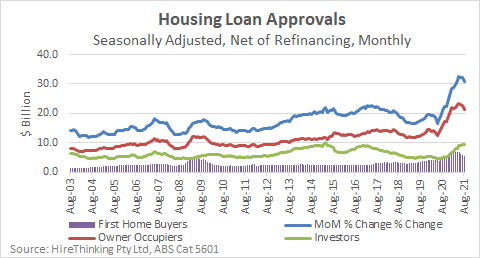

Supporting the incredible growth in dwelling approvals over the last year, the total value of all property loans was 47.5% higher in July 2021 than a year earlier, coming in at AUD30.76 billion. That was down 4.3% on the prior month, as lending to owner-occupiers dipped while increasing for investors.

Total lending for new dwellings can be observed in the chart below, with the month-on-month changes showing a real shift in the value of loans in the last few months.

Essentially, what the data shows is that as the value of loans to owner-occupiers cools, it is the first home buyers who are experiencing the deeper cuts. Lending to all owner-occupiers was down 6.6% in August compared to the prior month, but for first-timers it was a softer decline of 4.9%.

However, over the rolling quarter, loans to owner-occupiers were down 9.3% by value, while for first-timers it was a much larger 19.0% fall. They are now accounting for 20% of home loan value, down from 26% at the start of the year.

Equally striking is that investors are coming back into the market with loans to investors up 1.5% month-on-month to AUD9.49 billion, the highest level in dollar terms since April 2015.

In aggregate, we can see the softening of lending in this chart.

If we want to compare the year-ended August 2021 with prior years, the next chart does that more than admirably. It shows the magnitude of the increases in lending in this abnormal year, with the previous (mainly) abnormal year and the far more normal year to the end of August 2019.

The other factor worth considering is lending not for new homes, but for alterations and additions. Stimulated themselves, the value of reno loans really popped throughout the last financial year, but have, as we can see below, slowed and stabilised – albeit at high levels – in July and August.

The bottom line is that the finance data tells us much of what we knew already – there is a tonne of work in the pipeline and a very large amount of it needs wood and wood products to get itself built.

However, the real market interest has been in the extent to which APRA (Australian Prudential Regulatory Authority) would reintroduce macroprudential limits to curtail house prices. It is an important point that higher lending doesn’t necessarily drive higher prices – in the main it is driving more dwellings, but there is an inflationary flavour to a run of pretty free capital that lasts this long.

In late September, writing in the AFR, Ronald Mizen noted the concern of the International Monetary Fund (IMF) about Australia’s rising financial stability risks associated with the recent surges in house prices. The IMF joined with the OECD’s concerns a week earlier, with both the global agencies modelling Australian inflation hitting the 2% to 3% target band by the end of 2022. That would typically lead to interest rates starting to rise.

Some banks had already been lifting interest rates, but the market started to factor in some regulator-driven controls.

A few days later, also in the AFR, John Kehoe noted that debt to income ratios for lenders were really pushing out, saying:

“New residential mortgage loans where debt is at least six times greater than income jumped to a record-high 22 per cent in the June quarter, from 16 per cent a year earlier,…”

The source of information? That would be APRA, the regulator.

So, no one was shocked when APRA stepped in earlier this week and announced a series of new macro-prudential controls, aimed at reducing average leverage (and therefore default risk) in the lending market.

Just as important, no one particularly screamed about the controls. They appear to be reasonable on face value, and in line with the actions of several major banks in any event. At this point though, Stats Count will take a moment to consider the new controls a little further and cover them extensively in the next edition.

Reducing the supply of cheap and overly-leveraged money for the housing market should help take some of the heat out of prices, remove some of the speculation and perhaps play a part in equalising a market that is clearly out of shape.