As this first edition of Statistics Count was being completed, the Australian dollar had depreciated to USD0.896 (18th September 2014) as a series of events coincided to move the currency lower.

But considered over a longer period, the data shows that the Australian dollar averages well below the current levels.

Initially, the downwards shift of the Australian dollar against the US dollar was driven by faltering export iron ore prices and concerns about demand for Australia’s exports in 2H’14. The decline was arrested as iron ore prices rose modestly and the US dollar slipped ahead of the US Federal Reserve meeting that sets interest rates and other monetary policy in the world’s largest economy.

The second downwards shift occurred on 17th and 18th of September. It was driven by new strength in the US dollar as the US Federal Reserve confirmed, contrary to the speculation prior to its meeting, that it will end ‘quantitative easing’ (bond buying) in October and expects to increase interest rates in 2015.

Which all goes to show it is easy to get caught up in the daily exchange rates, the opinions of pundits and the micro movements that are reported every day in the general media.

However, the fundamentals of international trade are written over a longer term than a day of currency movements. That is why the FWPA Statistics Dashboard provides monthly updates of long term exchange rates.

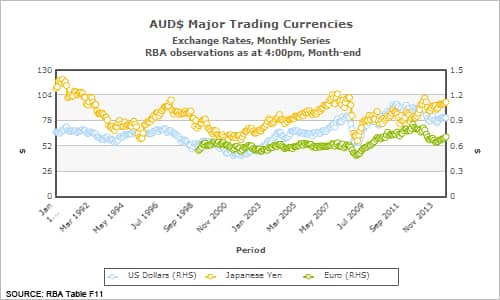

This chart, taken direct from the dashboard shows Australia’s long term exchange rate (against the US dollar) tracking below USD0.80 through until 2006.

Even a brief examination of historical exchange rate data demonstrates the Australian dollar remains high compared with its average over the last quarter century. It was, for instance, less than four years ago (December 2010) that the Australian dollar breached parity with the US dollar for the first time in more than 20 years.

In fact, as the data shows, the monthly average exchange rate recorded by the Reserve Bank of Australia in the last 25 years has been USD0.764/AUD.

Regardless of which way the Australian dollar moves today or tomorrow or next week, it is important to maintain an eye on what is a period of historical strength for the Australian dollar. How long it might remain at these heights is an important consideration for many Australian businesses. Future editions of Statistics Count will include more details and analysis of currency trends and forecasts.

Tim Woods

Industry Edge Pty Ltd

Click here to go straight to the FWPA dashboard.