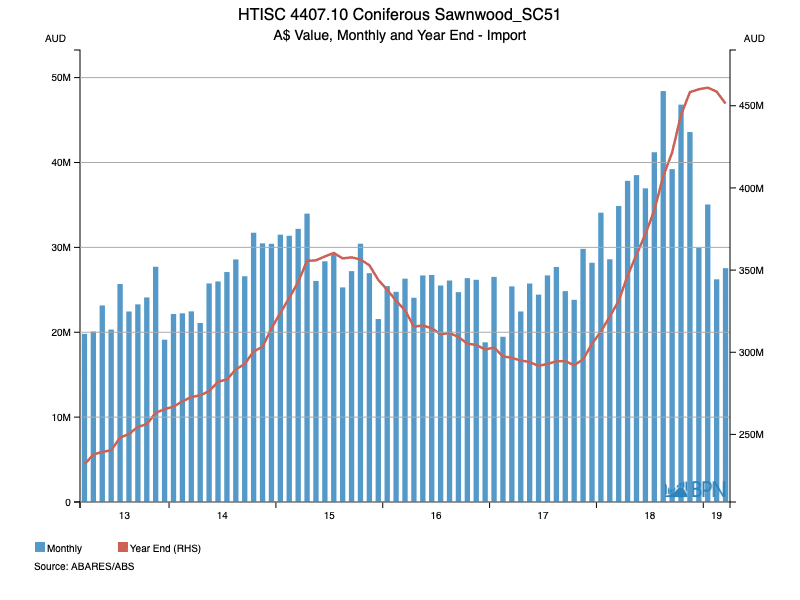

The value of Australia’s imports of sawn softwood products was 10.6% higher over the year-ended march 2019, compared to the prior year. Total value remained just above AUD451.3 million, but has commenced declining after peaking at AUD461.0 million for the year-ended January 2019. Feeding into that, import values in March 2019 plunged to AUD27.6 million, down 21.0% on March 2018.

The evidence of lower import values can be seen in the chart below, which also shows the record values achieved in October and November 2018. It is widely understood that after a large volume (and therefore value) of imports in those months, some importers pulled back to clear inventories. Anecdotally at least, that seems to have occurred on a stable and rational basis.

To go straight to the dashboard and take a closer look at the data, click here.

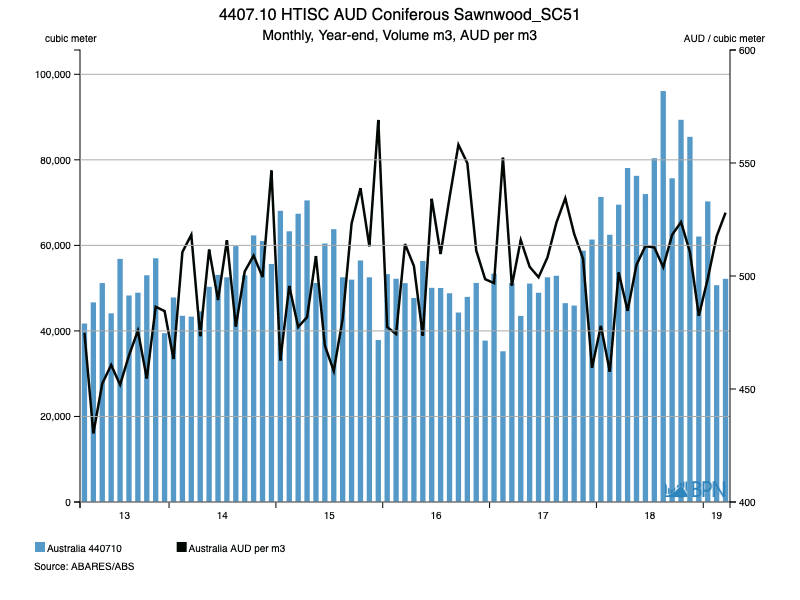

Evidence of apparent rationality can be found in average import pricing data for all sawn softwood products. The chart below shows import volumes in the blue bars and average prices on the black line.

Import volumes hit record monthly levels in August 2018 (96,072 m3), after having climbed almost continuously for a year. Notably, average import prices also rose across that period, before dipping sharply in December 2018 (AUDFob482.37/m3). By March 2019, average import prices had rebounded to AUDFob528.03/m3, but on lower import volumes.

To go straight to the dashboard and take a closer look at the data, click here.

On that headline data, it is relevant to examine the volume and price movements of some of the major import grades. We have selected three grades for this purpose:

- 4407.11.10.31 – Treated Structural (Dressed, Radiata)

- 4407.11.10.40 – Untreated Structural (Dressed, Pine, excl. Radiata)

- 4407.11.99.04 – Structural <120mm (Roughsawn, Pine, excl. Radiata)

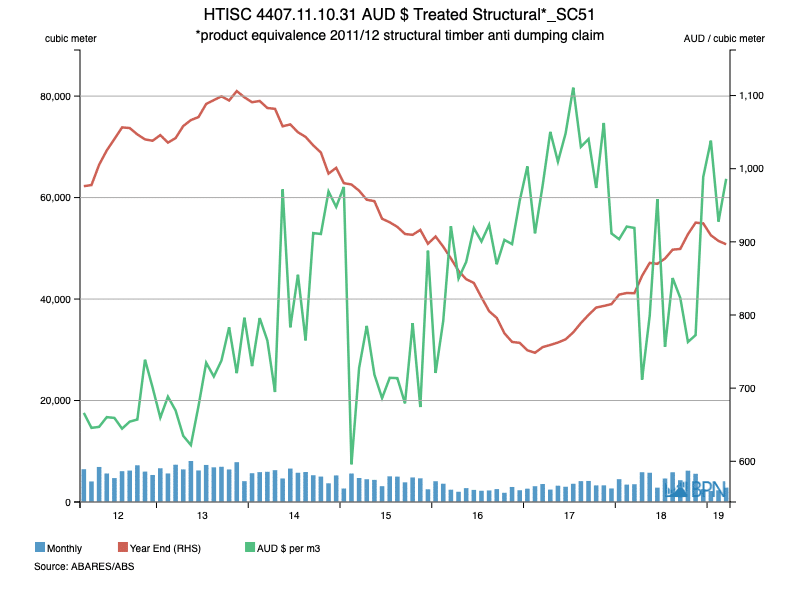

4407.11.10.31 – Treated Structural (Dressed, Radiata)

Primarily from New Zealand, this Radiata specific import designation has a different experience to the average sawn softwood imports. Year-end volumes (red line) are clearly below their peak and as the monthly volumes (blue bars) show, that is set to continue because recent months have seen imports fall further, totalling just 2,836 m3 in March 2019. On a year-end basis, imports to March were 50,791 m3, with the average price having risen to near the top of the range at AUDFob986.18/m3.

To go straight to the dashboard and take a closer look at the data, click here.

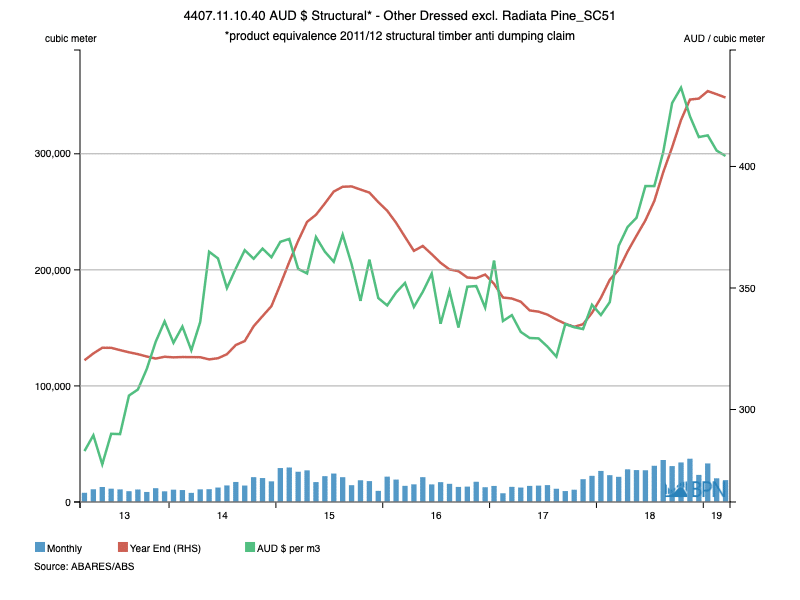

4407.11.10.40 – Untreated Structural (Dressed, Pine, excl. Radiata)

Untreated but dressed structural imports that are pine species other than radiata are primarily delivered from Europe. As the chart demonstrates, there has been a remarkable consistency between the growth patterns for the year-end volume (red line) and that of the average import price.

Import volumes have risen to an annualised 348,461 m3 year-ended March, just below the peak of 354,026 m3 achieved year-ended January. Average import prices peaked just a couple of months earlier at AUDFob432.42/m3 in October 2018, but by March 2019, had settled back to a still historically strong AUDFob404.33/m3.

It is this volume that supplied the significant bulk of total rising sawn softwood imports over the last year, and on which most attention has been applied in the market.

To go straight to the dashboard and take a closer look at the data, click here.

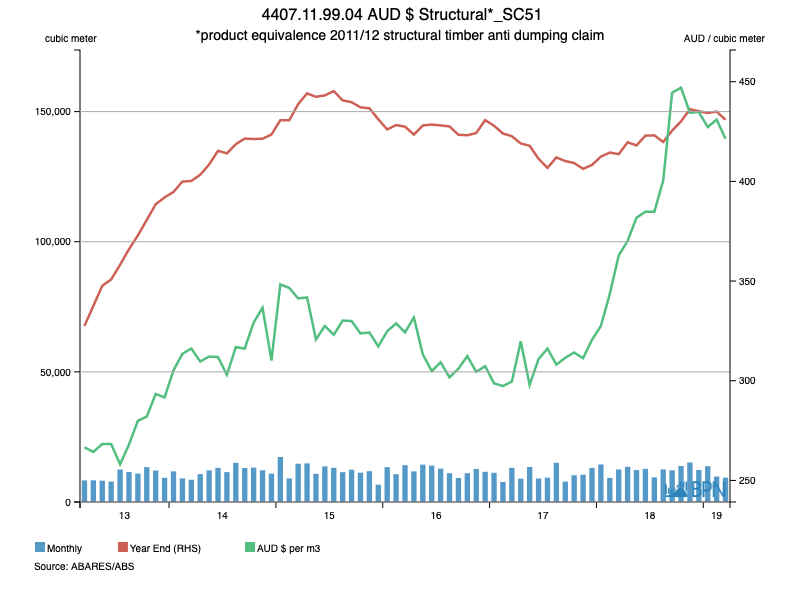

4407.11.99.04 – Untreated Structural <120mm (Roughsawn, Pine, excl. Radiata)

Among the roughsawn products, if one grade has contributed to the spike in imports it is the pine (other than Radiata) sibling of the big volume Dressed product described above. On an annualised basis, sitting just below their peak at 146,857 m3 in March 2019, these imports have grown a solid 9.9%, over a period in which the average price has risen to AUDFob421.37/m3, more than 16.1% higher than in March 2018.

As the chart shows, the big volume rise in imports occurred some years ago. What is new is the very significant leap in prices over the last two years.

To go straight to the dashboard and take a closer look at the data, click here.

Imports of sawn softwood products have risen to new peaks in the last year, and unusually, average prices have risen with them. The data shows that in the main, the big increases have been for structural products, mostly of species that are dominated by European producers.