The issue of housing affordability, combined with a shortage of supply, has prompted governments at both national and state levels to introduce a range of incentives aimed at increasing residential construction. From an economic perspective, such interventions are designed to address market failure and can significantly influence market trends. Current initiatives include commitments to build more social housing, fast-tracking development approvals, pausing the implementation of the National Construction Code, and, most recently, reducing the deposit requirement for first-home buyers to just 5%.

These policy measures, alongside improving economic indicators such as moderating inflation, stable unemployment rates, and lower interest rates, have collectively increased demand for new housing. Data from the ABS shows that dwelling approvals, which had been in steady decline following the pandemic, began to rebound from mid-2024. This rebound has been observed across all dwelling types, including detached houses, townhouses, and apartments.

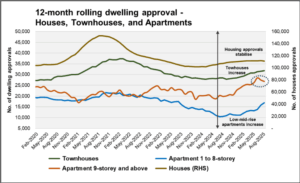

Looking at the 12-month rolling figures, approvals for houses started to recover in April 2024 and continued to rise consistently through to July 2025. The most recent release in August 2025, however, indicates that the pace of growth in house approvals has begun to ease. Townhouse approvals, which also began to climb from April 2024, have shown steady growth since that time.

In contrast, apartment approvals, both for medium-rise buildings (1–8 storeys) and high-rise buildings (9 storeys or more), have increased significantly. Growth in this type of dwelling began around September 2024 and has remained strong through the end of FY2024–25, averaging around 3% growth per month. This suggests that while detached dwelling is stabilising, multi-unit developments are becoming an increasingly important driver of new housing supply.

The sweet-spot: more townhouses and low-mid-rise apartments, but not high-rise apartments

Data from the past three months shows a clear change in dwelling approvals. Approvals for townhouses and low- to mid-rise apartments (up to 8 storeys) have increased significantly, while approvals for high-rise apartments (9 storeys and above) have decreased markedly (Figure 1). This trend indicates a developing shift in residential building, influenced by recent government incentives and evolving preferences among consumers and suppliers.

Figure 1: Trend of Dwelling Approvals by type

Source: ABS and FWPA analysis

The data indicates that the “sweet spot” for expanding housing supply lies in the townhouse and low- to mid-rise apartment segment. These types of dwellings are more adaptable to current policy settings and market demand, and can be delivered more efficiently than detached housing, which faces constraints.

Building additional houses requires more time due to a shortage of skilled workers, the slower pace of traditional on-site construction, and the challenges of scaling suburban developments. In contrast, townhouses and low- to mid-rise apartments can often be delivered more quickly, particularly when supported by prefabricated or modular construction methods that shorten build times and reduce costs.

Taken together, these trends suggest that while high-rise apartment construction may remain subdued in the short term, growth in medium-density housing is emerging as a more practical and immediate lever for addressing supply shortages in the housing market.

Proportion in dwelling approval

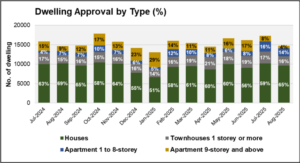

Historically, dwelling approvals in Australia have been dominated by detached houses, which accounted for around 60% of total approvals. Townhouses typically accounted for between 15% and 20%, while low- to mid-rise apartments made up approximately 5%, and high-rise apartments contributed roughly 15%. This distribution reflects the long-standing preference for detached housing.

Recent data, however, suggest that this balance may be shifting. Although additional observations will be required to confirm whether this represents a lasting trend, the latest approvals show that the combined share of townhouses and low- to mid-rise apartments has risen to 30% of total dwelling approvals.

If government incentives continue to align consistently with consumer preferences—such as policies that support affordability, encourage faster approvals, and enable more efficient construction methods—this trend toward medium-density housing will likely persist. This has important implications for how housing supply is delivered, suggesting that future growth may increasingly come from the middle ground between detached houses and high-rise towers. Figure 2 shows the most recent proportions of dwelling approvals by type, highlighting this emerging shift in the housing mix.

Figure 2: Dwelling approval in proportion by type

Source: ABS and FWPA analysis