The future of economic activity is of course, always uncertain, including within it, items such as risk and the appetite for taking it. As a concept, uncertainty is unable to be observed directly, but it impacts behavior enormously. The result is that economists – the most dismal of all scientists – spend enormous amounts of time trying to measure the real effects of uncertainty. Angus Moore, in an RBA Research Discussion Paper issued in February, explains how that body of work might apply to Australia.

The paper starts out by describing four measures of economic uncertainty:

- Newspaper-based measures

- Finance- based measures

- Forecaster disagreement

- Correlations between the measures

Arising from these measures and his analysis of it, Moore creates what appears to be a semi-official economic uncertainty index for Australia. The major factor is the newspaper-based measures, essentially adjusted for movements in the other measures.

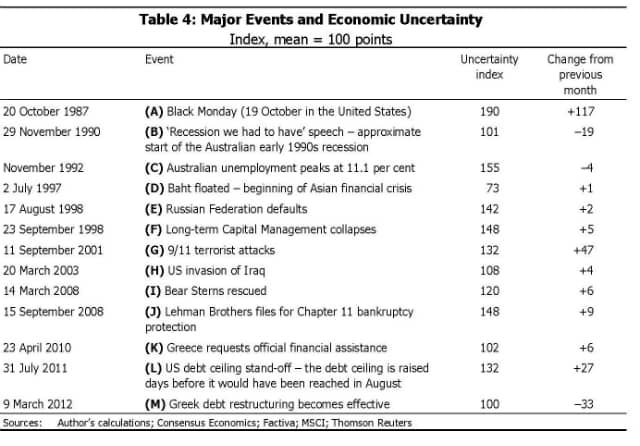

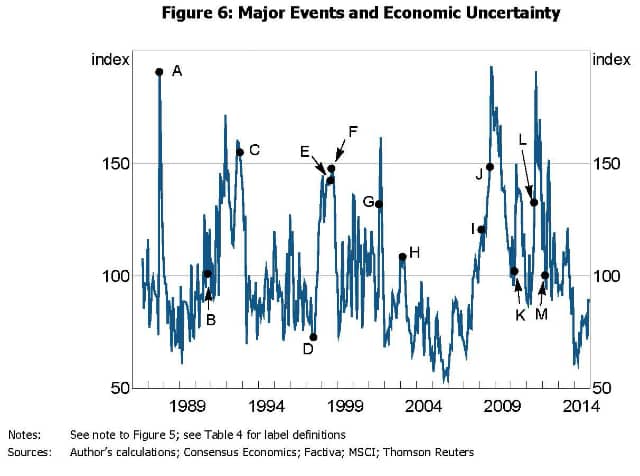

Subsequently, the index is used in the article to, over time, show how actual events and the index appear to move in a similar manner and pattern to each other. For example, the 9/11 attacks coincide with a significant period of uncertainty. In all, as the table and chart below shows, Moore correlates 13 events with the index.

In addition, to emphasise the veracity of the domestic version, the Australian index is correlated with its global equivalent.

Now, most importantly, the index proves certain points, according to Moore:

- Uncertainty increases faster than it decreases

- Uncertainty is higher during recessions

- Economic uncertainty is estimated to be higher than average before federal elections and in the month of the election

- Monetary policy ‘surprises’ based on RBA monetary policy decisions are correlated to the uncertainty index

The paper is dense and includes some theoretical concepts that rarely see the light of day. However, that doesn’t detract from the findings. Indeed, the point of this work is to progress the development of what could become a significant element in predicting the future direction of the national economy, especially in the lead up to major announcements and in the midst of significant events.

Also thinking laterally the paper highlights the importance of data in telling a story. In this case the use of obscure measures of uncertainty which in aggregate appear to correlate strongly to turning points in the economy. As information becomes available from the FWPA data aggregation program it is expected similar opportunities will arise to model and forecast data.

The full paper can be found at http://www.rba.gov.au/publications/rdp/2016/2016-01.html