The latest data on softwood sales volumes indicate that the recovery continued to strengthen over calendar year 2025 (January–November). Average softwood sales in the first half of the year (January to June) were 208,086 m³ per month, increasing to an average of 241,612 m³ per month from July to November. This represents a 16 per cent increase between the two periods, signalling a clear improvement in market conditions in the second half of the year. On a monthly basis, total softwood sales volumes grew at an average rate of 3.3 per cent, rising from 170,308 m³ in January to 234,852 m³ in November 2025. This steady upward trend reflects a gradual recovery in underlying demand.

Among product categories, packaging products recorded the strongest growth, increasing by an average of 7.1 per cent per month. Volumes approximately doubled from around 33,000 m³ in January to about 66,000 m³ in November 2025. This strong performance aligns with broader economic activity, particularly goods consumption, where increased logistics, transport, and distribution requirements have driven higher demand for packaging materials.

Structural timber also showed consistent growth, increasing by an average of 2.4 per cent per month over the same period (Figure 1 and Table 1). This trend reflects a gradual improvement in residential construction activity, as builders respond to improving market signals.

Monthly Softwood Sales Volume

Source: FWPA Data Dashboard, FWPA Analysis

Table 1: Softwood Volumes and Residential Approvals (in m3)

| Period | Structural products | Packaging products | Total Softwood Sales | 12-month rolling total residential approvals (no.) |

|---|---|---|---|---|

| Jan-25 | 86,903 | 33,442 | 170,308 | 172,672 |

| Feb-25 | 113,621 | 43,720 | 213,365 | 176,243 |

| Mar-25 | 111,407 | 44,608 | 211,731 | 178,269 |

| Apr-25 | 108,436 | 43,073 | 206,016 | 179,613 |

| May-25 | 116,615 | 47,386 | 224,328 | 180,528 |

| Jun-25 | 117,949 | 47,831 | 222,767 | 184,499 |

| Jul-25 | 119,568 | 51,083 | 232,108 | 184,747 |

| Aug-25 | 129,288 | 66,735 | 257,841 | 185,481 |

| Sep-25 | 104,674 | 66,448 | 231,619 | 187,993 |

| Oct-25 | 115,107 | 69,176 | 251,640 | 187,894 |

| Nov-25 | 109,906 | 66,522 | 234,852 | 189,111 |

Source: FWPA Data Dashboard, FWPA Analysis

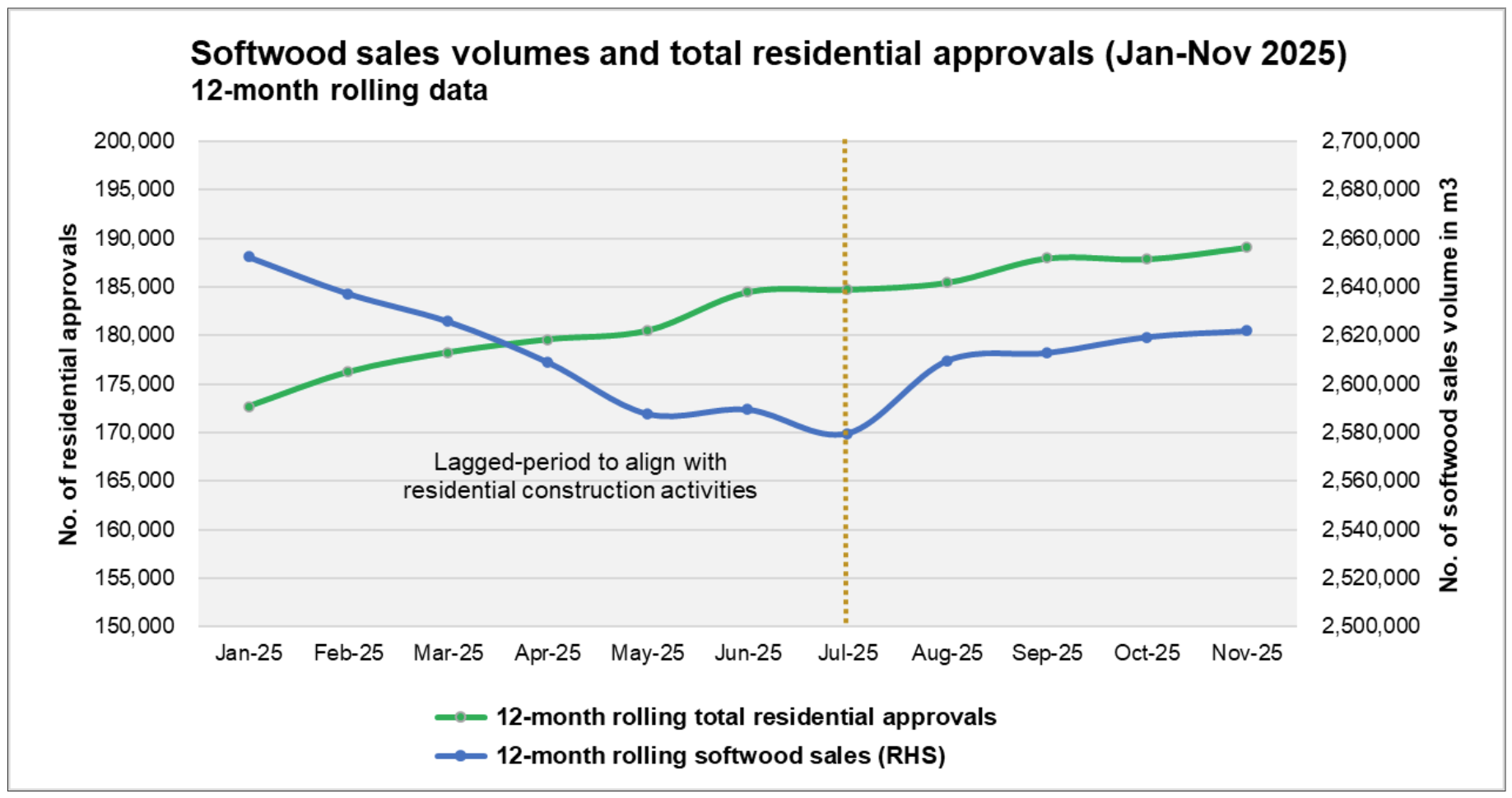

The upward trend in structural timber, and in total softwood sales volumes more broadly, is closely aligned with building activity indicators. A comparison of 12-month rolling data for residential building approvals and total softwood sales shows that the two series began to align from July 2025 onward (Figure 2). The first half of 2025 appears to represent a lagged adjustment period, during which sales volumes were responding to earlier weakness in approvals before the recovery became more evident.

Softwood sales volume and residential approvals

Source: FWPA Data Dashboard, FWPA Analysis

Overall, these trends observed during calendar year 2025 (January to November) provide positive signals for the timber industry, suggesting that demand is beginning to recover. This outlook is supported by recent macroeconomic indicators, including the latest National Accounts data from the ABS (released in December), which show an improvement in GDP growth, and CPI data indicating that trimmed-mean inflation is expected to remain stable and well controlled. Together, these factors are likely to support continued growth in softwood sales in the short term, assuming no significant external shocks from the global economy.