Date: 31 July 2023

The 2023 outlook for Australian woodchip exports is MODERATING and heading toward softness. This applies to both hardwood chips and softwood chips, with downside price risks directly associated with lower pulp prices, which continued to fall in June, but appear to be reaching their base, at least for hardwood pulp.

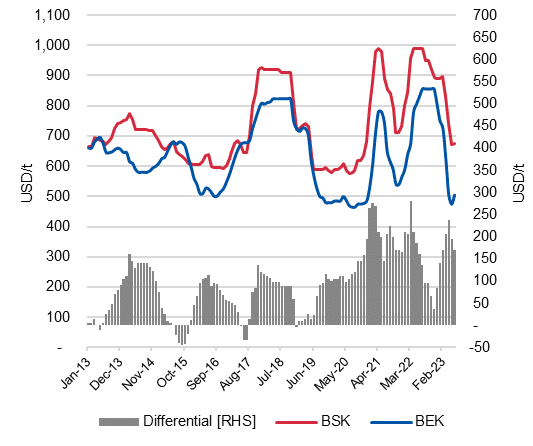

In June, the Bleached Eucalypt Kraft (BEK) pulp price rose an average 6% (USD30/t) to USD505/t in China, ending a spectacular five successive month crash. The BEK price has fallen USD300/t since the start of 2023.

The Bleached Softwood Kraft (BSK) price rose an average 0.7% for the month, declining to average USD675/t. Since the start of 2023, the BSK price is down USD215/t.

As a result of the variable declines, the differential between the two pulp prices narrowed in June and returned to the decadal average of USD98/t.

The BSK price is now 32% lower than one year ago, while the BEK price is 40% lower than a year earlier. Many pulp mills in China are either producing at below the cost of production or are scaling back their production until prices improve.

China Pulp Prices: Jan ’13 – June ‘23 (USD/t)

Source: Hawkins Wright and IndustryEdge

Global prices trending down on similar trajectories

A brief analysis of hardwood chip delivery volumes and prices for both China and Japan demonstrates softening is occurring in both major markets. The trajectories for China and Japan are similar for prices, but Japan is more stable when it comes to volumes.

Although for the year-ended May 2023, shipments to China are still 2.0% higher than a year earlier, they are rapidly declining and are around 600,000 bdmt per month lower than for the same months in 2022.

The Japanese situation is more stable, with annualised volumes up 2.0% as the table and chart below demonstrate. Volumes are shown on the dotted lines.

It is on prices that Japan and China appear to be more in sympathy.

As the solid lines show, although the average price of hardwood chips delivered to China (USDCif211/bdmt in May ’23) remains higher than that reported for Japan (USDCif188/bdmt in May ’23), the trend decline is very similar since the start of 2023. The pricing differential appears related primarily to shipping costs.

The delivered price to Japan is 11.9% lower and to China, it is 10.4% lower since the start of 2023.

Prices are relatively stable in the face of the pulp price declines experienced through the first half of 2023. The likelihood is that there will be some further average price decline, but it is volumes that are most likely to be under pressure, especially into China and especially from Australia and the other eucalypt producing nations.

Subscribers will note the data for this analysis has been prepared using the Asian Woodchip Deliveries file, available under the ‘Global’ heading in Wood Market Edge online. Click here to get the data.

Hardwood Chip Deliveries to China and Japan: Jan 2020 – May 2023 (bdmt & USDCif/bdmt)

Source: GTIS and IndustryEdge

|

bdmt |

YE May-21 |

YE May-22 |

YE May-23 |

YE May-22 to May-23 |

|

Japan |

8,304,931 |

9,433,779 |

9,652,124 |

2.3% |

|

China |

14,528,892 |

15,416,852 |

15,731,995 |

2.0% |

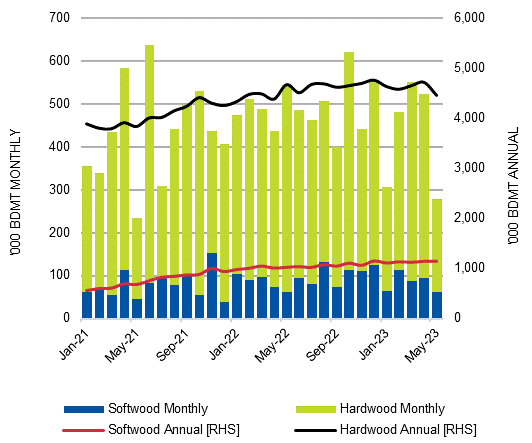

Annual woodchip exports totalled 5.621 Mbdmt year-ended May 2023

Australia’s combined annual exports of hardwood and softwood woodchips totalled 5.621 million bdmt year-ended May 2023. Hardwood chip exports totalled 4.469 million bdmt, 4.6% lower than a year earlier. Exports of softwood woodchips totalled 1.152 million bdmt. The chart displays total woodchip exports on a monthly and annual basis.

Australian Woodchip Exports by Species: Jan ’21 – May ‘23 (‘000 bdmt)

Source: ABS, GTIS & IndustryEdge estimates

Australia’s entire woodchip export trade, including both hardwood and softwood, is still masked by confidentiality restrictions, declared as ‘No Country Details’ (NCD). As such, no formal export data is available, only the monthly total volume and a total average price are reported by the Australian Bureau of Statistics (ABS).

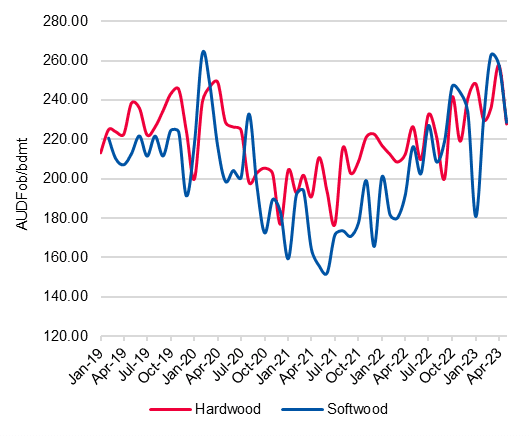

Export prices

Australia’s average hardwood chip export price was AUDFob228/bdmt in May 2023, down 11.6% on the prior month. Average softwood chip export prices fell 11.4% to AUDFob229/bdmt.

Woodchip Export Prices by Species: Jan ’19 – May ‘23 (AUDFob/bdmt)

Source: ABS, derived and IndustryEdge

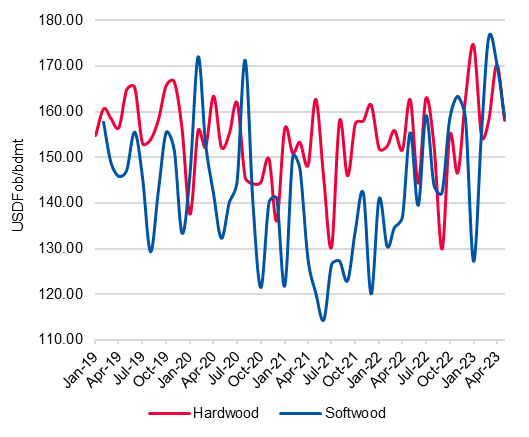

The following chart shows the same prices, calculated in US dollars, using RBA end of month exchange rates.

Woodchip Export Prices by Species: Jan ’19 – May ‘23 (USDFob/bdmt)

Source: ABS, derived, RBA and IndustryEdge

Australian Woodchip Export Market Update

Australian Woodchip Export Market Update

|

|

Current |

% Change |

||

|

Month |

||||

|

May-23 |

MoM |

QoQ |

YoY |

|

|

Total exports (kbdmt) |

279.3 |

-46.7% |

0.8% |

-1.7% |

|

Hardwood (kbdmt) |

218.3 |

-49.2% |

6.7% |

-4.6% |

|

Softwood (kbdmt) |

61.0 |

-35.3% |

-19.7% |

11.3% |

|

Hardwood (AUDFob/bdmt) |

227.66 |

-11.6% |

1.7% |

9.9% |

|

Softwood (AUDFob/bdmt) |

228.75 |

-11.4% |

13.9% |

25.6% |