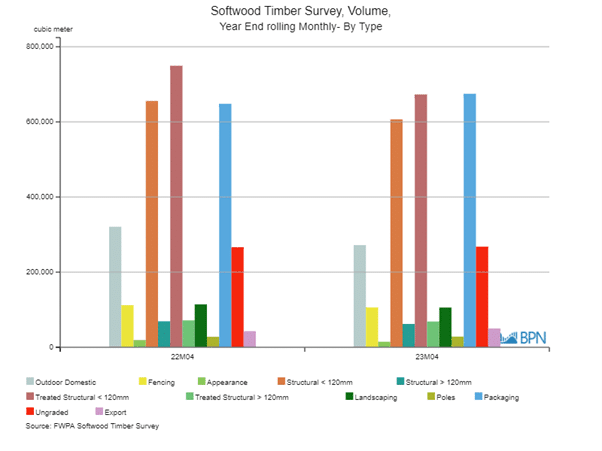

Sales of locally produced sawn softwood declined 5.4% over the year-ended April 2023, slipping back to 2.930 million m3. The latest data shows sales of the Export grade were up 17% over the year, which is supported by the total rise in exports of sawn softwood shown through the trade data.

Other than the specific ‘Export’ grade, the only major grade to display any sales growth is the Packaging grade, sales of which were up 4.1% over the year-ended April, to 674,787 m3. This is all the more significant because at least for now, Packaging is the single largest sales grade.

Combined, the Structural grades absolutely dominate, with sales totalling 1,410,423 m3 over the year, accounting for 48.1% of total annual sales, down from 49.9% for the prior year.

The chart here shows the relationship between total monthly exports of sawn softwood products (the blue line) and those specifically declared ‘Export’ grade (the red line) under the FWPA sales reporting system. The grey bars show sawn softwood exports that are made up by other grades that end up being exported.

The relationship between the total exports of sawn softwood and those supplied by the specific Export sales grade is very clear, as is the continuing trend decline in exports. They are now negligible.

Exports of Sawn Softwood: Jan ’15 – Apr ’23 (‘000 m3)

Source: ABS, FWPA & IndustryEdge

It was once the case exports of sawn softwood routinely totalled more than 200,000 m3 per annum and topped out at around 370,000 m3 in late 2010. Aggregate sawn softwood exports lifted 29.6% year-ended April 2023 to reach 107,870 m3. The local export grade saw sales lift 17.0% over the same period to reach 50,118 m3, a little more than 46.4% of total exports.

As sales soften, although they will remain small, expect to see exports continue to rise.