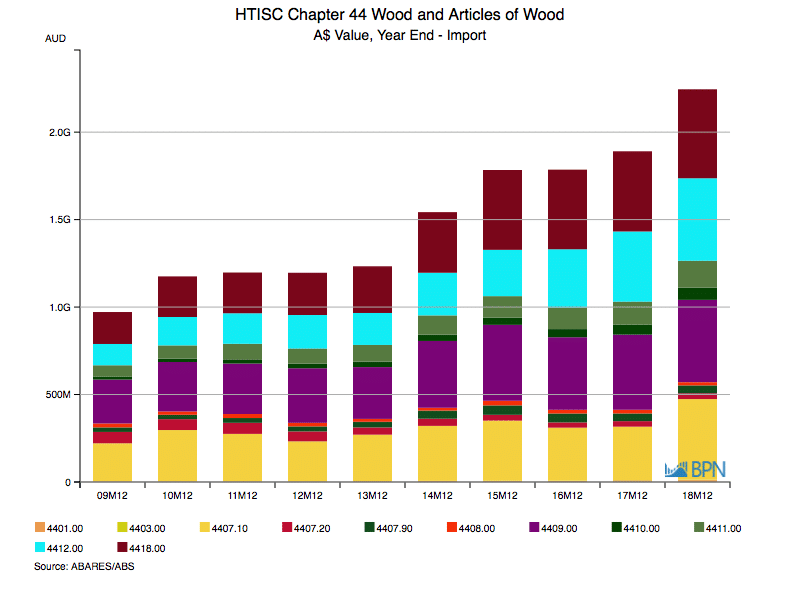

Australia’s imports of wood and wood products were valued at an all time record AUD2.245 billion in 2018, up a very large 18.8% compared with 2017. The sixth successive annual increase in import values was driven primarily by a massive 51% increase in the value of sawn softwood imports, to AUD460.0 million. Despite the stellar growth rate, sawn softwood was only fourth placed by value, behind Mouldings, Plywood and Builders’ Joinery.

In Statistics Count’s view, it is notable and worthy of detailed reflection, that the three highest value import lines are for the most manufactured wood products. *

The chart and table below show each of the wood product import lines (as defined in the trade data), displaying the last two years of import values and the change from 2017 to 2018.

| AUDM | 2017M12 | 2018M12 | % Change |

| Woodchips, pellets – 4401 | 8,672,433 | 10,667,304 | 23.0% |

| Logs – 4403 | 2,511,093 | 3,240,024 | 29.0% |

| Sawn softwood – 4407.1 | 305,077,278 | 460,007,147 | 50.8% |

| Sawn tropical wood – 4407.2 | 31,643,467 | 33,123,820 | 4.7% |

| Sawn hardwood – 4407.9 | 43,882,672 | 44,981,182 | 2.5% |

| Veneer – 4408 | 21,062,779 | 18,453,684 | -12.4% |

| Mouldings – 4409 | 429,318,281 | 470,650,126 | 9.6% |

| Particleboard – 4410 | 56,274,673 | 70,384,913 | 25.1% |

| MDF – 4411 | 132,458,448 | 153,326,926 | 15.8% |

| Plywood – 4412 | 401,079,640 | 471,354,188 | 17.5% |

| Builders’ Joinery – 4418 | 458,428,676 | 508,854,345 | 11.0% |

| Total | 1,890,409,440 | 2,245,043,659 | 18.8% |

To go straight to the dashboard and take a closer look at the data, click here.

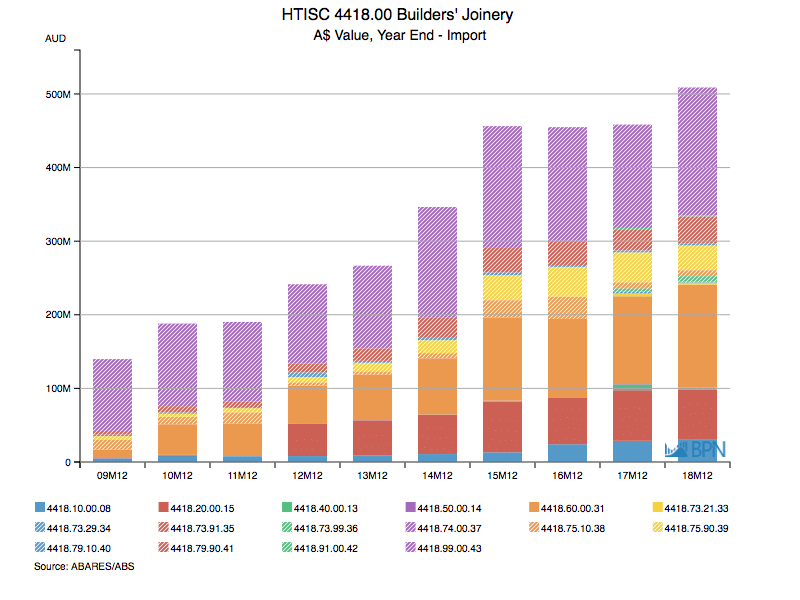

Value comparisons are very helpful because all grades and products are recorded by value, but some are not recorded for the number of units, quantity or volume. Builders’ Joinery, for example, includes such different products that it is recorded only by value.

Builders’ Joinery products include everything from Doors, Windows, Wooden Posts & Beams, Cellular Panels and various grades or formats of timber flooring. Its importance as an omnibus classification for imports of wood products is that by value, it accounts for almost 23% of total imports.

The chart below gives a sense of the number of products included as Builders’ Joinery, as well as charting their strong growth over the decade, capped off by the big rise in 2018.

To go straight to the dashboard and take a closer look at the data, click here.

The chart is a little too detailed, so the table below shows the value of imports of those products valued above AUD10 million in 2018.

| AUDM | 2017 | 2018 |

| Windows – 4418.10.00.08 | 28,719,793 | 30,116,225 |

| Doors – 4418.20.00.15 | 68,724,282 | 68,416,232 |

| Posts & Beams – 4418.60.00.31 | 119,368,687 | 140,166,671 |

| Wooden flooring – multi-layer – 4418.75.90.39 | 40,879,968 | 33,843,140 |

| Wooden flooring – not multi-layer – 4418.79.90.41 | 27,764,490 | 36,633,060 |

| Other – 4418.99.00.43 | 140,415,381 | 173,603,061 |

While the ‘Other’ designation is a regular aggravant to trade transparency, the most useful data may well be that related to Posts & Beams, the value of which increased 17.4% to a record AUD140.2 million. This is the import designation that includes LVL and I-Beams, which are becoming such a significant feature of the modern housing landscape.

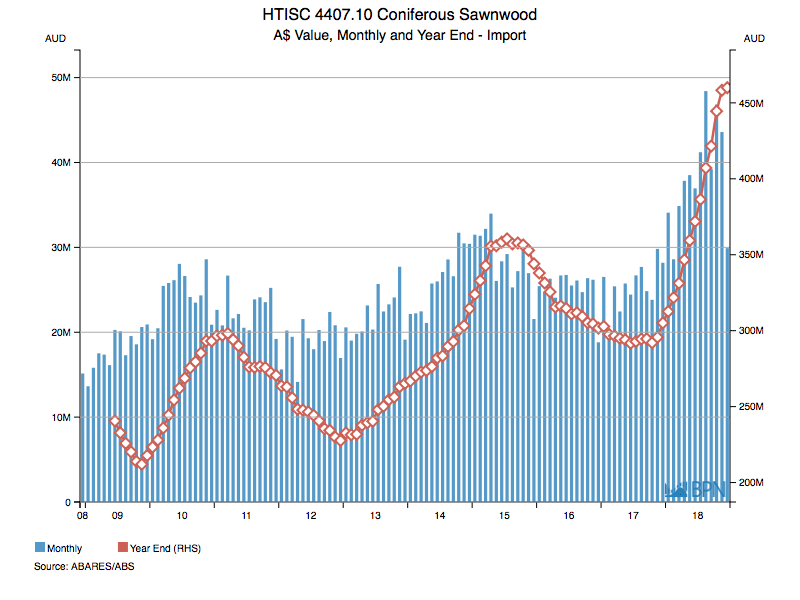

Returning to the aggregate value of imports, it is important to understand sawn softwood imports from this value perspective, as well as the regularly discussed volume considerations. There is, as the chart below shows, clear cyclicality in import values.

To go straight to the dashboard and take a closer look at the data, click here.

Cycles are one thing – and the value of sawn softwood imports appears to be at the top of its cycle – but that may obscure the main point: the value of imports has grown rapidly to this massive new record.

Imports can grow – by value or volume – for a variety of reasons, but successive periods of growth do suggest that imports are filling a supply gap in Australia. For sawn softwood products, that is clearly true, after the closure of the Morwell sawmill in late 2017 and the domestic supply chain appearing to be at or near their peak.

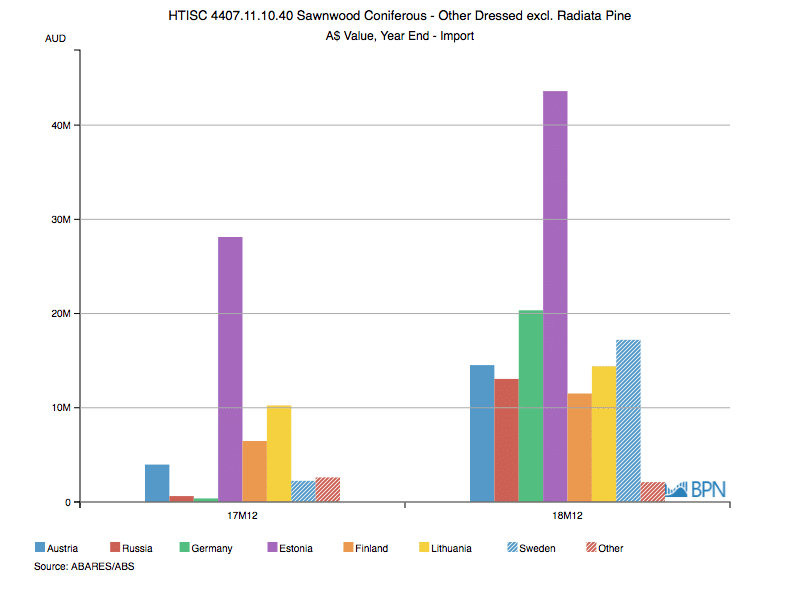

Examining the highest value of the product lines making up these sawn softwood imports – Dressed, other than Radiata – we can see the unsurprising influence of the Scandinavian and other European suppliers, and we can see the extent to which they grew their import value over the last year.

A massive rise in value of 150% saw the total value of imported dressed sawn softwood rise to an incredible AUD136.8 million, accounting for just short of 30% of the total value of all sawn softwood imports.

To go straight to the dashboard and take a closer look at the data, click here.

The table below demonstrates the country-by-country growth in the value of dressed, sawn softwood imports over the last year.

| 2017 | 2018 | % Change | |

| Austria | 3,972,917 | 14,529,337 | 265.7% |

| Russia | 627,142 | 13,063,828 | 1983.1% |

| Germany | 378,088 | 20,345,723 | 5281.2% |

| Estonia | 28,125,579 | 43,610,769 | 55.1% |

| Finland | 6,470,327 | 11,514,726 | 78.0% |

| Lithuania | 10,242,584 | 14,402,667 | 40.6% |

| Sweden | 2,246,452 | 17,214,281 | 666.3% |

| Other | 2,610,769 | 2,106,668 | -19.3% |

| Total | 54,673,858 | 136,787,999 | 150.2% |

Considered from a value standpoint, imports of wood products to Australia are booming. While the emphasis is often, rightly, on sawnwood products, it does pay to maintain attention on the full range of products made from wood. Imports are well established and growing their share of the total market.

* This data does not include the value of furniture and furnishing products, or paper and paper products imports