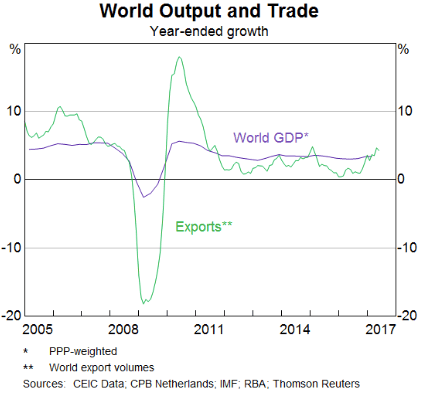

As the Australian economy displays signs of growth, with unemployment falling and the participation rate growing strongly over the year, the global economic outlook has also started to turn. Since late 2016, the global economy has seen an uplift in industrial production and merchandise exports that has itself driven growth in resource use and trade, the latter providing uplift for the Australian economy.

The global economy, according to the International Monetary Fund’s (IMF) World Economic Outlook released in October projects global economic growth in 2017 will be a solid 3.6% and a growing 3.7% in 2018.

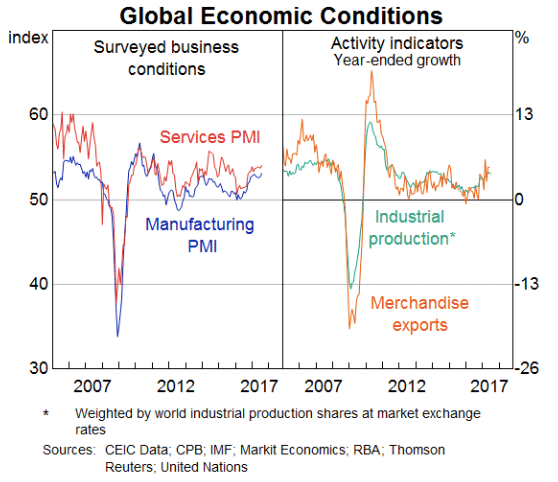

In a recent speech, the RBA’s Assistant Governor (Economic) Luci Ellis pointed to these recent developments and growth in industrial production and exports, along with growth in the global Purchasing Manager’s Indices (PMIs) for Services and Manufacturing. These are shown in the chart below.

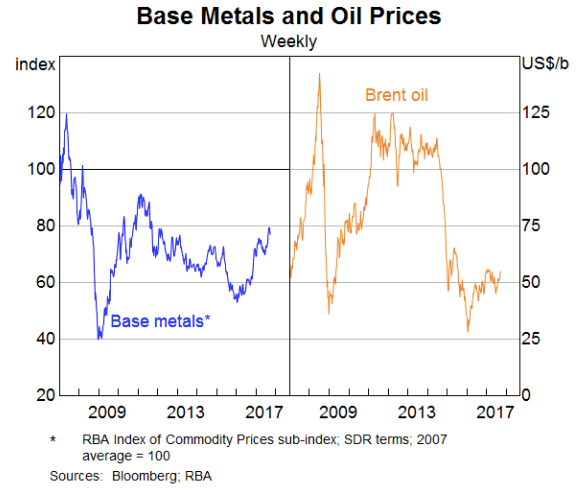

This positive news on a merchandise trade basis, flowing into services, was also very positive over the period for commodities. Both base metals and oil prices – shown in the chart below – experienced solid expansion over the same period.

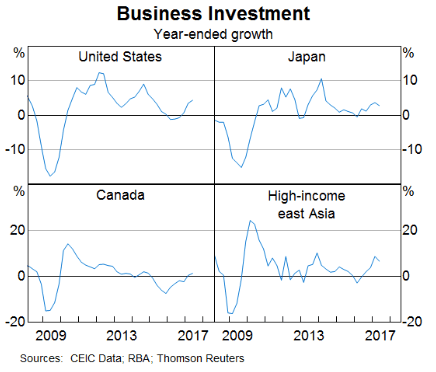

Continuing the RBA’s very upbeat outlook for global economic growth, Assistant Governor Ellis pointed to a much-discussed Australian growth concern – business investment. As Ellis commented:

“Particularly welcome was the recovery in investment growth, which can now be seen in a range of major economies and regions.”

For our part we will offer the caution that the multi-economy rise in business investment on a year-end basis that is shown in the chart below is still well below the late 2012, early 2013 peak.

It should be noted that the IMF stated, for its part, that despite the strong outlook, the recovery is not complete and growth remains weak in many countries, especially with inflation still below target in most advanced, consumption driven economies.

The moment of skepticism or conservative assessment can be put to one side for a moment however, because in the latest RBA Statement on Monetary Policy, the qualification is supplied for us. It read:

“The global economy entered 2017 with more momentum than earlier expected.”

Following on, Ellis reminds us to be cautious about some measures and their implications. For instance, the amplification of economic growth reflected in trade volumes comes in for some attention. As the chart below shows, in almost all situations, trade will swing more rapidly than economic growth and thus will ‘amplify’ the likely level of GDP growth.

Additionally, Ellis points out that investment comes after the upswing commences, at least in the modern era. As she puts it:

“…businesses are more likely to invest in things that boost labour productivity when the labour market is tight, not when there is considerable slack. So in the current environment, we would not expect business investment to be at the leading edge of a pick-up in economic activity.“

What Ellis says therefore is that:

“…we have to be willing to call the pick-up before we see it in business investment.”

https://www.imf.org/en/Publications/WEO/Issues/2017/09/19/world-economic-outlook-october-2017