The current economic conditions offer encouraging signals for the timber industry, particularly in shaping the business outlook for FY2025–26. Several important economic indicators suggest positive trends, especially in construction and macroeconomic indicators such as interest rates and gross value added in the agricultural sector:

Building Activity

The latest Australian Bureau of Statistics (ABS) data on building activity (as of March 2025) shows improvement growth rates, particularly in the residential construction sector. Commencements for detached houses rose by 6.3%, while semi-detached dwellings (including townhouses and units) increased by 11.7% between December 2024 and March 2025. This suggests confidence in the housing sector and an increase in demand for construction materials, including timber.

Interest Rates

The Reserve Bank of Australia (RBA) began easing monetary policy in May 2025, reducing the official cash rate from 4.1% to 3.85%. Further cuts are expected, with rates projected to fall by 3.6% by August and reach 3.35% by the end of 2025. Lower interest rates are likely to stimulate investment, business activity, and housing demand, all of which are key drivers of timber usage.

Gross Value Added in Agriculture and Forestry

According to the ABS, the gross value added (GVA) in the agricultural sector, which includes forestry, rose by 4.3% on a quarterly basis, and 10.3% year-on-year as of March 2025. This growth reflects improvement in productivity and demand across the broader natural resources sector.

Forward-Looking Forecasts

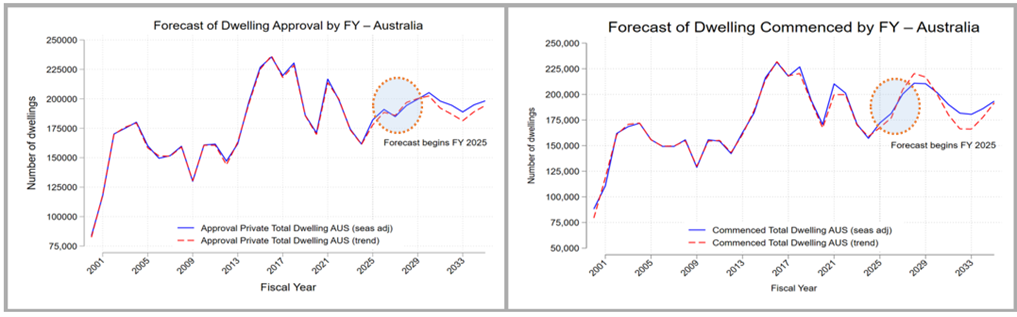

FWPA’s monthly forecasts on Australian dwelling commencements also indicate a positive trend. The projections suggest that private residential construction activity will continue to grow over the next 12 months, supporting further demand for timber products (see Figure 1).

Together, these indicators suggest a more favourable outlook for the timber industry over the coming financial year, supported by improving macroeconomic conditions and increasing residential construction activity.

Figure 1: Forecast Dwelling Approval and Commencement

Source: FWPA Data Dashboard of Australian Dwelling Forecast Dataset July 2025

Softwood Structural Timber

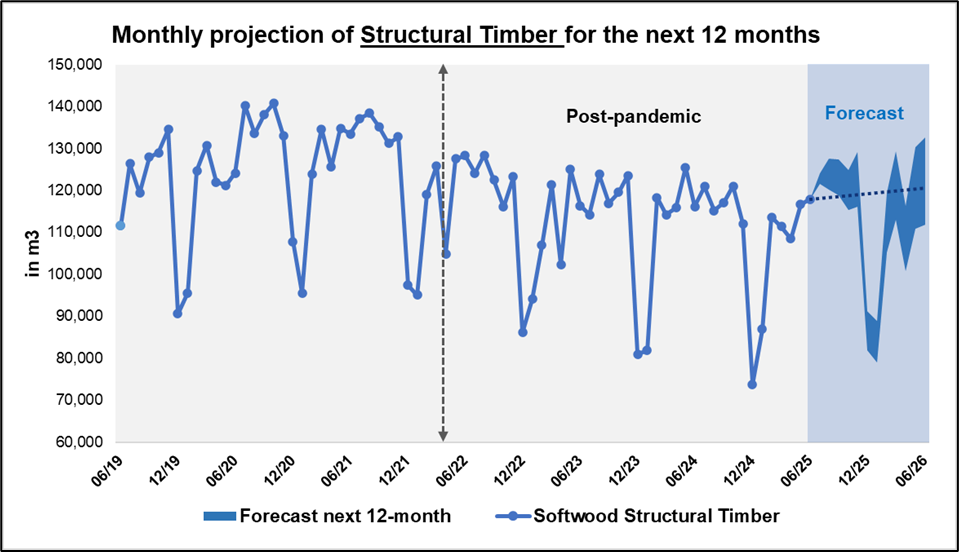

Softwood structural timber is primarily used in residential and low-rise building constructions. The long-term data demonstrates a strong correlation between demand for this product and the level of private residential construction activity (see the Brief Analysis on 23 August 2024). Based on current and projected economic conditions, including indicators from the Reserve Bank of Australia (RBA), analysis by FWPA forecasts that demand for structural timber will increase by 2–4% over the next 12 months (FY2025–26).

This translates to a rise in volume from approximately 1.3 million m³ in FY2024-25 to around 1.35 million m³ by the end of FY2025-26 (see Figure 2). It is important to note that this projection is subject to the continuation of current economic trends and the accuracy of key macroeconomic forecasts.

Figure 2: Projection of Softwood Structural Timber

Source: FWPA Data Dashboard, FWPA analysis

Note: The 12-month forecast includes seasonality effect and upper-lower standard deviation

Subscribe FWPA Data Dashboard here: https://fwpa.com.au/industry-info/fwpa-data-dashboard/

Packaging

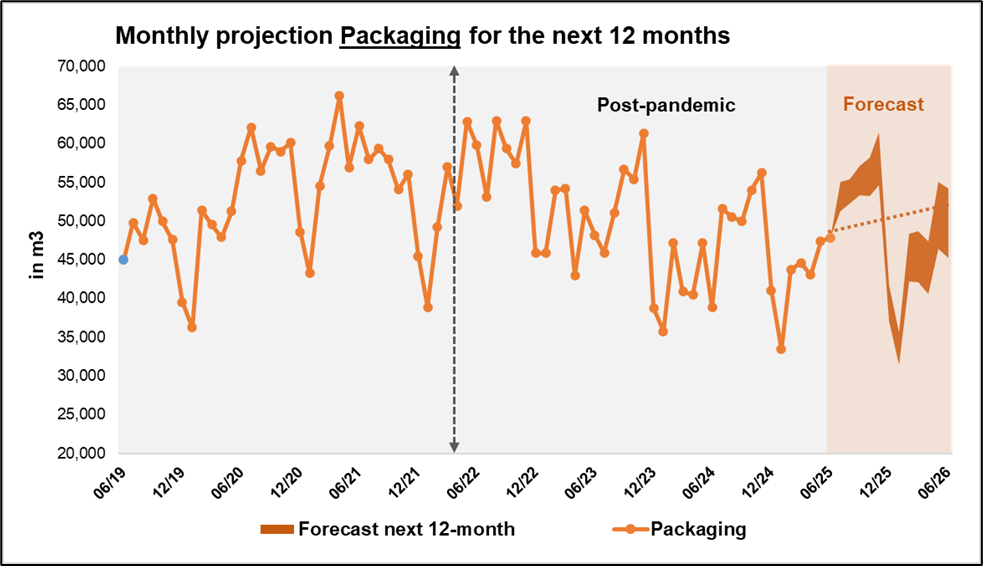

Another softwood product showing strong responsiveness to positive economic conditions is packaging timber. This product benefits from the multiplier effect of increased economic activity, particularly through its use in logistics and the transportation of goods across various sectors. Recent data for the quarter from March to June 2025 shows a 7% increase in packaging demand, reflecting broader growth in freight and distribution-related industries.

Looking ahead, packaging timber is expected to follow a similar growth trajectory to structural timber, with projected demand increasing by 2–4% over the next 12 months. In volume terms, this would see demand rise from approximately 560,000 m³ in FY2024–25 to around 570,000 m³ in FY2025–26. These projections are based on current economic indicators and assume continued strength in the logistics and manufacturing sectors.

Figure 3: Projection of Packaging

Source: FWPA Data Dashboard, FWPA analysis

Note: The 12-month forecast includes seasonality effect and upper-lower standard deviation

Subscribe FWPA Data Dashboard here: https://fwpa.com.au/industry-info/fwpa-data-dashboard/

In summary, both structural timber and packaging products are expected to benefit from sustained economic momentum over the next 12 months. With projected growth of 2–4%, these forecasts reflect the strong link between softwood product demand and key economic indicators, particularly in residential construction and logistics.