Note: More recent and granular data is available through the FWPA data dashboard

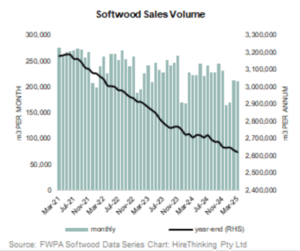

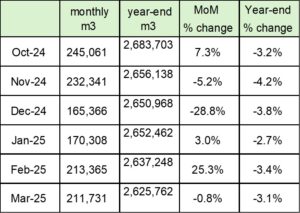

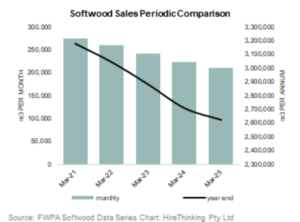

Softwood sales for the month of March 2025 continued the decline in local sales volume from a peak in May 2021. Sales were 211,731m3 down -0.8% on February and on a year-end basis sales were 2.625 million m3 down -3.1% on the previous period.

Over the past 6 months, monthly sales have seen some strong months but these have been wiped out by larger negative months resulting in the ongoing decline in the year-end sales.

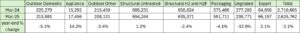

Softwood Table 1

Source: FWPA Softwood Data Series

This was also the lowest March monthly sales over the past 5 years.

Softwood Chart 2

Softwood Table 2

Source: FWPA Softwood Data Series

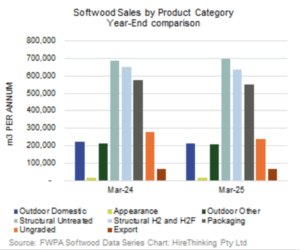

Looking at specific product groupings on a year-end basis Appearance grades +14.2%, Structural Untreated +1.2% and Exports +2.1% remained in positive territory during the March period.

Softwood Chart 3

Softwood Table 3

Source: FWPA Softwood Data Series

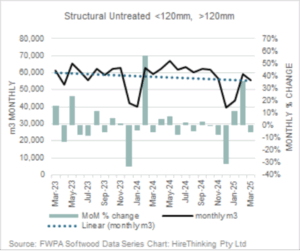

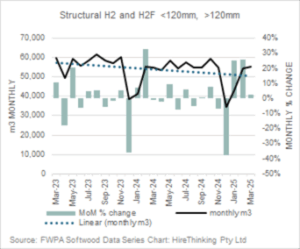

Although the trend position on a monthly basis for the 2 largest product groupings Structural Untreated and Structural H2 and H2F remained negative.

Structural Untreated

This product grouping includes;

Structural <120mm defined as: Untreated, Seasoned (Kiln Dried or Air Dried), Pine Structural Framing 70 x 35 up to 90 x 45 MGP or F Grades – may include FJ studs, and

Structural >120mm defined as: Untreated, Seasoned (Kiln Dried or Air Dried), Pine Structural Framing 120 x 35 up to 290 x 45 MGP or F Grades.

Softwood Chart 4

Softwood Table 4

Source: FWPA Softwood Data Series

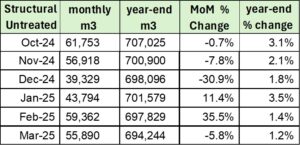

Structural Treated incl H2 and H2F

This product grouping includes;

Structural Treated <120mm defined as: Treated (LOSP H2), Seasoned (Kiln Dried or Air Dried), pine structural framing 70 x 35 up to 140 x 45, MGP or F Grades, and

Structural Treated >120mm defined as: Treated (H2-F), Seasoned (Kiln Dried or Air Dried), pine structural framing Large end section 120x35mm, 120x45mm, 140x45mm, 190x45mm MGP or F Grades).

Softwood Chart 5

Softwood Table 5

Source: FWPA Softwood Data Series

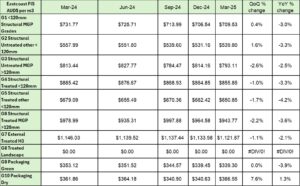

Softwood Weighted Average Prices

Note: More recent and granular data is available through the FWPA data dashboard.

A summary table of the 10 product groupings covered in the FWPA weighted average price data series shows 3 product groupings had some positive momentum in March 2025 quarter. These were Structural Untreated MGP grades <120mm (+0.4%), Structural Untreated other grades <120mm end section (+1.6%) and Dry Packaging (+7.6%).

Softwood Table 6

Source: FWPA Softwood Data Series

Prices for the main structural products appear to be relatively stable during the quarter.

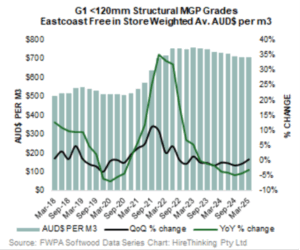

G1 weighted average price in the March quarter was $709.54 per m3 FIS up +0.4% during the March quarter. Historically, prices in this cycle peaked in March 2023 of $759.26.

Softwood Chart 6

FWPA Product Group Definition: Measure 1: MGP 10 – 90 x 35, Measure 2: MGP 10 – 90 x 45 Measure 3: MGP 10 70 x 35, 45 Measure 4: MGP 12 and MGP 15 – 70 & 90 x 35 Aggregate)

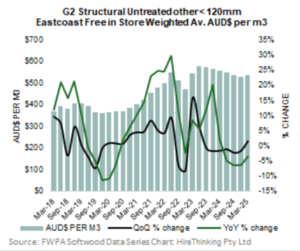

For G2, Untreated Structural other grades <120mm the weighted average price in the March quarter was $539.80 per m3 FIS. An increase of +1.6% over the previous quarter but a decline over the year of -3.3%. Historically, prices in this cycle peaked in June 2023 of $580.42 per m3 FIS.

This is down from the peak in of $428.75 per m3 FIS in December 2022.

Softwood Graph 7

(FWPA Product Group Definition Measure 5: Other F4, F5 & F7 Aggregate)

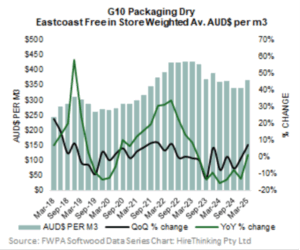

The other product group which experienced strengthening prices in the March quarter was G10 Dry Packaging. The weighted average price in the March quarter was $366.55 per m3 FIS up +7.6% and up +1.3% year-ending compared to a previous peak of $428.75 per m3 FIS in December 2022.

Softwood Graph 8