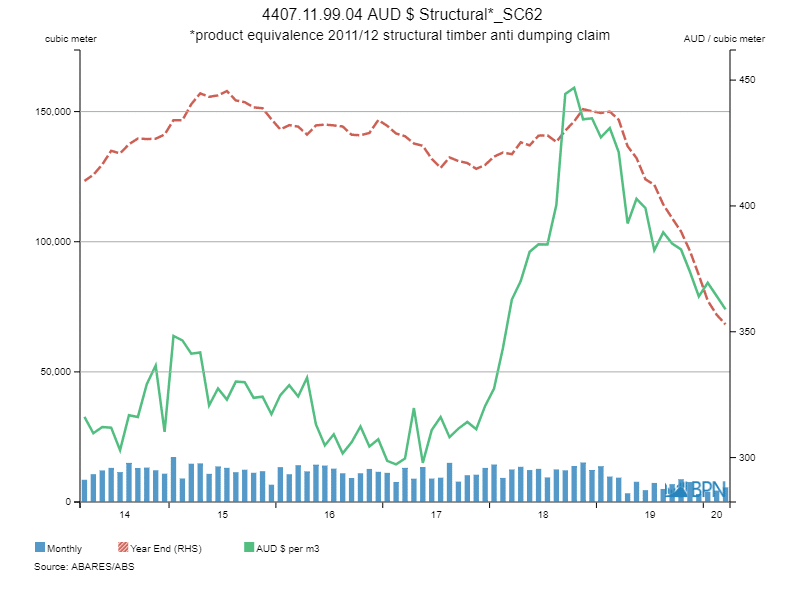

By way of contrast, the second chart shows roughsawn product imports (4407.11.99.04) declining a little more gradually than their dressed counterparts, but to date failing to have reached any consistent plateau that suggests they have also reached their natural base, either as to volume or price. It may be that the slightly less transformed product is due to experience further falls of both.

Fig. 19

To go straight to the dashboard and take a closer look at the data, click here.

Declines in sawn softwood imports appear to have been broadly consistent – but steeper – than the declines in the total market for sawnwood in Australia. What remains to be seen is how imports respond to the pandemic and the near inevitable decline in demand that will bring to Australia, and the rest of the world.