An update from FWPA’s Statistics and Economics Program.

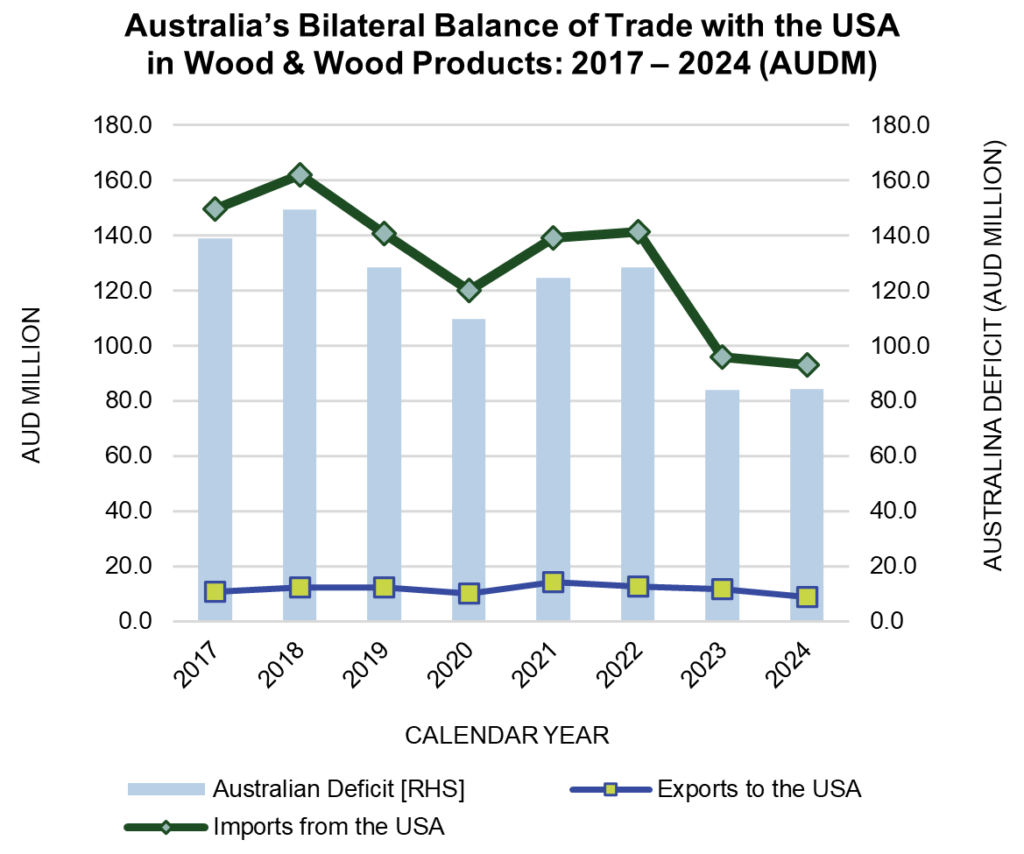

- In 2024, Australia’s wood and wood products trade deficit with the USA was AUD84.2 million

- 2024 exports to the USA were AUD9.0 million, while imports from the USA were AUD93.2 million

- Global trade architecture and associated economic security are under threat

If there is a ‘barbecue stopper’ conversation the world over right now, it has to be global trade, tariffs, and international disruption.

The situation is shifting, changing, and remains very fluid, which makes providing analysis at a point in time a little tricky. By the time a paragraph is written, the US President has changed his mind.

This analysis seeks to address the ‘timeliness’ problem by providing an understanding of Australia’s wood products trade with the USA and focussing on what appears to be the underlying motivation of the US administration, and the risks they might pose for global trade.

What we know. Something of a timeline

On 2nd April, the US President imposed ‘base’ 10% tariffs on Australia’s imports to the USA. President Trump also announced much higher ‘reciprocal tariffs’ on many countries, with the largest tariffs imposed on Asian nations, including China, and some uninhabited, non-trading islands. A full list is available here.

As the world quickly learned, the rationale for the tariffs was a mix of misunderstanding, economic voodoo and a failure to check whether some locations were even countries or inhabited by anything other than penguins. Laughable certainly, but not a joke.

Global capital and stock markets immediately faltered, with losses recorded on the US exchanges equivalent to those of the global financial crisis and the more-recent pandemic panic.

Investors recalculated risks and devalued assets worldwide. Major institutions reported analysis that a global recession in 2025 was a 50/50 bet, and a US recession was pretty much assured.

Some countries responded with retaliatory tariffs, most notably China, and the European Union chimed in similarly. Other countries, less able to withstand pressures, reportedly queued up to, as President Trump himself said:

“…negotiate a solution to the subjects being discussed relative to Trade, Trade Barriers, Tariffs, Currency Manipulation, and Non Monetary Tariffs,…”

In an overnight backflip on 9th April, the US President used these apparent concessions and their impact on stock and capital markets to reverse the retaliatory tariffs, pausing them for 90 days. Nearly all countries are on a diet of 10% tariffs for their imports to the USA, while they negotiate with their bully. We discuss this further toward the conclusion of this analysis.

The notable exception to the 10% tariffs is China, of course.

China has reciprocated with tariffs on imports from the USA, such that (at the time of writing), the two countries have 125% (China into USA) and 84% (USA into China) tariffs. These ridiculous tariff levels essentially stall trade between the two great powers. We also discuss this at the conclusion of this analysis.

Below, we outline the headline facts of Australia’s trade in wood products with the USA.

Australia has a wood and wood products deficit with the USA

- In calendar year 2024, Australia operated a trade deficit for wood and wood products with the USA, valued at AUD84.2 million. That is, Australia exported wood and wood products valued at AUD9.0 million, while imports from the USA were valued at AUD93.2 million. That balance of trade deficit was the lowest in many years.

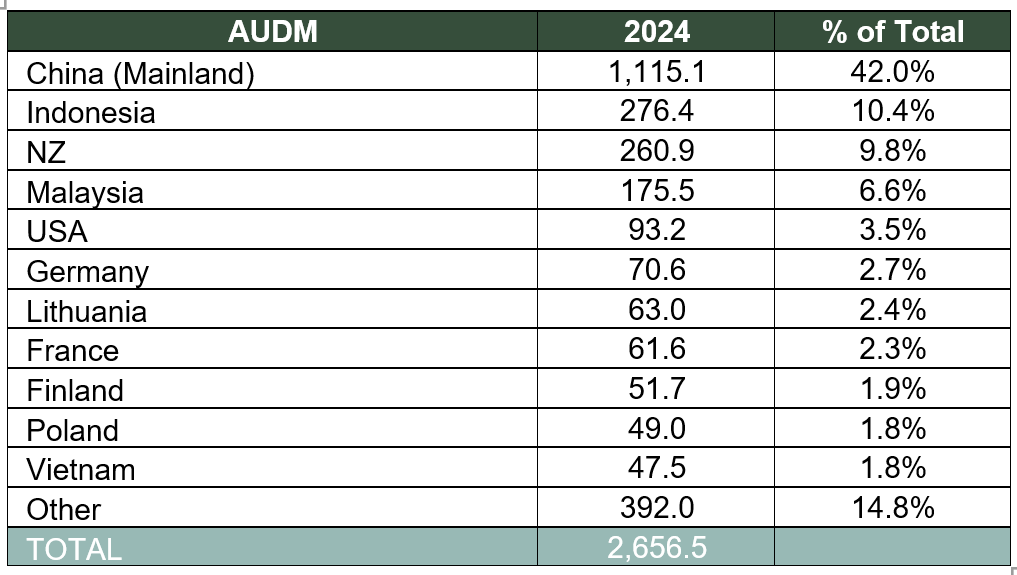

- Imports from the USA accounted for 3.5% of total wood and wood products imports by value. The USA was the fifth largest supplier to Australia, with total imports valued at AUD2.657 billion.

- Exports to the USA accounted for just 0.5% of total wood and wood products exports by value. The USA received the ninth highest value of Australian products, which in aggregate were valued at AUD1.639 billion, dominated by woodchip exports.

1.1 Australia’s Bilateral Balance of Trade with the USA in Wood & Wood Products

Source: ABS, derived and IndustryEdge

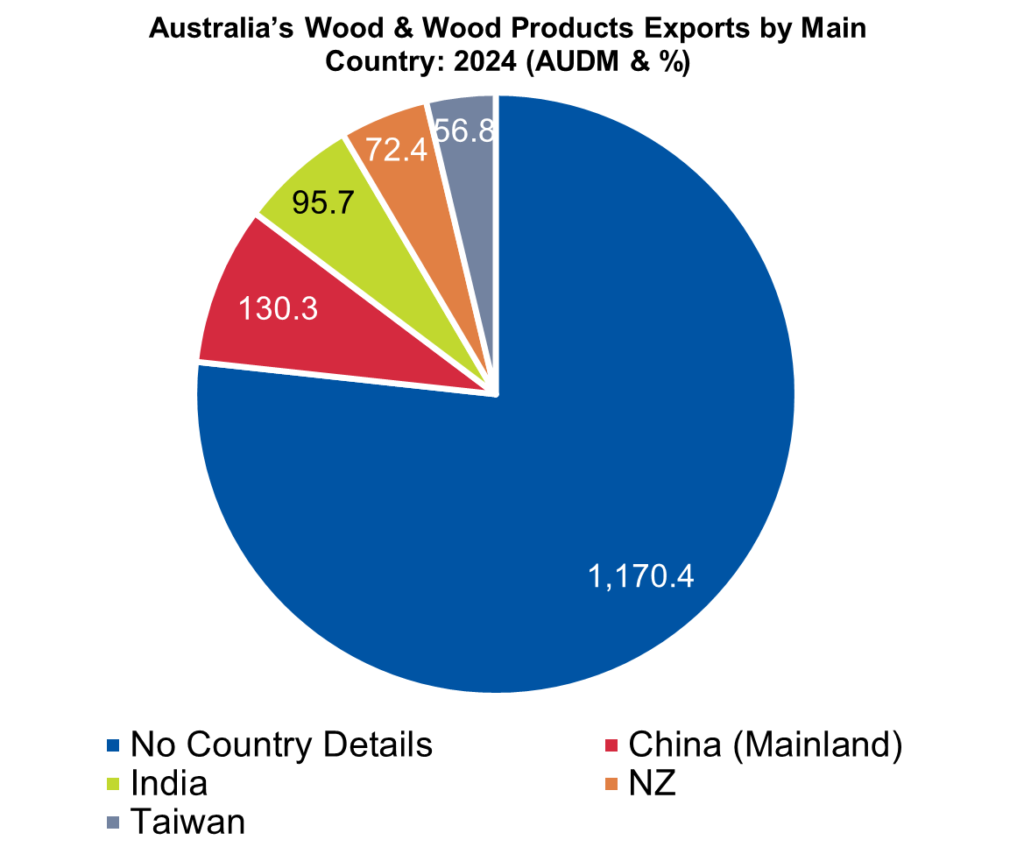

Australia’s exports of wood and wood products

In 2024, Australia exported wood and wood products valued at AUDFob1,638.9 million. Nearly one-third went to New Zealand and close to 15% was delivered to the USA. Australia’s exports went to 155 countries over the year. The chart shows the top five ‘countries’, the table shows the top 14.

It is notable that ‘No Country Details’ dominates. This is the entirety of Australia’s hardwood and softwood woodchip exports, most of which are delivered to China and Japan.

1.2 Australia’s Wood & Wood Products Exports

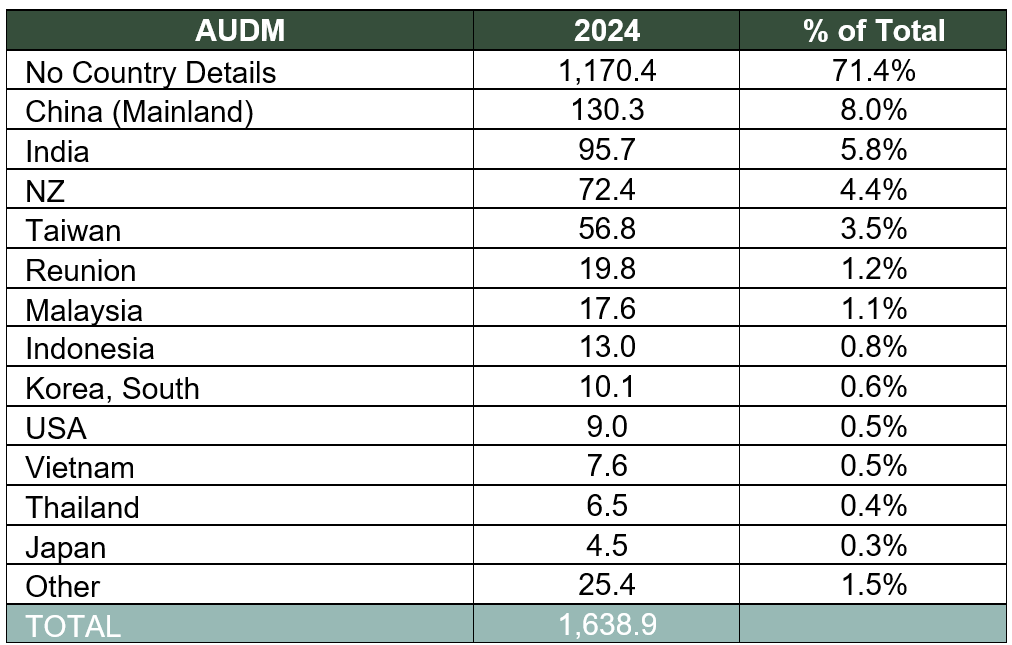

1.3 Australia’s Wood & Wood Products Exports by Country

Source: ABS, derived and IndustryEdge

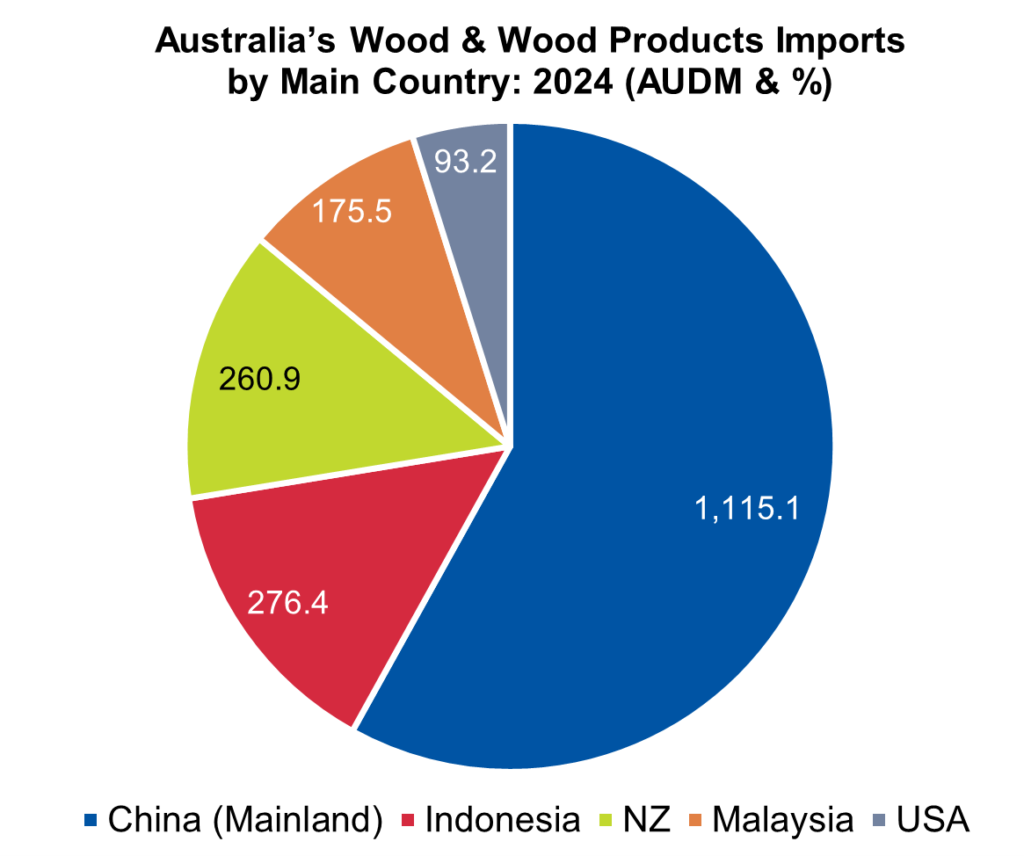

Australia’s imports of wood and wood products

In 2024, Australia imported wood and wood products valued at an enormous AUDFob2,656.5 million. China delivered 42.0 % of that – more than AUD1.1 billion worth, with the USA in fifth place behind Indonesia, New Zealand and Malaysia.

The chart shows the top five countries, the table shows the top 12, but again, it is relevant that Australia received shipments from 126 countries in 2024.

Unlike Australia’s exports, which are mainly of woodchips and logs, imports are mainly of finished products, including flooring, mouldings, engineered wood products (LVL, GLT and so on). If the main suppliers were frozen from the US market – as appears likely for China – the risk of increased imports of finished products to Australia increases dramatically. The hollowing out of current levels of domestic manufacturing is a significant and real risk under this scenario.

1.4 Australia’s Wood & Wood Products Imports by Main Country

1.5 Australia’s Wood & Wood Products Imports by Country

Source: ABS, derived and IndustryEdge

Isolationism, not protectionism

The regrettable, worrying and seemingly ill-considered positioning of the US President can have many effects. Not least is a slowdown in global economic conditions, as trade reduces and is, at minimum, is completely disrupted.

As The Economist magazine wrote on 2nd April: “Although Mr. Trump has committed one of the worst policy blunders of all time, he was lucky to inherit a strong economy. How much pain can it take?”

The short answer is that we do not know and probably will not ever know. Because there is such inconsistency in the behaviour of Mr. Trump’s administration, specific policies and actions can last as long as it takes to brush your teeth.

However, US consumer prices are likely to increase – they are already doing so. Economic growth will deteriorate in the US, and a recession seems likely.

This tariff approach is something of a rerun of the 1930 Smoot-Hawley Tariff Act, which created a trade war that extended the Great Depression by years and was opposed almost universally outside the US, and by nearly all economists and business leaders.

When the Smoot-Hawley Act was in full force in 1931-33 – because then President Hoover refused to veto it – the US economy tanked: GDP collapsed, both imports and exports fell dramatically, and the unemployment rate doubled. Arguably, those tariffs extended the Depression.

By 1934, the tariffs were much-reduced, though it took the Second World War for the US to recover properly.

Liberation from the global rules-based system

In arguing the tariffs amounted to ‘liberation’ for America, we are entitled to ask the proponent, Mr. Trump, ‘liberation from what?’ It seems likely the liberation to which Mr. Trump refers, is liberation from the rules of global trade.

This must be of particular concern to countries like Australia, which trade openly and use the global rules-based system.

Following the intercession of World War II, the global trade architecture heralded by the Bretton Woods Agreement, the International Trade Organisation (ITO) and the General Agreement on Tariffs and Trade (GATT) (the USA and Australia were among the eight original signatories) were quickly installed, heralding a period of substantial and open international trade.

When the World Trade Organisation replaced the ITO and the GATT in 1995, both countries were again at the forefront. It is not a coincidence that the US established its economic power in the second half of the twentieth century, by championing the global trade system.

Today, that openness, the architecture supporting it, and the benefits accrued from it, appear to be again threatened by US isolationism and bullying. This behaviour seems driven by Mr. Trump’s desire to remain in control of global trade and capital flows, despite the balance of global wealth and, therefore, influence, slowly shifting toward the main population centres, which happen to be, predominantly, in Asia.

During his first term in office, Mr. Trump famously shouted: ‘China, China, China’ over the latest agitation. In hindsight, that seems a frustrated moment from a President without the tools to change a situation he found and clearly still finds, intolerable.

The problem for the world is that the tools Mr. Trump has found and has placed on display, sap confidence in the US in respect of trade and question its reliability in terms of other critical matters, like defence and security.

For Australia, that is a particularly challenging situation, because – as the data in this analysis demonstrates – trade is dominated by the relationships in Asia, especially China but defence ties are linked to the USA.