This article is produced by FWPA’s Statistics and Economics program.

- Particleboard imports were down more than 30% year-ended February, after spiking in 2023-24

- Plywood imports have risen 1.1% over the same period and at more than 400,000 m3 per annum, dominate wood panel imports

- MDF imports fell more than 30% over the year-ended February 2025

Although not entirely self-sufficient – plywood and OSB are the stand outs – local supplies of particleboard and medium-density fibreboard (MDF) dominate the Australian market. Here we take a brief look at imports of each of the grades of wood panels.

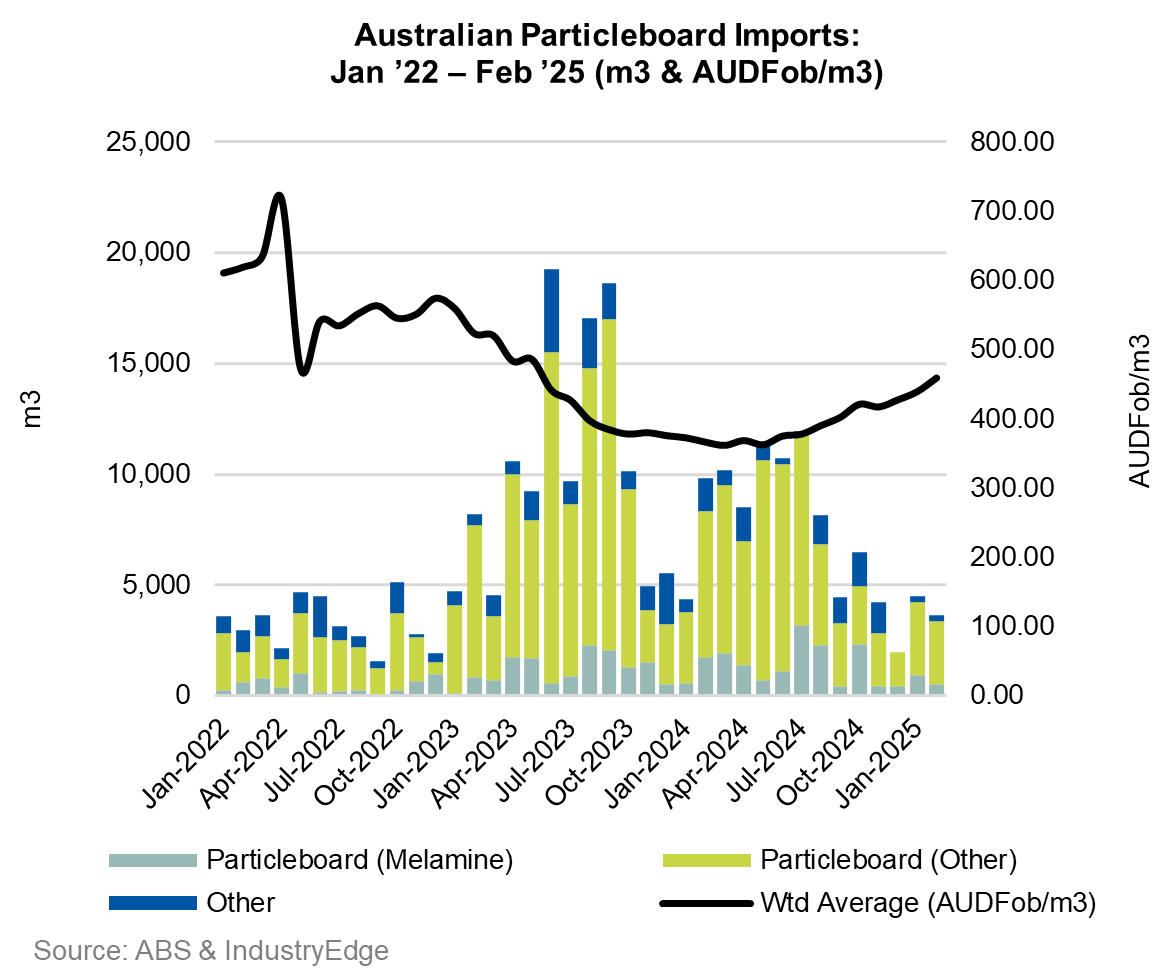

Particleboard imports fell 30.4% year-ended February 2025

Australia’s annual particleboard imports fell 30.4% across the year-ended February 2025, to total 86,174 m3. Over the same period, import prices averaged AUDFob459/m3.

The major import grade is ‘Particleboard (Other)’, that is, raw Particleboard without a melamine finish.

Imports of this grade totalled 61,251 m3 across the year, down 32.4% on the previous year, accounting for 71.1% of all Particleboard imports. In February, the average import price for the Particleboard (Other) grade rose to AUDFob533/m3.

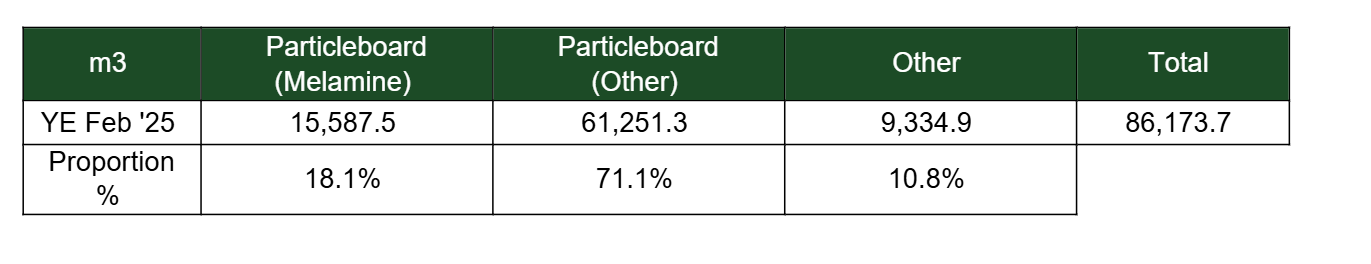

Plywood imports lifted up 1.1% over the year

Plywood imports rise 1.1% to total 408,777 m3 year-ended February 2025. These imports do not include plywood-backed material like that used for flooring, wafer, batten, and other board products that are mingled into traditional plywood definitions.

However, some importers report smaller quantities of engineered wood products – especially laminated veneer lumber – under these codes. In most cases, these instances have been inadvertent and part of mixed loads.

The chart below displays the import experience.

The table below shows annual Plywood imports for the year-ended February 2025.

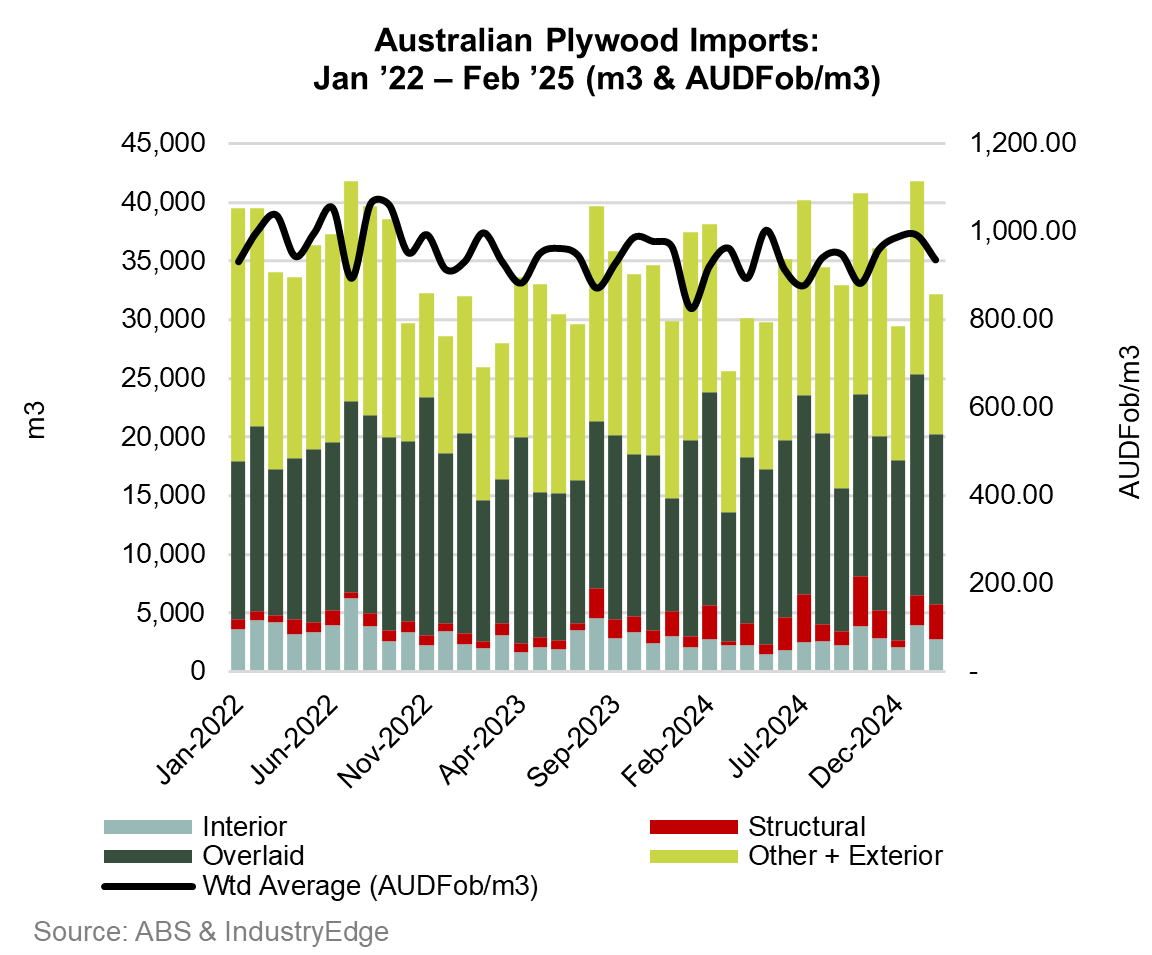

MDF imports down 8.8% year-ended February 2025

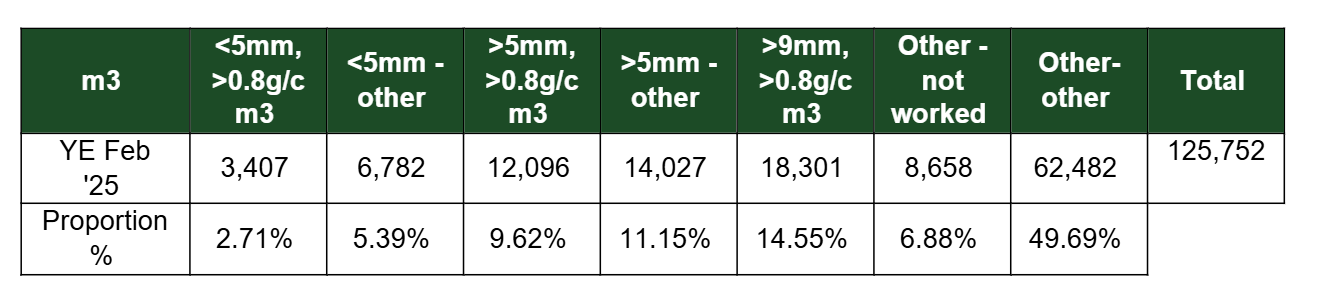

Australia’s imports of Medium Density Fibreboard (MDF) were 8.8% lower year-ended February 2025, compared to the previous year. Imports totalled 125,752 m3 for the year.

Of the different density grades, imports of the somewhat absurd ‘Other-Other’ grade continue to record significantly higher volumes. This grade saw imports total 62,482 m3 across the year, down 6.8% on the previous year.

That is, around half of all MDF imports to Australia fall outside the defined density grades, making analysis more complex and suggesting that perhaps the grades need revision. As many know, that requires international agreement through global trade organisations, which is unlikely happen anytime soon.

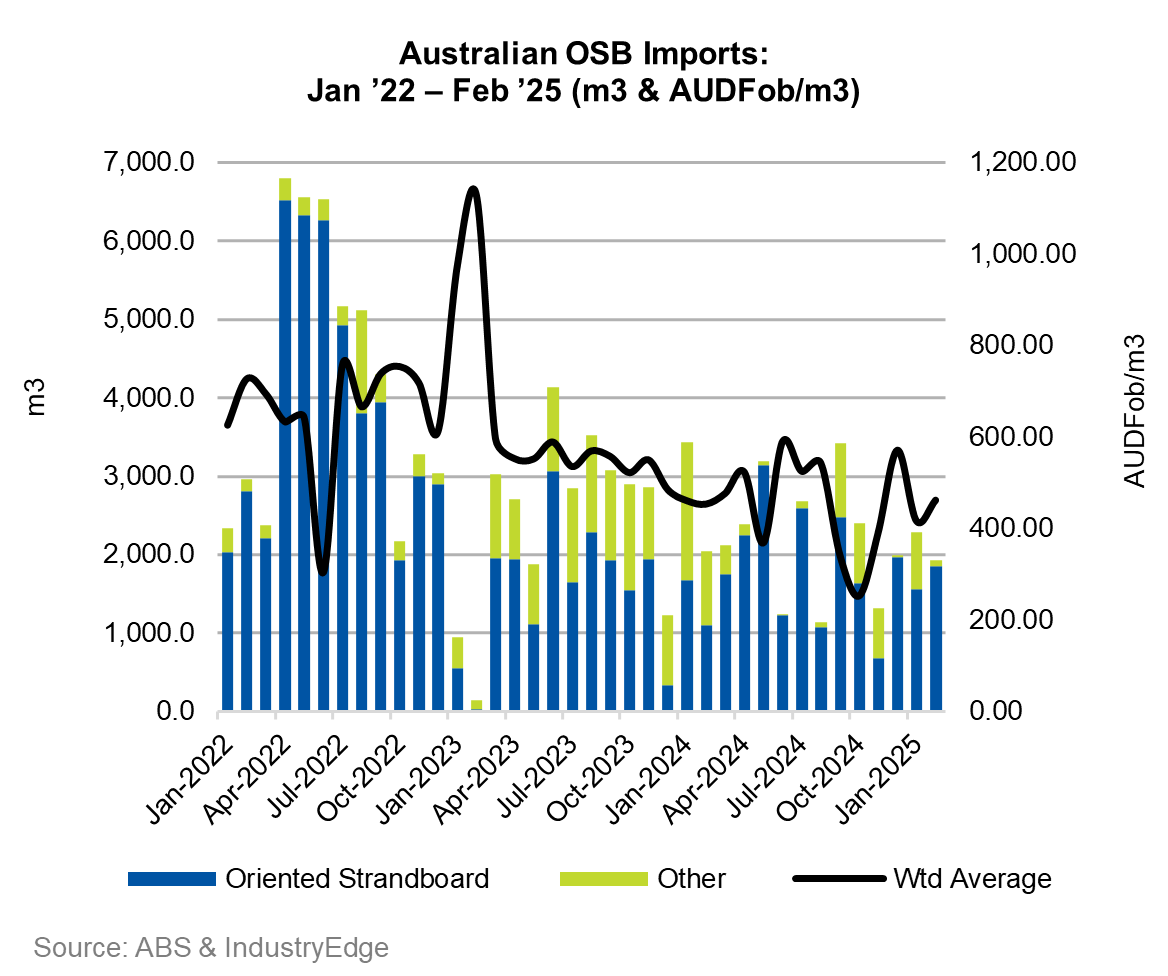

OSB imports fell 22.4% year-ended February 2025

Imports of Oriented Strand Board (OSB) totalled 26,127 m3 year-ended February 2025, down 22.4% compared to the prior year. Monthly import volumes had generally been stable from early 2021, with volumes averaging approximately 3,000 m3 per month in total. In April 2022, imports temporarily spiked, averaging approximately 6,000 m3 per month.

From September 2022 shipments returned to more typical levels but have again become more varied each month. From April 2023 onwards, OSB shipments again began to average 3,000 m3 per month, but have now dipped to about 2,000 m3 per month.

In February 2025 shipments totalled 1,936 m3, down 15.5% on the month prior.

Prices stabilised during early 2021, after which they became erratic, before entering a near year-long period of decline. In February 2025, the weighted average price was AUDFob462.55/m3 or an increase of 10.9% compared to the month prior.

About FWPA’s Statistics and Economics program

FWPA’s Statistics and Economics Program provides reliable industry data to support stakeholder decision making and business planning across the forest and wood products industry. Learn more about the range of tools we provide, including the new FWPA Data Dashboard, via this link.