The following update has been supplied by IndustryEdge from its online platform, Wood Market Edge online. All the data used and referred to here is available for download by IndustryEdge subscribers and is part of the most timely and comprehensive data and information service available in Australia.

![]()

Learn more about Wood Market Edge online here.

Australia’s annual woodchip exports lifted to a twenty-four month high of 5.576 million bdmt year-ended March 2022. Strong demand in China and stability in Japan are the current hallmarks of the woodchip export trade, with strong pulp prices providing for Australia’s premium plantation eucalypt supply in particular to be fully allocated as Chinese pulp mills seek to maximise yield.

Year-ended March, annual hardwood chip exports continued to strengthen, rising 19.1% to 4.518 million bdmt. However, it is the 70% lift in softwood chip exports to a record 1.059 million bdmt that has delivered the prospect of a 6.0 million bdmt export year being achievable in the second half of 2022.

Important in any consideration of the large rise in softwood chip exports is that the driver for the rise has been the inability to export logs to China. Chipping has proved a continually reliable option for utilising fibre. That, coupled with demand growth in China, which has also shorted itself of recovered fibre, has allowed softwood woodchip exports to soar.

In March, softwood chip exports totalled 98,000 bdmt, up 7.4% on the prior month and exported at an average price of AUDFob187/bdmt. By contrast, hardwood chip exports were 2.0% lower than in February, totalling 412,000 bdmt, at an average price of AUDFob204/bdmt.

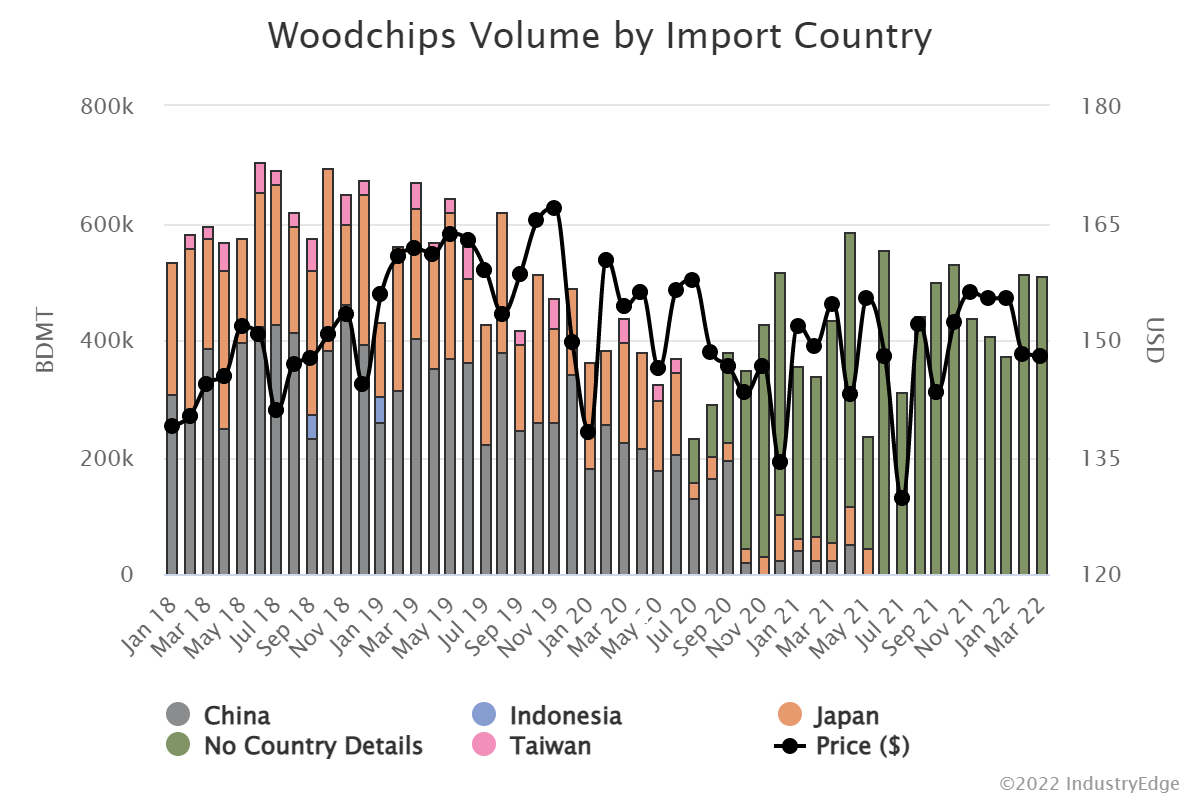

Exporters mask the destination of woodchips as reflected in the chart below, which shows nearly all exports currently recorded as ‘No Country Details’. As a result, the only way to understand the volume and destination of Australian woodchips on an ongoing basis, is to track woodchip vessels.

Australian Woodchip Exports by Country: Jan ’18 – Mar ‘22 (kbdmt & AUDFob/bdmt)

Port-to-port vessel tracking in April – ahead of the formal trade data by an average five weeks – indicated woodchip exports for the month totalled around 425,000 bdmt, with seventeen vessels leaving Australia in the month. Nine vessels were despatched to mainland China (est. 205,000 bdmt), six to Japan (est. 188,000 bdmt and one to Taiwan (est. <32,000 bdmt).

Because of shipping times, delivery data never matches up with despatch data, however, the information below shows the vessel-based analysis of Australia’s exports, for the month in which they were delivered. Over the period displayed, China received 58.7% of Australia’s exports, Japan 36.1% and Taiwan 5.2%.

Australian Woodchip Exports by Country of Delivery: Jun ’21 – Apr 22 (bdmt)

Source: VesselFinder, ports of despatch and IndustryEdge

Turning to the outlook, industry intelligence suggests there is no unallocated supply available in the second half of 2022, with little available for the next year. There seems little doubt scarcity is one of the factors driving prices, which are stable and likely to increase, as pulp prices and general cost inflation drive all commodity prices higher.

The price prognosis for Australian hardwood chip is made stronger still by the prospect of new South American pulp capacity being brought to market by the end of the year and again in 2023. It is widely expected those pulp expansions (close to 2.0 million air dried tonnes of pulp per annum) will see exports of eucalypt chip from Chile and Brazil slow further. The result of that will be Australia’s leadership position in the premium plantation eucalypt woodchip market will extend well beyond 50% of global supply.

As the chart here shows, the weighted average delivered hardwood chip price always favours the eucalypt suppliers over the Asian Acacia suppliers like Vietnam. Reduced supply of that product from South America should be to the advantage of Australian producers and exporters.

Hardwood Chip Prices by Main Exporting Country: 2012 – 21 (USDCif/bdmt)

Source: GTIS & IndustryEdge

The following tables and charts, in both AUD and USD, show the relative price movements of Australia’s exports of hardwood and softwood woodchips, from January 2018.

Australian Woodchip Exports by Species: Jan ’18 – Mar ‘22 (AUDFob/bdmt)

Source: ABS & IndustryEdge

Australian Woodchip Exports by Species: Jan ’18 – Mar ‘22 (USDFob/bdmt)

Source: ABS, RBA & IndustryEdge

Australian Woodchip Export Market Update

|

|

Current Month |

% Change |

||

|

Mar ‘22 |

MoM |

QoQ |

YoY |

|

|

Total exports (kbdmt) |

517.9 |

+9.1 |

-4.6 |

+24.7 |

|

Hardwood (kbdmt) |

425.7 |

+14.4 |

+0.8 |

+18.2 |

|

Softwood (kbdmt) |

92.2 |

-10.2 |

-24.8 |

+65.1 |

|

Hardwood (AUDFob/bdmt) |

212.82 |

-1.8 |

+3.6 |

-5.9 |

|

Softwood (AUDFob/bdmt) |

184.32 |

-8.6 |

+1.6 |

-10.9 |