Note: More recent and granular data is available through the FWPA data dashboard

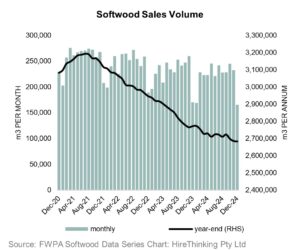

Softwood sales for the month of December 2024 were 165,366m3 down a very bleak -28.8% over the previous month. The less volatile year-end data showed sales were 2.65 million m3 down -3.8% on the previous period.

The monthly data is more positive with sales for October of 245,061m3 which was up +7.3% over the previous month. Over the past 6 months monthly sales have seen 4 positive months vs 2 negative months.

Source: FWPA Softwood Data Series

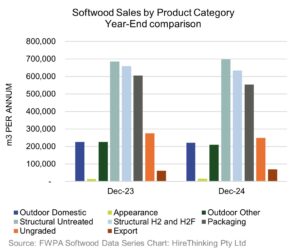

Looking at specific product groupings Appearance was up +9.8%, Structural Untreated +1.8% and Exports up +11.8% the year-ending December 2024.

Source: FWPA Softwood Data Series

The biggest negative impact on sales were Structural Treated H2 and H2F grades which were down -3.9%, Packaging down -8.6% and Ungraded sales down -9.7%. The increase in exports would suggest some shifting from packaging and ungraded domestic markets across to international sales.

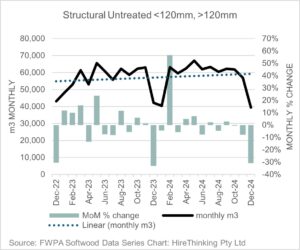

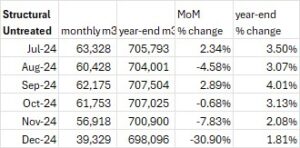

The bleak monthly picture is challenging even with some of the products which have held up on the less volatile year-ending comparison discussed above. For instance Structural Untreated sales in December were 39,329m down -30.9% for the month.

Source: FWPA Softwood Data Series

Softwood Weighted Average Prices

Note: More recent and granular data is available through the FWPA data dashboard

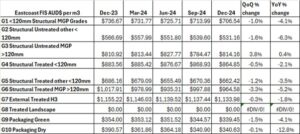

A summary table of the 10 product groupings covered in the FWPA weighted average price data series shows a decline in pricing for all groupings except Structural Untreated MGP grades >120mm end section during the December quarter and the year-ending December period.

Source: FWPA Softwood Data Series

Prices for the main structural products appear to be holding up reasonably well during the period particularly given the decline in volumes discussed elsewhere in Stats Count.

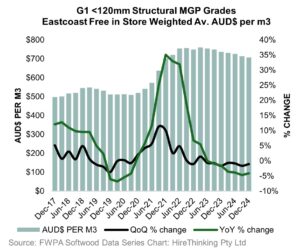

G1 weighted average price in the December quarter was $706.54 per m3 FIS. This was a decline on the previous quarter of -1.0% and over the year of -4.1%. Historically, prices in this cycle peaked in March 2023 of $759.26.

(FWPA Product Group Definition: Measure 1: MGP 10 – 90 x 35, Measure 2: MGP 10 – 90 x 45 Measure 3: MGP 10 70 x 35, 45 Measure 4: MGP 12 and MGP 15 – 70 & 90 x 35 Aggregate)

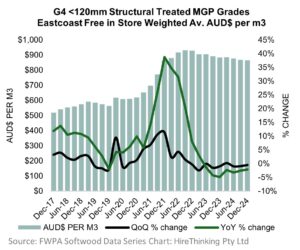

For G4, the equivalent treated structural product, the weighted average price in the December quarter was $864.85 per m3 FIS. A decline over the previous quarter of -0.5% and over the year of -2.1%. Prices for G4 peaked in the September quarter 2022 at $931.41 per m3 FIS two quarters before the peak in G1 (Structural Untreated MGP grades <120mm).

(FWPA Product Group Definition Measure 7: Treated MGP 10 – 90 x 35, Measure 8: Treated MGP 10 – 90 x 45, Measure 9: Treated MGP 10 70 x 35, 45, Measure 10: Treated MGP 12 and Treated MGP 15 – 70 & 90 x 35 Aggregate)

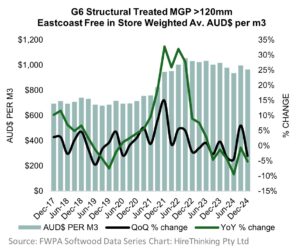

Large-end section G6 Structural Treated MGP > 120mm was down -3.3% during the quarter to $964.58 per m3 FIS and -5.2% year on year. This is down from the peak in of $1,053.12 per m3 FIS in September 2022.

(FWPA Product Group Definition: Measure 12: Treated MGP Grades Large end section incl; 120 x35 & 45, 140 & 190 x 45)

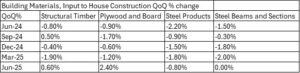

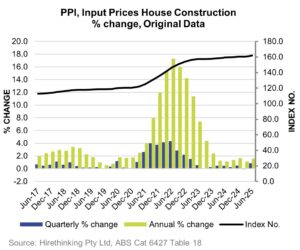

The ABS producer price index also provides some insight into building material price movements with the current structural materials index for the June quarter showing some stabilisation of prices.

Source: ABS Cat 6427

The broader Producer Price Index for the Input to House Construction showed moderate increases in the June quarter for Structural Timber up 0.6% and Plywood and Board up 2.4%.

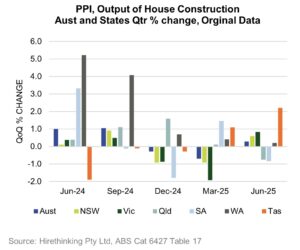

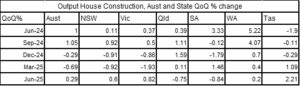

In terms of the output from House Construction (ie the finished house) affordability continued to improve for Australia with a rise of 0.29% well inside the inflation rate.

Source: ABS Cat 6427