- Annual sawn softwood consumption down 1.0% year-ended May 2025

- Sawn softwood imports up 12.1% year-ended May

- Imports of sawn hardwood down 14.3% for the full year

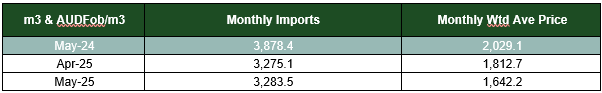

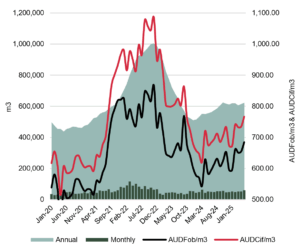

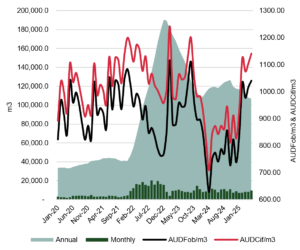

Sawn softwood consumption for the year-ended May 2025 totalled 3.002 million m3, down 1.0% on the prior year. As the chart shows, the decline in consumption has been hugging the 3.0 million m3 mark for the better part of a year, underscoring the wait and see approach of the Australian housing economy.

Annual production (domestic sales are the proxy measure), were down a calculated 5.0% to 2.588 million m3. May data shows monthly sales increased 8.9% to 0.224 million m3. The magnitude of the increase was largely due to seasonality, with sales 8.7% lower than in May 2024.

The FWPA data series is a voluntary survey and does not include all sawn softwood production. The data can be impacted by different companies coming into and leaving the survey, though this is now rare. Analysis indicates less than 15% of total softwood sales may be outside the survey.

Apparent Consumption of Sawn Softwood Products: Jan ’20 – May ‘25 (‘000)

Source: FWPA, ABS and IndustryEdge Note: Production is actually ‘sales’ volumes from each month

Based on the latest industry data (May 2025), sales of locally produced structural grades declined 2.8% year-ended May (1.313 million m3). Among the significant or major grades, ‘Untreated Structural <120mm’ remained alone in delivering stability, with sales down 2.4% over the year, to 0.680 million m3.

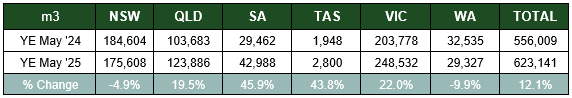

Sawn softwood imports up 12.1% year-ended May

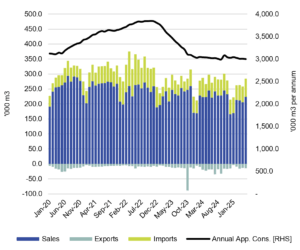

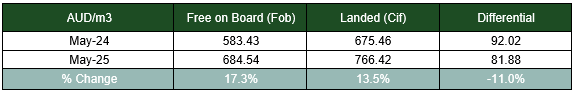

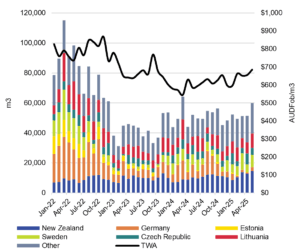

Remaining well below their pandemic peaks, imports of sawn softwood rose 12.1% year-ended May 2025. Imports totalled 623,141 m3, just below the levels recorded in late 2021, when imports were ramping up during the pandemic.

However, comparisons end there, with little on the horizon to suggest a surge in demand will drive imports higher in 2025, albeit the US tariffs and trade war could shake imports into new and different locations later in the year.

The total weighted average import price in May was AUDFob684.54/m3, up 17.3% on a year earlier and 4.5% higher than one month earlier.

Australian Sawn Softwood Imports: Jan ’17 – May ‘25 (m3 & AUDFob/m3)

Source: ABS and IndustryEdge

The second chart provides an alternate view of the same data, placing both free-on-board and ‘landed’ or costs, insurance and freight (Cif) prices in comparison to the annual import volume.

Shipping and freight costs increased at around the current level of AUD82/m3 – down 11.0% compared with a year prior, but well below the five-year average of AUD118/m3. Importer advice is shipping and freight costs are expected to rise. To date, increases have been relatively modest.

Australian Sawn Softwood Imports: Jan ’20 – May ‘25 (m3 & AUDFob/m3 and AUDCif/m3)

Source: ABS, FWPA and IndustryEdge

Key Import Grades

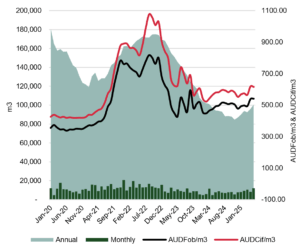

Among the major import grades, the 6.4% increase in Untreated Dressed Pine imports has seen volumes rise to an annualised 100,302 m3, with a weighted average import price of AUDFob541/m3 in May 2025, while the landed price was AUDCif615.77/m3.

This grade accounted for 16.1% of total imports for the full year.

Untreated Dressed Pine Sawnwood Imports: Jan ’20 – May ’25 (m3 & AUDFob/m3 and AUDCif/m3)

Source: ABS and IndustryEdge

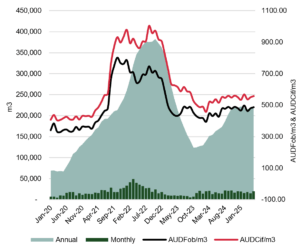

Imports of Treated, Dressed Fir and Spruce continue to be the largest single import grade or line, accounting for 35.2% of total imports for the year.

Import volumes were 35.0% higher than one year ago, after plunging at the end of the pandemic inspired boom. Year-ended May, imports totalled 219,627 m3, ending the year priced at AUDFob487.76/m3 or AUDCif556.92/m3 on a landed basis.

The differential between the two prices shows that freight and insurance costs accounted for AUD69.16/m3 in May 2025, around AUD52/m3 lower than the long-term average for this grade.

Dressed, Treated Fir & Spruce Sawnwood Imports: Jan ’20 – May ’25 (m3 & AUDFob/m3 and AUDCif/m3)

Source: ABS and IndustryEdge

Imports of Dressed Treated Radiata Pine remain at elevated levels compared with imports prior to and during the early phase of the pandemic. Year-ended May, imports totalled 106,940 m3, ending the year priced at AUDFob1,040.67/m3 or AUDCif1,140.92/m3 on a landed basis.

This grade accounted for 17.2% of total imports for the year.

The differential between the two prices shows that freight and insurance costs accounted for AUD100.25/m3 in May 2025, AUD9/m3 lower than the long-term average. New Zealand is the main supplier.

Dressed, Treated Radiata Pine Sawnwood Imports: Jan ’20 – May ’25 (m3 & AUDFob/m3 and AUDCif/m3)

Source: ABS and IndustryEdge

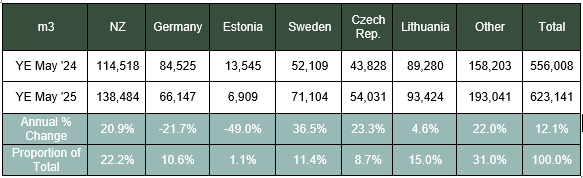

Major Importing Countries

Australia’s imports of sawn softwood come from a relatively wide number of countries, with the mainstay being New Zealand (about 22% of supply on a consistent basis), Lithuania and Germany. The chart and table below show the main countries, with future versions of this reporting needing to include Latvia separated out from ‘Other’.

Australian Sawn Softwood Imports by Main Country: Jan ’22 – May ‘25 (INDEX & %)

Source: ABS and IndustryEdge

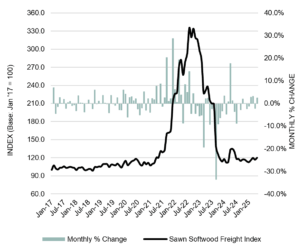

IndustryEdge’s Australian Sawn Softwood Freight Cost Index (Softwood FCI)

IndustryEdge’s Australian Sawn Softwood Freight Cost Index (Softwood FCI) increase 2.6% in May. The monthly weighted average cost of freight was up at AUD81.88/m3, representing 10.7% of the total landed cost of imported sawn softwood.

The chart demonstrates the cost of freight for sawn softwood imports to Australia has almost returned to pre-pandemic levels.

The index measures the relative cost of freight for sawn softwood imports, over time.

Australian Sawn Softwood Freight Cost Index: Jan ’17 – May ‘25 (INDEX & %)

Source: ABS and IndustryEdge

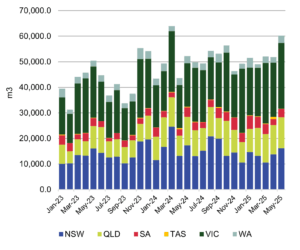

Imports by State

At the state level, sawn softwood imports continue to alter as total volumes change dramatically.

Sawn Softwood Imports by State: Jan ‘23 – May ’25 (m3)

Source: ABS and IndustryEdge

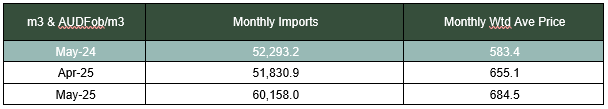

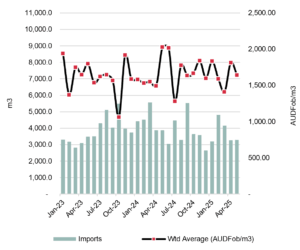

Imports of sawn hardwood down 14.3% year-ended May

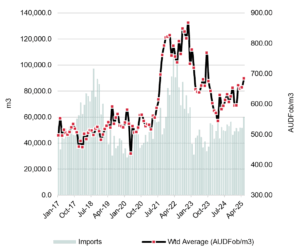

Year-ended May 2025, sawn hardwood imports were down 14.3% to 44,946 m3. In May itself, imports totalled 3,284 m3, at an average price of AUDFob1,642/m3. The chart shows the price remains mobile at an average of around AUDFob1,650/m3 over the last year, with the variability expected for a relatively small and variable trade.

Australian Sawn Hardwood Imports: Jan ’23 – May ‘25 (m3 & AUDFob/m3)

Source: ABS and IndustryEdge