The following trade update has been supplied by IndustryEdge from its online platform, Wood Market Edge online. All the data used and referred to here is available for download by IndustryEdge subscribers and is part of the most timely and comprehensive data and information service available in Australia.

Learn more about Wood Market Edge online here.

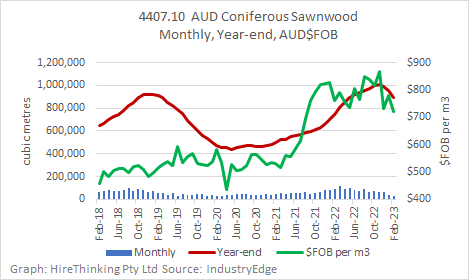

Over the year-ended February 2023, sawn softwood imports totalled 891,719 m3, up 19.7% on the year prior. The total weighted average import price has declined modestly over the year and was AUDFob719.29/m3 in February 2023. The trend decline now underway was always to be expected, but with monthly imports falling to 31,257 m3 (down 21% on the prior month), it is clear imports have turned.

The headline chart below, provides the details and shows that unlike prices, import volumes have been declining rapidly, as inventory and the slow pace of housing construction continue to take their toll on the market.

|

m3 & AUDFob/m3 |

Monthly Imports (m3) |

Monthly Wtd Ave Price (AUDFob/m3) |

|

Feb-22 |

91,134.0 |

759.74 |

|

Jan-23 |

39,540.7 |

778.86 |

|

Feb-23 |

31,256.8 |

719.29 |

For all that monthly imports are shredding, total annual imports at 891,719 m3 are still 19.7% higher than they were just a year ago.

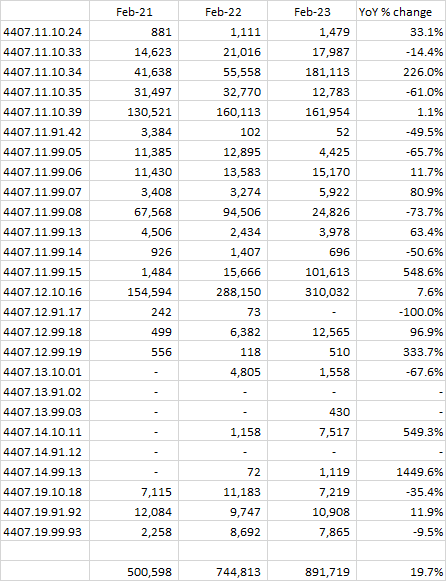

When it comes to specific supply, there are always outliers and as the table below indicates, there are a handful of grades that continue to dominate import supply.

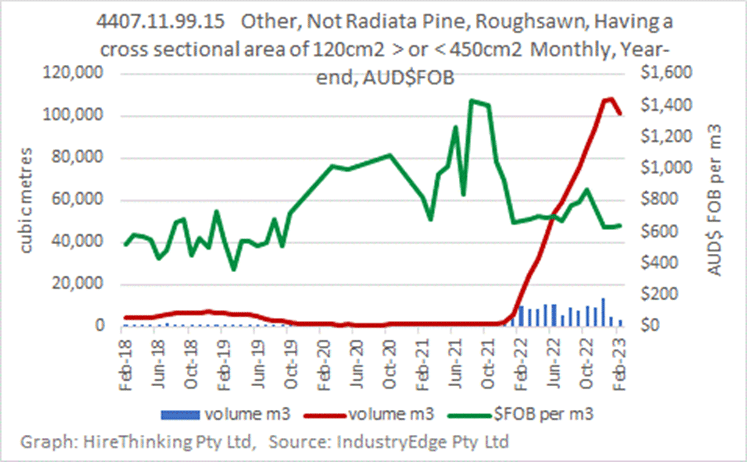

It is hard to go past the stellar rise in imports of the 4407.11.99.15 grade, which is essentially larger dimension roughsawn softwood, other than radiata pine. The chart below shows its details.

Observably, the volume increase for this grade came as the price corrected sharply downwards, and as the second chart shows, that was fuelled by supply from the Czech Republic and Poland, right about the time Russia commenced its war on Ukraine.

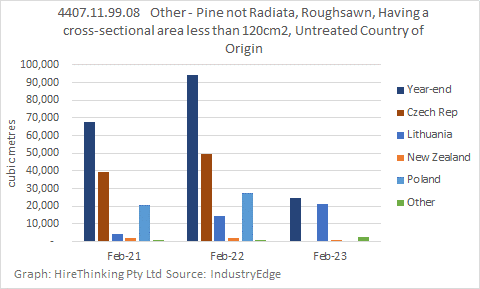

By contrast, the 4407.11.99.08 grade, which is the smaller dimensions of the same non-Radiata pine, experienced a 73.7% decline over the same period, after its average price initially rose, jumped around as volumes declined, and subsequently has fallen away as the volumes have been negligible on a month-to-month basis.

Of note is unlike the earlier grade we spotlighted, this grade has seen the Czech Republic and Poland exit supply to Australia, apparently in favour of larger dimension products.

Overall, a small number of countries dominate supply. Year-ended February 2023, Germany (up 32.6% on the prior year), delivered 196,475 m3, supported by Lithuania (up 120.0% to 138,408 m3) and New Zealand (up 4.2% to 109,489 m3) as the main suppliers. Together they accounted for around 48% of total import supply over the year.

With annual volumes still 20% higher than a year earlier, the Russian Federation took most of the downside (-70.2%). Sweden saw its shipments down 13.2% or a little over 13,600 m3 for the year, so that barely registers in the total.

At the state level, sawn softwood imports have been changing quite rapidly. NSW and Victoria have seen stable growth, while Queensland has seen sharp falls and Western Australia has experienced very significant increases, above even those of the smaller SA and Tasmania.

The aggregate details for port are displayed below, noting most align directly to State imports.