Since slumping to a record low of just USD509 in mid-February, the Baltic Dry Index (BDI), which measures the price of bulk dry shipping, has steadily increased to USD568 at the close on 10th March. The modest recovery came as shipping orders reportedly improved for the period immediately following the Lunar New Year, however, most telling in the higher prices is the impact of higher bunker fuel prices.

The chart below shows the BDI since the beginning of 2014.

Improvements in demand are currently, at best, modest on a long-term basis. However, from its historic low of USD509 in mid February, the cost of shipping has recovered 11.6% in just three weeks.

Slowing demand in Asia, commencing with commodity inputs, is a major driver of pressure on shipping costs.

In February, expectations were that bunker fuel prices had near bottomed. It seems that is the case, although the modest improvement in price may yet prove fleeting.

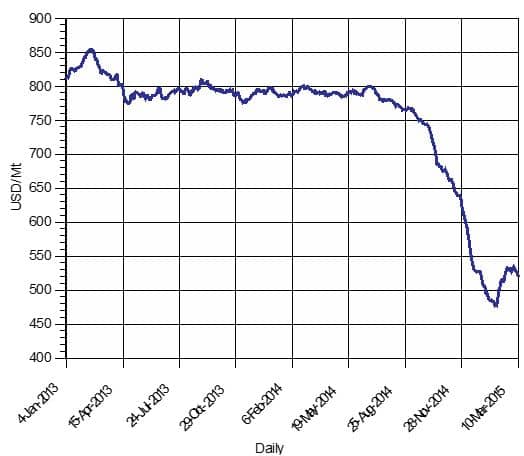

The next chart displays the index of bunker fuel prices since the start of 2013.

As the chart shows, the price of bunker fuel, measured in US Dollars, rose from the middle of February 2015, but dipped again in early March. In fact, looking just at the chart, there is some evidence provided by the recent recovery then downturn, of what is known as a ‘dead cat bounce’.

Since the beginning of 2015, the price of bunker fuel has declined 0.7%, but since the beginning of 2014 has declined a very sizeable 34.5%, almost all of which occurred since the middle of 2014.

Where shipping costs will head next is anyone’s guess at the moment, but most commentators and analysts expect modest price improvements through the remainder of 2015, though not for all routes.

This is an important distinction. Routes on which there is a variance in demand may well experience different freight costs to their normal trajectories. That could become critically important for sectors and situations in which price competition is very tight.