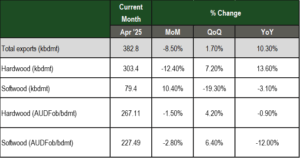

Australian woodchip exports totalled 382.8 kbdmt (thousand bone-dry metric tons) in April 2025, down -8.5% on the prior month

- Annual exports slipped to 5.008 million bdmt

- Month-on-month, hardwood chip exports fell 12.4% to 303.4 kbdmt while softwood chip exports rise 10.4% to 79.4 kbdmt

- In April, the average hardwood chip export price was AUDFob267/bdmt, or a calculated USDFob171/bdmt, while the softwood chip export price totalled AUDFob227/bdmt or a calculated USDFob146/bdmt. (Note that in export Fob/bdmt stands for Free-on-board per bone-dry metric tone).

Asian Chip Trade Review

Chip trade plummets while prices remain stable

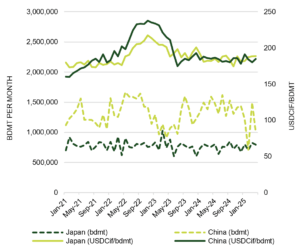

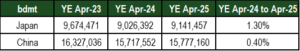

Global hardwood chip deliveries to China fell in April, with deliveries down 33.4% (0.994 million bdmt) while softwood chips were up 4.9% (0.009 million bdmt). Over the year-ended April, hardwood chip deliveries into Japan were 1.3% higher than a year earlier and into China were 0.4% higher over the same period.

Reported global softwood chip deliveries to China decreased over the year-ended April, down 21.2% compared to a year earlier. Imports in April totalled just 9,493 bdmt. Expectations remain that volumes of Russian supply are being imported informally, but there is no indication of likely volumes. Japan’s softwood chip imports were 9.3% higher over the year at 1.958 million bdmt. The trade summary of woodchip products (W1 to W10) is below.

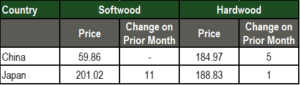

Global Delivered Woodchip Prices: Apr ’25 (USDCif/bdmt)

Source: China Customs, Japan Customs and IndustryEdge

Source: China Customs, Japan Customs and IndustryEdge

Australian Exports

Annual woodchip exports totalled 5.008 Mbdmt year-ended April 2025

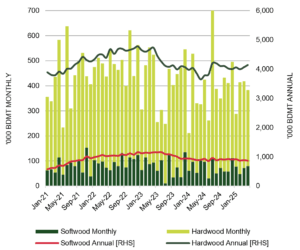

Australia’s combined annual exports of hardwood and softwood woodchips totalled 5.008 million bdmt as of year-end April 2025.

Hardwood chip exports totalled 4.142 million bdmt, 13.6% higher than a year earlier. Exports of softwood woodchips totalled 0.866 million bdmt, 3.1% lower compared to the previous year. The chart on the following page displays total woodchip exports on a monthly and annual basis.

Australia’s entire woodchip export trade, including both hardwood and softwood, is still masked by confidentiality restrictions, declared as ‘No Country Details’ (NCD). As such, no formal export data is available, only the monthly total volume and a total average price are reported by the Australian Bureau of Statistics (ABS).

Australian Woodchip Exports by Species: Jan ’21 – Apr ‘25 (‘000 bdmt)

Source: ABS, GTIS & IndustryEdge estimates

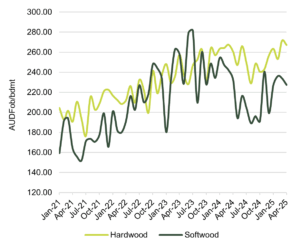

Australia’s average hardwood chip export price decreased in April 2025, down 1.5% to AUDFob267/bdmt. The average softwood chip export prices also fell 2.8% to AUDFob227/bdmt.

Woodchip Export Prices by Species: Jan ’21 – Apr ‘25 (AUDFob/bdmt)

Source: ABS, derived and IndustryEdge

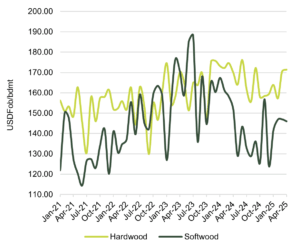

The following chart shows the same prices, calculated in US dollars, using RBA end of month exchange rates. The recent month’s price movements in US dollars should be treated as indicative only as the USD/AUD exchange rate was quite febrile for the month.

Woodchip Export Prices by Species: Jan ’21 – Apr ‘25 (USDFob/bdmt)

Source: ABS, derived, RBA and IndustryEdge

Australian Woodchip Export Market Update

Source: ABS, derived, RBA and IndustryEdge

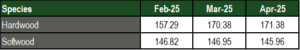

Based on month-end exchange rates, the table below shows the average price of Australia’s woodchip exports in US dollars for the last three months.

Australian Woodchip Export Prices: Feb ‘25 – Apr ’25 (USDFob/bdmt)

Source: ABS, derived, RBA and IndustryEdge

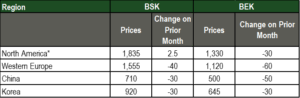

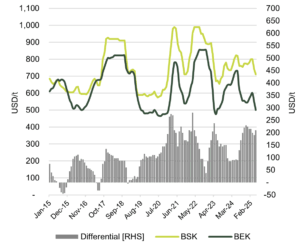

Pulp prices continue to decrease in May – fundamentals soft as tariffs continue to flex

In May, the Chinese Bleached Softwood Kraft (BSK) price fell at USD710/t, while the Bleached Eucalypt Kraft (BEK) price was down at USD500/t. In China, the pulp price differential was USD210/t.

Other main global markets also saw pulp prices fall, with Hawkins Wright reporting many producers are operating below the cash cost of production. In general, when this occurs, the market will either adjust prices upward or significant disruption among producers may follow. .

Demand for Bleached Hardwood Kraft (BHK) in China appears to have improved, but only off the back of stumbling prices.

Importing pulp is a challenging in a market where there are high levels of uncertainty throughout the supply chain. Again, as Hawkins Wright identifies, there are distinct advantages in such situations, for the domestic producers of pulp. Put another way, for paper makers right now, it appears to be something of a hand-to-mouth existence, when it comes to their pulp consumption.

Even in disrupted North America, pricing is settling lower, especially for BEK. However, the really significant downwards movements appear to be in Europe, where spot pricing is below indexed contract pricing and demand is continuing to fall away.

It may be that prices have a little further to fall, as rebalancing occurs, but the likelihood is there will be an upturn in the next two to three months, especially with summer downtime about to reduce production levels.

That said, the suspicion must be that printing paper demand is continuing to eat into demand for pulp, right across the world.

China Chemical Pulp Prices by Grade and Spread: Jan ’15 – May ’25 (USD/t)

Global Chemical Pulp Prices: May ‘25 (USDCif/t)