This article is produced by FWPA’s Statistics and Economics program.

- Imports of sawn softwood are gradually increasing, up 15.4% year-ended February 2025

- Import prices recovered in February, lifting more than 11% on the prior month

- Although all the focus is on global trade dynamics right now, the major supplier of sawn softwood to Australia remains New Zealand

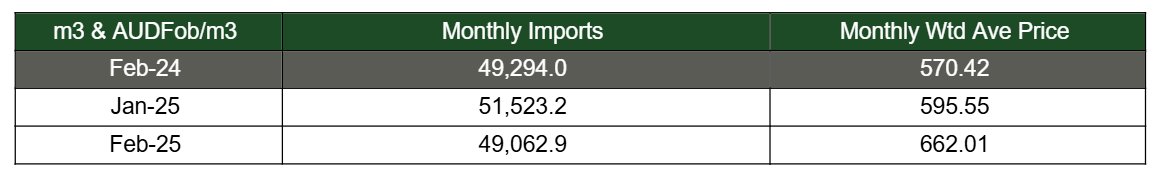

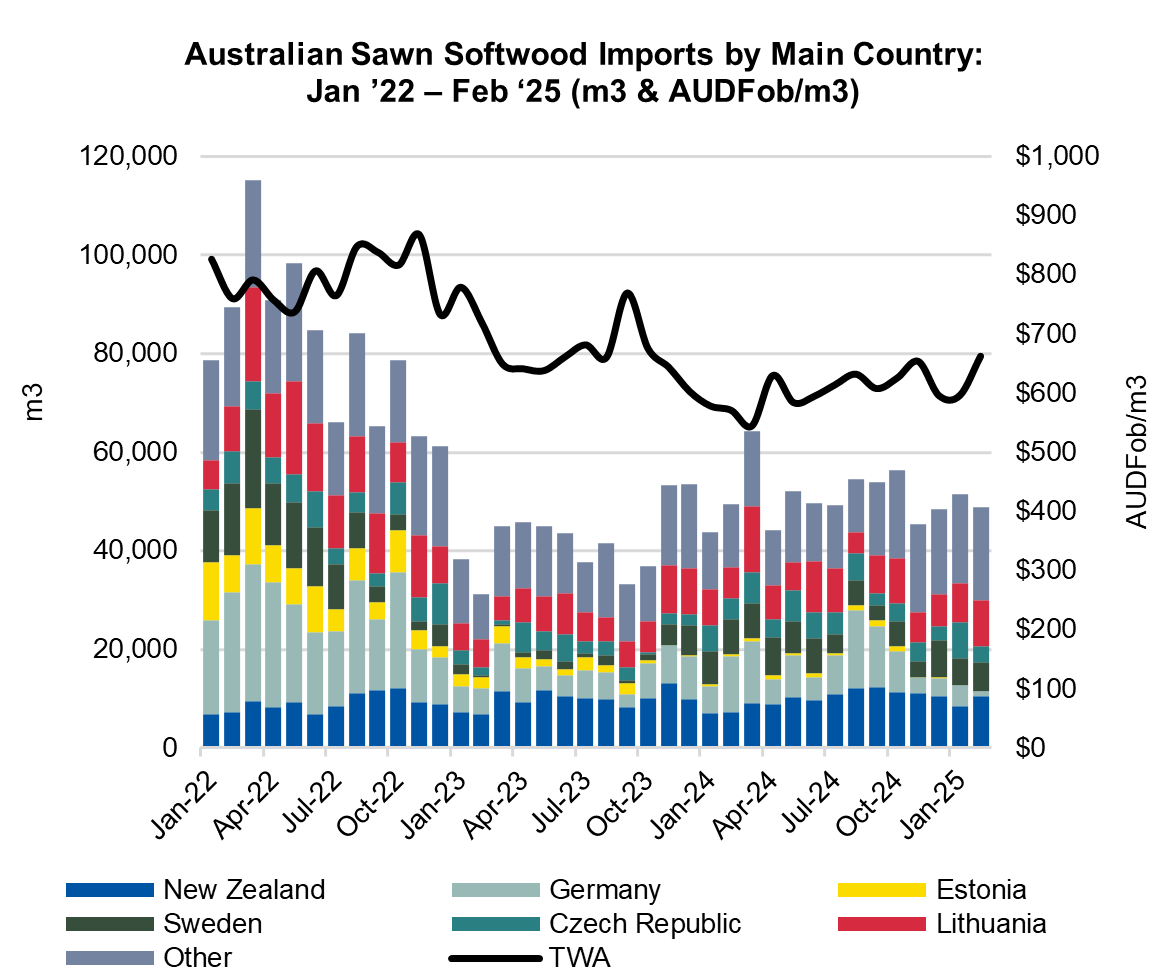

Remaining well below their pandemic peaks, imports of sawn softwood rose 15.4% year-ended February 2025. Imports totalled 619,039 m3, just below the levels recorded in late 2021, when imports were ramping up during the pandemic.

However, comparisons end there, with little on the horizon to suggest a surge in demand will drive imports higher in 2015, albeit the US tariffs and trade war could shake imports into new and different locations later in the year.

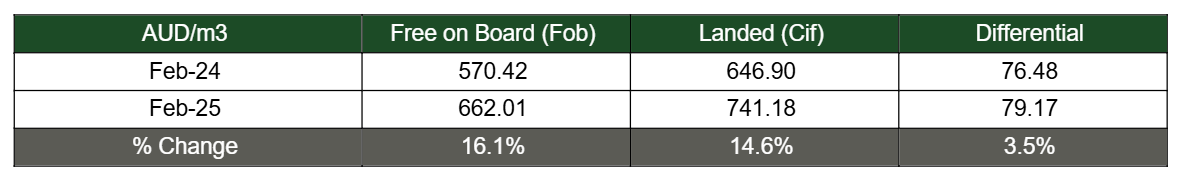

The total weighted average import price in February was AUDFob662.01/m3, up 16.1% on a year earlier and 11.2% higher than one month earlier.

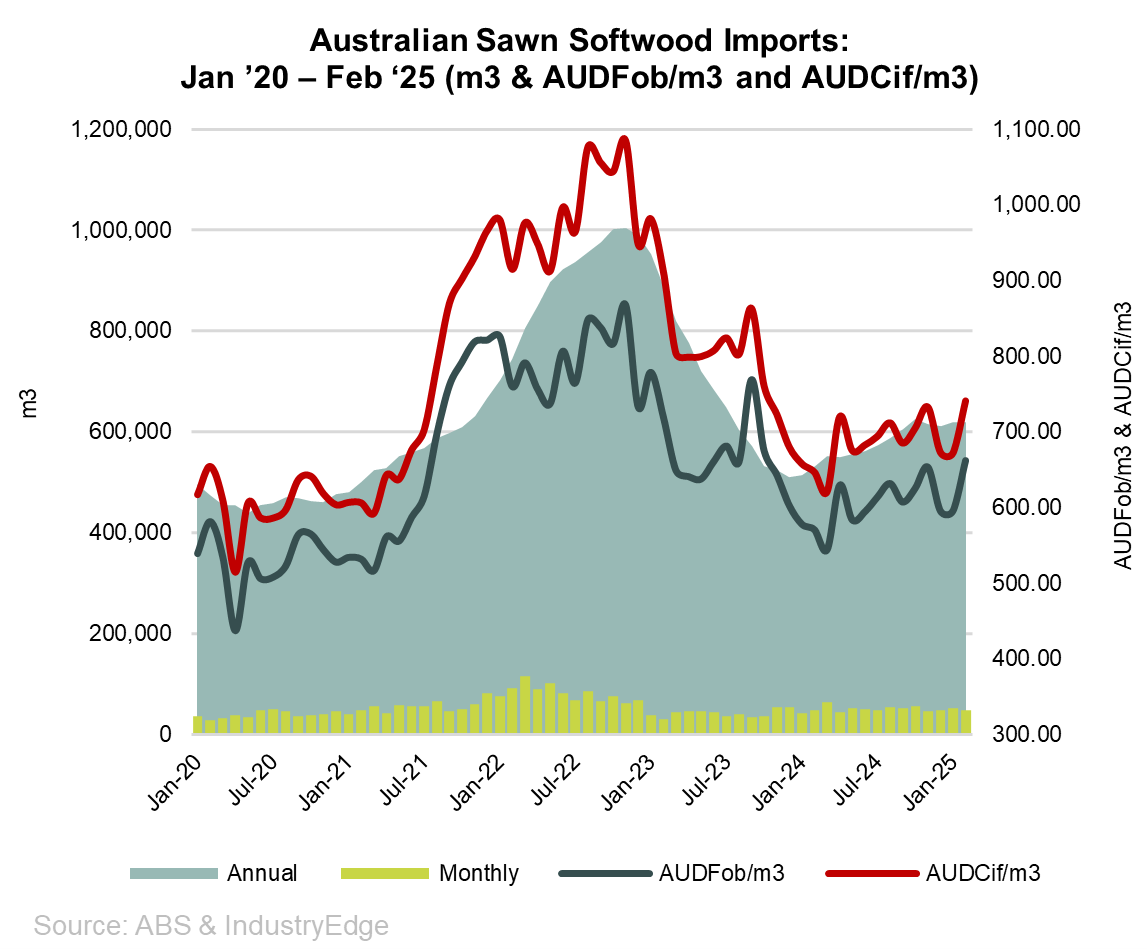

The second chart provides an alternate view of the same data, placing both free-on-board and ‘landed’ or costs, insurance and freight (Cif) prices in comparison to the annual import volume.

Shipping and freight costs are stable at around the current level of AUD79/m3 – up 3.5% compared with a year prior, but well below the five-year average of AUD117/m3. Importer advice is shipping and freight costs are expected to rise. To date, increases have been relatively modest.

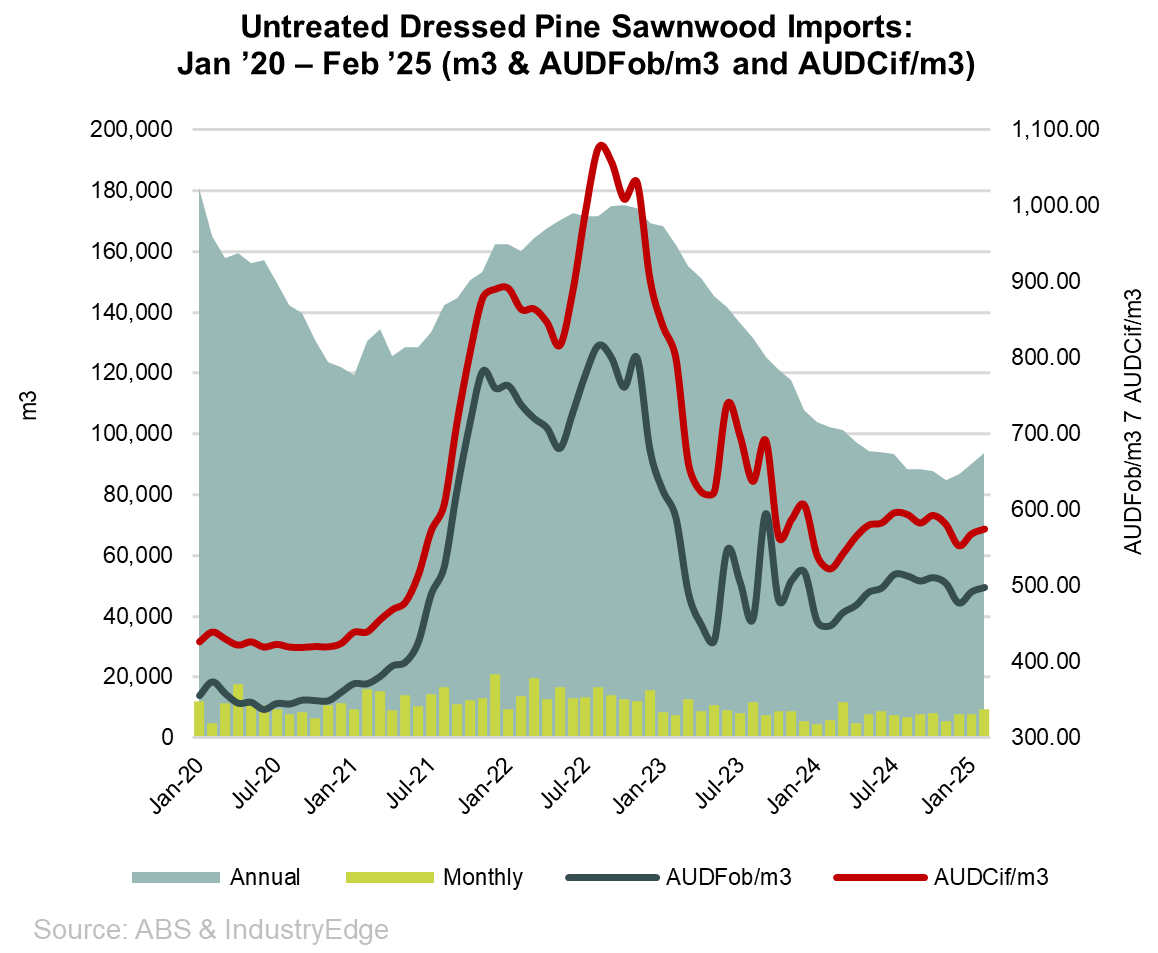

Untreated Dressed Pine import volumes slid 8.2% year-ended February, deteriorating to an annualised 93,791 m3, with a weighted average import price of AUDFob498/m3 in February 2025, while the landed price was AUDCif574.45/m3. This grade accounted for 15.2% of total imports for the full year.

Imports of Treated, Dressed Fir and Spruce continue to be the largest single import grade or line, accounting for 35.3% of total imports for the year.

Import volumes were 56.3% higher than one year ago, after plunging at the end of the pandemic inspired boom. Year-ended February, imports totalled 218,239 m3, ending the year priced at AUDFob498.43/m3 or AUDCif567.58/m3 on a landed basis.

The differential between the two prices shows that freight and insurance costs accounted for AUD69.15/m3 in February 2025, around AUD51/m3 lower than the long-term average for this grade.

Dressed Treated Radiata Pine imports remain at elevated levels compared with imports prior to and during the early phase of the pandemic. Year-ended February, imports totalled 115,855 m3, ending the year priced at AUDFob1,033/m3 or AUDCif1,124/m3 on a landed basis. This grade accounted for 18.7% of total imports for the year.

The differential between the two prices shows that freight and insurance costs accounted for AUD91/m3 in February 2025, AUD17/m3 lower than the long-term average. New Zealand is the main supplier.

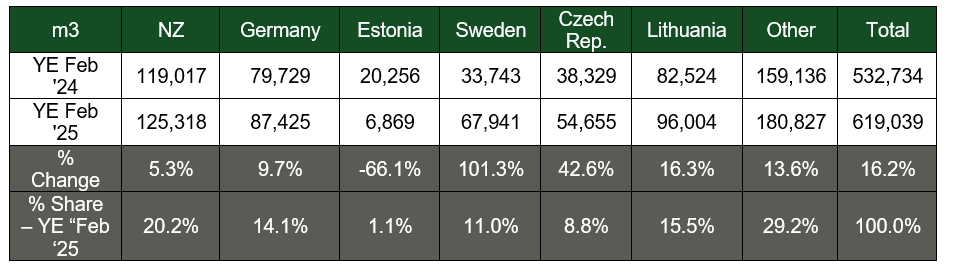

Shipments from New Zealand continue to dominate, but eyes remain on Europe

Australia’s imports of sawn softwood come from a relatively wide range of countries, with the mainstay being New Zealand (about 20% of supply on a consistent basis), and more recently, Lithuania and Germany. The chart and table below show the main countries, with future versions of this reporting needing to include Latvia separated out from ‘Other’.

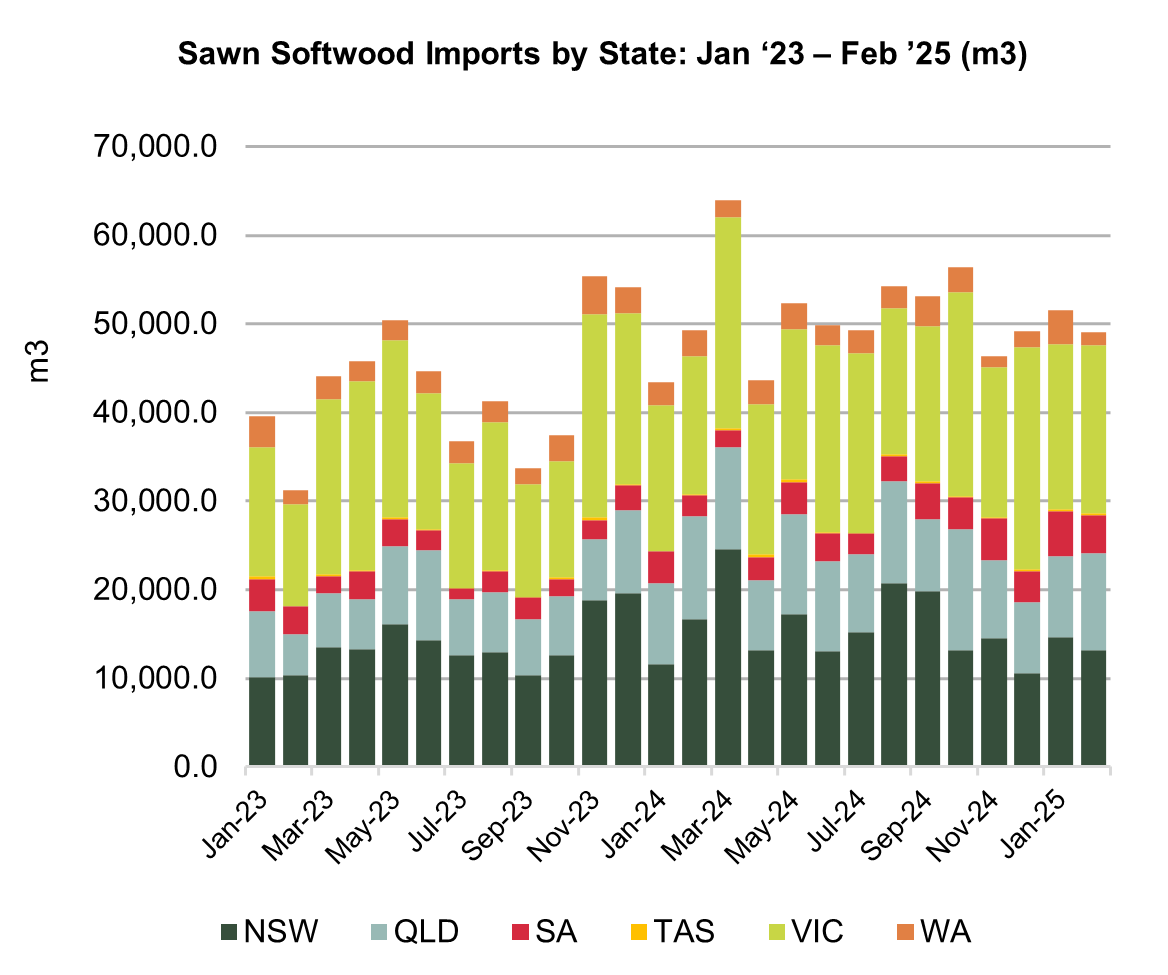

Victoria dominates imports but that is a false flag

At the state level, sawn softwood imports continue to alter, with the largest share of imports being received into Victoria. However, Victoria is the landing place for some imports to Tasmania, South Australia, the Australian Capital Territory and southern New South Wales.

As the table shows, for all that they dominate receipt of imports, New South Wales and Victoria have experienced slower import growth than Queensland and South Australia. Western Australia has been the clear outlier, with imports to it declining over the year, despite what is reported as ‘better than the rest’ building activity levels.

About FWPA’s Statistics and Economics program

FWPA’s Statistics and Economics Program provides reliable industry data to support stakeholder decision making and business planning across the forest and wood products industry. Learn more about the range of tools we provide, including the new FWPA Data Dashboard, via this link.